12 Feb RBI’s report “Finances of Panchayati Raj Institutions”

This article covers ‘Daily Current Affairs’ and the topic details of ”Finances of Panchayati Raj Institutions”.This topic is relevant in the “Polity & Governance” section of the UPSC CSE exam.

Why in the News?

The Reserve Bank of India (RBI) has released a report titled ‘Finances of Panchayati Raj Institutions’ for fiscal year 2022-23, which throws light on the financial dynamics of India’s Panchayati Raj Institutions (PRI). According to the report, local taxes and levies provided only 1.1 per cent of Panchayats’ overall revenue.

Key findings of the report

State Revenue Share and Disparities:

Panchayats continue to get a little portion of their state’s revenue. For instance, in Andhra Pradesh, revenue receipts of Panchayats constitute only 0.1% of the State’s own revenue, while in Uttar Pradesh, it comprises 2.5%, the highest among states. There are significant variations among states in terms of the average revenue earned per Panchayat, with Kerala and West Bengal leading with average revenues exceeding Rs 60 lakh and Rs 57 lakh per Panchayat, respectively.

Financial Statistics:

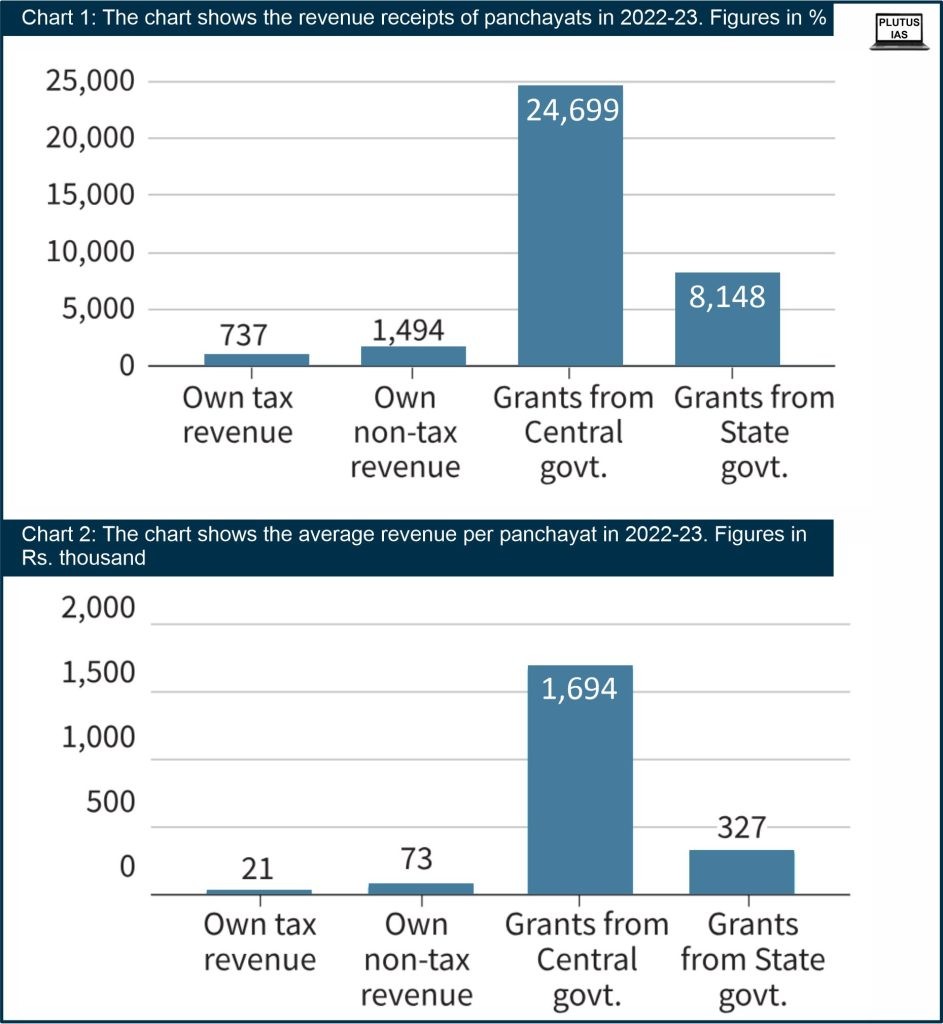

In the fiscal year 2022-23, Panchayats registered a total revenue of Rs 35,354 crore. A meagre Rs 737 crore was generated through their own tax revenue, which includes taxes on professions and trades, land revenue, stamps and registration fees, property taxes, and service tax. Non-tax revenue amounted to Rs 1,494 crore, mainly from interest payments and Panchayati Raj programs. Notably, Panchayats received Rs 24,699 crore in grants from the Central government and Rs 8,148 crore from State governments.

