06 Feb Interim Budget 2024

This article covers ‘Daily Current Affairs’ and the topic details of “Interim Budget 2024″.This topic is relevant in the “Indian Economy” section of the UPSC CSE exam.

Why in the News?

The Interim Budget for 2024-25 was just tabled in parliament. It aims to reach ‘Viksit Bharat’ by 2047, with all-round, widespread, and inclusive growth.

About Interim Budget?

An interim budget is submitted by a government in transition or its final year of power prior to general elections. The interim budget’s objective is to ensure that government expenditure and critical services continue until the next government can present a full budget after taking office.

Major Highlights of the Interim Budget 2024-25

Capital Expenditure:

An 11.1% increase in the capital expenditure budget for 2024-2025 was announced. The capital expenditure is scheduled at Rs 11,11,111 crore, which represents 3.4% of GDP.

Economic Growth Projections:

For fiscal year 2023-24, real GDP growth is expected to be 7.3%, in line with the RBI’s revised growth prediction. The International Monetary Fund raised India’s growth forecast to 6.3% for fiscal year 2023-24. It also expects India to become the third-largest economy by 2027.

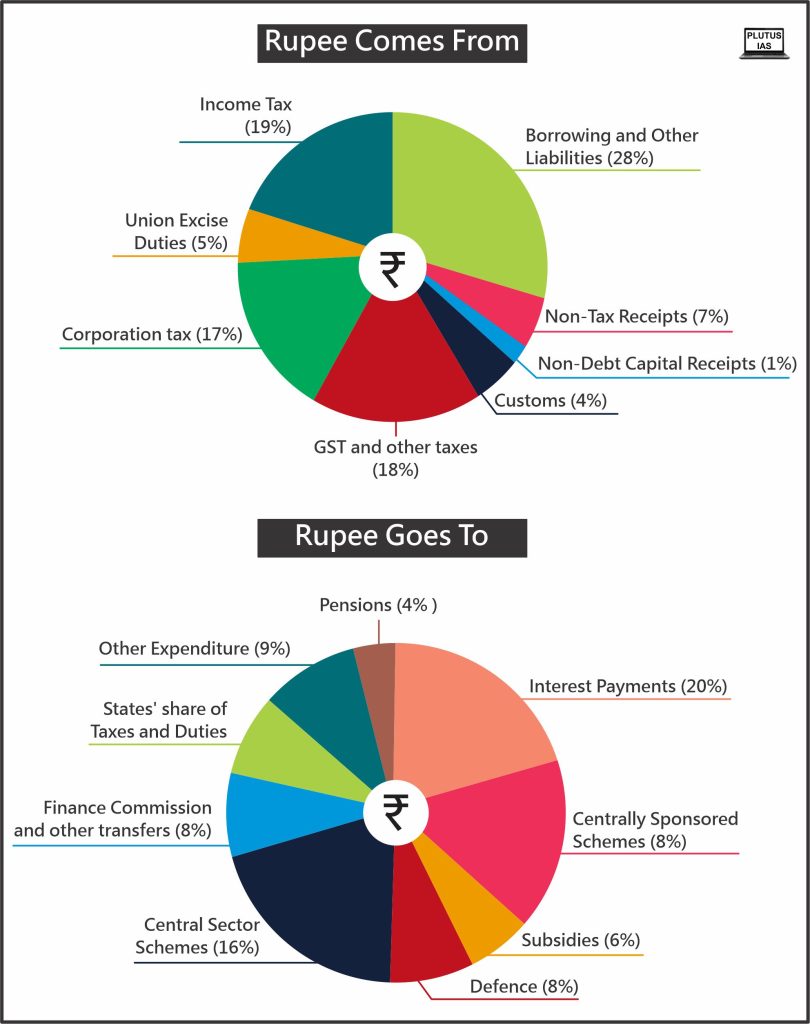

Revenue and Expenditure Estimates for 2024-25:

Total receipts are estimated at Rs 30.80 lakh crore, excluding borrowings. Total expenditure is estimated at Rs 47.66 lakh crore. Tax receipts are estimated at Rs 26.02 lakh crore.

GST collections:

It reached ₹1.65 lakh crore in December 2023, surpassing the ₹1.6 lakh crore threshold for the sixth time.

Fiscal Deficit and Market Borrowing:

The fiscal deficit is expected to be 5.1% of GDP in 2024-25, with a target of lowering it to less than 4.5% by 2025-26 (as indicated in the budget 2021-22). The gross and net market borrowings through dated securities in 2024-25 are anticipated to be Rs 14.13 and 11.75 lakh crore, respectively.

Taxation:

The Interim Budget keeps the current rates of direct and indirect taxes, including import charges. Corporate taxes are 22% for existing domestic enterprises and 15% for selected new manufacturing companies. Under the new tax regime, taxpayers earning up to ₹7 lakh are not required to pay any taxes. Certain tax incentives for startups and investments are prolonged by one year up to March 31, 2025

Infrastructure:

- Railways: Three important economic railway corridor projects will be implemented: energy, mineral and cement corridors, port connectivity corridors, and high traffic density corridors. Forty thousand regular rail bogies will be upgraded to Vande Bharat standards to improve safety, convenience, and passenger comfort.

