26 Dec Chinese Ban on Export of Rare Earth Technologies

GS3 – Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

WHY IN NEWS?

- China, the world’s top processor of Rare earths minerals, on Thursday banned the export of technology to extract and separate the strategic metals, as it overhauled a list of technologies deemed key to national security.

- In October 2023, USA had put restrictions on exporting advanced Artificial Intelligence (AI) to China to prevent it from acquiring cutting edge chips to develop AI technologies such as large language models that power applications such as ChatGPT.

- For example, the Biden Administration had banned two Chinese chip startups, Biren and Moore Threads.

- In retaliation, Beijing exercised its lever as the largest supplier of Rare earth metals needed for chip production:

- In July 2023, China placed restrictions on some Gallium and germanium products. In December, restrictions were placed on several types of Graphites and a ban imposed on the export of technology for making rare earth magnets and technologies for extracting and separating rare earths.

- This can become a major energy security issue as China is the world’s top processor of rare earths, accounting for 70% of the world’s production.

WHAT ARE RARE EARTH MINERALS (REE)?

- They are set of 17 metallic elements: Including 15 lanthanides on the periodic table in addition to scandium and yttrium that show similar physical and chemical properties to the lanthanides.

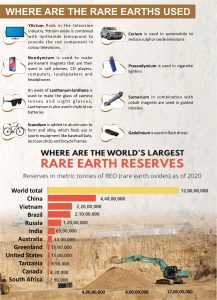

- The 17 Rare Earths are: Cerium (Ce), dysprosium (Dy), erbium (Er), europium (Eu), gadolinium (Gd), holmium (Ho), lanthanum (La), lutetium (Lu), neodymium (Nd), praseodymium (Pr), promethium (Pm), samarium (Sm), scandium (Sc), terbium (Tb), thulium (Tm), ytterbium (Yb), and yttrium (Y).

- NOTE: Gallium and germanium banned by China are NOT Rare Earth minerals.

- REEs are crucial in manufacturing of Batteries: Minerals like Cobalt, Nickel, and Lithium are required for batteries used in Electric vehicles.

- As per NITI Ayog: 80% of the country’s two- and three-wheeler fleet, 40% of buses, and 30 to 70% of cars will be EVs by 2030.

- REEs are an essential component of more than 200 consumer products which includes mobile phones, computer hard drives, electric and hybrid vehicles, semiconductors, flat screen TVs and monitors, and high-end electronics.

- Industrial use: Traditional uses like Cerium for glass polishing and lanthanum for car catalysts or optical lenses.

- Manufacturing of magnets: neodymium, praseodymium and dysprosium, are crucial to the manufacture of magnets which are used in industries and also in wind turbines and Drones.

- Even futuristic technologies need these REEs. For example, high-temperature superconductivity, safe storage and transport of hydrogen for a post-hydrocarbon economy, environmental global warming and energy efficiency issues.

- They are called ‘rare earth’ because earlier it was difficult to extract them from their oxides forms technologically.

- They occur in many minerals but typically in low concentrations to be refined in an economical manner.

DOMINANCE BY CHINA:

- China has mastered the solvent extraction process to refine the strategic minerals, which Western rare earth companies have struggled to deploy due to technical complexities and pollution concerns.

- China has over time acquired global domination of rare earths, even at one point, it produced 90% of the rare earths the world needs.

- Today, however, it has come down to 60% and the remaining is produced by other countries, including the QUAD countries: Australia, India, Japan and United States.

- China under Wolf warrior Diplomacy is using supply of Critical Earth minerals as tool of Economic warfare:

- Eg- China’s ownership of Democratic Republic of Congo’s Cobalt mines which produces 70% of world’s Cobalt output.

ADVERSE IMPACT ON INDIA:

- Along with REEs, Critical minerals such as Lithium (White gold), cobalt & graphite etc. are crucial to country’s manufacturing & infrastructure development.

- Green Energy based upon Semiconductors used to run batteries such as Lithium-Ion battery is imperative to meet India’s Net Zero target by 2070.

- India has only 6% of the world’s rare earth reserves. It only produces 1% of global output and meets most of its requirements of such minerals from China.

- High Import dependency due to concentration of extraction & processing of REEs in few regions:

- For Example: India is 100% Import dependent for supply of critical minerals such as lithium, cobalt, nickel, beryllium etc.

- REEs such as Dysprosium, Terbium, and Europium are not available in Indian deposits in extractable quantities.

- In India, monazite and thorium is the principal source of rare earths.

- Thus, in case of Supply chain vulnerability caused by export ban by China or Semiconductor chip war between USA & China can be detrimental to India’s energy security concern and its target to become 3rd largest economy by 2027.

- High import dependency also leads to High Current Account Deficit (CAD): Eg- India Imported worth ₹27,000 crore Copper in 2022.

ISSUES FACED BY INDIA:

- Expensive exploration & mining of deep-seated minerals such as gold, silver, copper, platinum etc

- Limited investment in Research & Development of Technologies: India spend only 1.7 % of its GDP while China spends 17 times more than India.

- For Example: India’s share in Global mineral exploration budget stands only at 1%

- As per Geological Survey of India (GSI): India has done only 10% exploration of its Geological potential while out of potential sites discovered; only 2% sites have been mined. (Source: Hindu Report, July 2023)

- Due to this poor exploration & production, India has been denied membership in Minerals Security Partnership (MSP) launched by USA: which aims at catalyzing investment from governments and the private sector to develop supply chains of Critical minerals & challenge China’s monopoly.