Revenue Structure:

Only 1% of the revenue collected by Panchayats is derived from taxes, with the majority originating from grants provided by the Central and State governments. Data indicates that 80% of the revenue is sourced from Central government grants, while 15% is obtained from State government grants.

Per Panchayat Revenue:

On average, each Panchayat earned only Rs 21,000 from its own tax revenue and Rs 73,000 from non-tax revenue. Conversely, grants from the Central government totalled approximately Rs 17 lakh per Panchayat, with State government grants reaching over Rs 3.25 lakh per Panchayat.

RBI Recommendations:

The RBI advocates for promoting greater decentralization and empowering local leaders and officials. It suggests measures to enhance the financial autonomy and sustainability of Panchayati Raj, emphasizing transparent budgeting, fiscal discipline, community involvement in development prioritization, staff training, and rigorous monitoring and evaluation. Additionally, the report underscores the importance of raising public awareness about PRI functions and encouraging citizen participation for effective local governance.

Financial resources available to Panchayati Raj Institutions (PRIs) are:

- Funding originates from the Central Finance Commission, specifically through tax devolution , and additional grants allocated by the Central Government.

- Finances collected by the State government on behalf of local bodies, known as State Finance Commissions Transfer, encompass tolls, taxes, duties, fees, and grants-in-aid.

- In accordance with Article 243-H, PRIs have the authority to impose, gather, and allocate taxes, duties, tolls, and fees.

Funding Issues faced by Panchayats:

Dependency on Grants: Panchayats heavily rely on grants from the Central and State governments, making them financially dependent. Inadequate grants can hinder their ability to implement developmental projects and provide essential services.

Inadequate Own Revenue Generation: Panchayats face challenges in generating sufficient revenue through local taxes and fees. Limited financial autonomy restricts their ability to fund local initiatives and reduces self-sustainability.

Unequal Distribution of Funds: The distribution of funds among Panchayats is often unequal, leading to disparities in resource availability. Some Panchayats receive more financial support than others, exacerbating regional imbalances in development.

Limited Fiscal Devolution: The devolution of financial powers to Panchayats is not always comprehensive. This limited fiscal devolution impedes their ability to make independent financial decisions and address local needs effectively.

Lack of Transparency in Fund Allocation: In some cases, the allocation and utilization of funds may lack transparency, leading to mismanagement and corruption. This can undermine the intended impact of funds on local development.

Insufficient Capacity Building: Panchayats may face challenges in effectively utilizing funds due to a lack of administrative and financial management capacity. Adequate training and capacity-building programs are essential to enhance their financial management skills.

Unpredictable Funding Patterns: The unpredictability of fund releases from higher levels of government can create uncertainty for Panchayats in planning and executing long-term projects. Timely and consistent funding is crucial for sustained development.

Download plutus ias current affairs eng med 12th Feb 2024

Prelims practice questions

Q1) The fundamental object of the Panchayati Raj system is to ensure which among the following? (UPSC Prelims-2015)

- People’s participation in development

- Political accountability

- Democratic decentralisation

- Financial mobilisation

Select the correct answer using the code given below

a) 1, 2 and 3 only

b) 2 and 4 only

c) 1 and 3 only

d) 1, 2, 3 and 4

ANSWER: C

Q2) Consider the following statements:

- The role of the District Planning Committee in Panchayati Raj is to Coordinate development activities in the district

- The term duration for Panchayats as per the 73rd Amendment Act is 5 years

- 21 years is the minimum age to contest elections for the post of a Panchayat Samiti member

How many of the above statements are correct?

a) Only one

b) Only two

c) Only three

d) None

ANSWER: B

Mains practice questions

Q1. To what extent has the decentralisation of power in India changed the governance landscape at the grassroots? (UPSC Mains-2022)

Q2. In the absence of a well-educated and organised local-level government system, ‘Panchayats’ and ‘Samitis’ have remained mainly political institutions and not effective instruments of governance. Critically discuss. (UPSC Mains-2015)

I am a content developer and have done my Post Graduation in Political Science. I have given 2 UPSC mains, 1 IB ACIO interview and have cleared UGC NET JRF too.

No Comments