- Aviation: The UDAN programme includes the expansion of current airports as well as the comprehensive development of new airports.

- Urban Transport: Promoting urban development through Metro Rail and NaMo Bharat.

Housing Sector:

The government intends to subsidize the development of 30 million affordable homes in rural areas. The Housing for Middle-Class initiative will be created to encourage the middle class to buy or build their own homes.

Healthcare Sector:

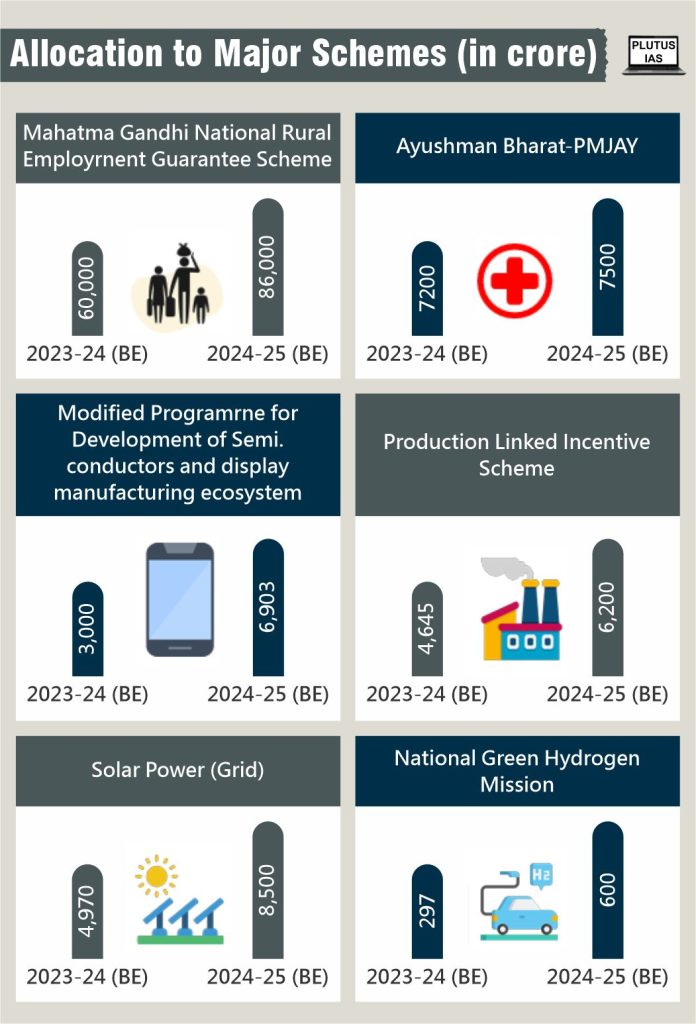

Promoting Cervical Cancer Vaccination for Girls (9-14 Years). Mission Indradhanush’s immunization activities will be carried out through the U-WIN platform. They are expanding the Ayushman Bharat programme to cover all ASHA, Anganwadi, and assistants.

Agricultural Sector:

Promoting the use of ‘Nano DAP’ for a variety of crops across all agro-climatic regions. Developing strategies to help dairy farmers and combat Foot and Mouth Disease and strategizing for AtmaNirbharta (self-reliance) in oilseeds, including research, procurement, value addition, and crop insurance.

Fishery Sector:

Creating a new department, ‘Matsya Sampada,’ to meet the demands of fishermen.

For States Capex:

The continuance of the fifty-year interest-free financing arrangement for capital spending by states was announced. A total outlay of Rs 1.3 lakh crore, with Rs 75,000 crore set aside for fifty-year interest-free loans to assist state-led reforms. The eastern area will receive special attention in order to become a strong driver of India’s economy.

Download plutus ias current affairs eng med 6th Feb 2024

Prelims practice questions

Q1) What is the difference between “vote-on-account” and “Interim Budget”? (UPSC Prelims-2011)

1) The provision of a “vote-on-account” is used by a regular Government, while an “interim budget” is a provision used by a caretaker Government.

2) A “vote-on-account” only deals with the expenditure in the Government’s budget, while an “interim budget” includes both expenditures and receipts.

Which of the statements given above is/are correct?

a) 1 only

b) 2 only

c) Both 1 and 2

d) Neither 1 nor 2

ANSWER: B

Q2) Consider the following statements:

1) The Prime Minister is responsible for presenting the annual budget in India

2) The “Pink Book” of the Indian budget is associated with the Defence aspect

3) The annual financial statement of the government is commonly known as the Finance Bill

How many of the above statements are correct?

a) One

b) Two

c) Three

d) None

ANSWER: B

Mains practice questions

Q1) Assess the potential impact of an expansionary fiscal policy introduced in a government budget on the overall economy. Discuss how it may influence inflation, employment, and economic growth.

I am a content developer and have done my Post Graduation in Political Science. I have given 2 UPSC mains, 1 IB ACIO interview and have cleared UGC NET JRF too.

No Comments