- In Mining & Exploration sector, there is huge dependency on PSUs & Govt’s Organizations such as MECL, GSI etc.

- Example: Indian Rare Earths Ltd (IREL) which is a Government of India Undertaking, and KMML, a Kerala State Government Undertaking are actively engaged in mining and processing of beach sand minerals from placer deposits.

- Low Private Sector Involvement: Mining & Exploration is highly capital intensive & long gestation period which deter Private investment.

- Also, there is requirement of Advance Technology such as Aerial surveys, geochemical analysis, geological mapping etc. which are not available at remote locations and at ground level.

- Environmental Impact: The chief concern is that the REEs are bound up in mineral deposits with the low-level radioactive element like thorium, exposure to which has been linked to an increased risk of developing lung, pancreatic, and other cancers.

STEPS TAKEN BY INDIA:

- MINES & MINERALS ACT 2023:

- To attract private investment in exploration of critical minerals: 6 minerals including Lithium has been removed from “critical & strategic” minerals category thus allowing private exploration.

- To encourage prospective stage exploration: Drilling & subsurface excavation has been allowed.

- National Mineral Exploration Trust (NMET) has been setup to Fund G4-G1 explorations.

WAY FORWARD:

- India should amend Atomic Mineral Concession Act (2016) which has reserved all beach Sand Mines deposits containing more than 0.75 per cent Monazite (source of REE) for government owned companies.

- Department for rare earths (DRE) could secure access to REEs of strategic importance by offering viability gap funding to companies to set up facilities in the upstream sector.

- Australia Model: “Junior explorer” private firms which have expertise to map commercially viable mines shall be incorporated who can further sell the research to bigger private companies which will eventually develop & operate mines.

- Building up domestic capability: There is a need to build domestic capability and broad-base supply sources for such an important and strategic raw material.

- Making it part of Make in India campaign: There is a need to make rare earth minerals a part of the ‘Make In India’ campaign, citing China’s ‘Made in China 2025’ initiative that focuses on new materials, including permanent magnets that are made using rare earth minerals.

- Supply chain resilience: The focus should be back on building cooperation on supply chain resilience which is a trade partnership for critical and emerging technology to deal with issues of climate, economy and pandemic impact.

- QUAD Critical and Emerging Technology Working group: It aims to develop supply resilience among Quad members which includes India, US, Japan, and Australia.

- Green goals: the critical minerals and emerging technology are the major need of the hour for achievement of green future goals.

- Minerals Security Partnership (MSP): India should try through diplomatic channels to enter this partnership.

POTENTIAL PRELIMS 2024 QUESTION:

Q1: Consider the following statements regarding Rare Earth Elements (REE) often seen in the news:

- China accounts for more than half of the World’s Rare Earth metals production

- REEs are set of 17 metallic elements including Gallium & Germanium

- REEs are used from manufacturing of Semiconductors to Cerium used for Glass polishing

- They are called as “Rare” metals because of their low availability in the world

Which of the above given statements is correct?

a. 1,2 and 4

b. 2 and 3 only

c. 1,3 and 4

d. 1, and 3 only

ANSWER: D

Explanation: RARE EARTH MINERALS:

- They are set of 17 metallic elements: Including 15 lanthanides on the periodic table in addition to scandium and yttrium that show similar physical and chemical properties to the lanthanides.

- The 17 Rare Earths are: Cerium (Ce), dysprosium (Dy), erbium (Er), europium (Eu), gadolinium (Gd), holmium (Ho), lanthanum (La), lutetium (Lu), neodymium (Nd), praseodymium (Pr), promethium (Pm), samarium (Sm), scandium (Sc), terbium (Tb), thulium (Tm), ytterbium (Yb), and yttrium (Y).

- NOTE: Gallium and germanium banned by China are NOT Rare Earth minerals.

- REEs are crucial in manufacturing of Batteries: Minerals like Cobalt, Nickel, and Lithium are required for batteries used in Electric vehicles.

- As per NITI Ayog: 80% of the country’s two- and three-wheeler fleet, 40% of buses, and 30 to 70% of cars will be EVs by 2030.

- REEs are an essential component of more than 200 consumer products which includes mobile phones, computer hard drives, electric and hybrid vehicles, semiconductors, flat screen TVs and monitors, and high-end electronics.

- Industrial use: Traditional uses like Cerium for glass polishing and lanthanum for car catalysts or optical lenses.

- Manufacturing of magnets: neodymium, praseodymium and dysprosium, are crucial to the manufacture of magnets which are used in industries and also in wind turbines and Drones.

- Even futuristic technologies need these REEs. For example, high-temperature superconductivity, safe storage and transport of hydrogen for a post-hydrocarbon economy, environmental global warming and energy efficiency issues.

- They are called ‘rare earth’ because earlier it was difficult to extract them from their oxides forms technologically.

- They occur in many minerals but typically in low concentrations to be refined in an economical manner.

- China is the world’s top processor of rare earths, accounting for 70% of the world’s production.

- India has only 6% of the world’s rare earth reserves. It only produces 1% of global output and meets most of its requirements of such minerals from China.

MAINS QUESTION 2024:

Q .The world is in search of alternative supply chains. India with its reserves in rare earth elements must leverage this, in this context discuss the importance of Rare Earth Material. What should be the steps for boosting Rare Earth Material industry in India? Illustrate.

I have appeared in Mains 2022 & 23 of UPSC CSE exam. I also guide students regarding their NEET & JEE preparations.

Working as Content developer at Plutus IAS since 2023.

No Comments