14 Apr Rupee Trade

This article covers “Daily Current Affairs” and the topic details “Rupee Trade”. There are discussions going on to transact in Rupee than in other currencies like the dollar or euro. The topic “Rupee Trade” has relevance in the “Economy” section for the UPSC CSE exam.

For Prelims:

What is Rupee Trade?

For Mains:

GS 3: Economy

What are the benefits of Rupee Trade?

What is the significance of the Rupee Trade?

What are the challenges in Rupee Trade?

What is the way forward?

Why in the news?

Recently RBI and the Ministry of Finance have urged the industry to make the transactions in Rupee. Rupee Trade will make aid in making the transaction cost lower. Currently, they trade in other currencies like the dollar and euro majorly.

What is Rupee Trade?

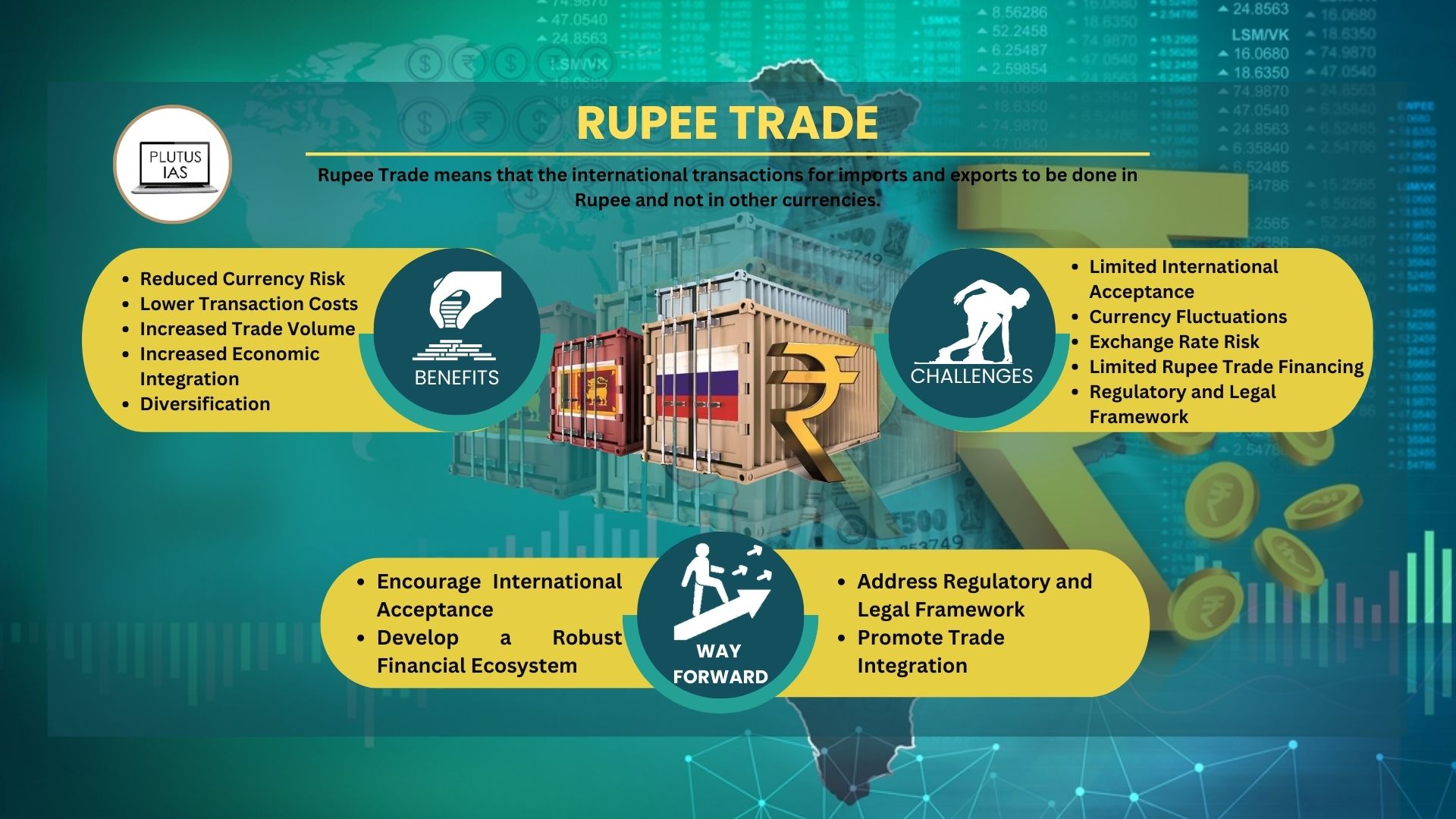

Rupee Trade means that the international transactions for imports and exports are to be done in Rupee and not in other currencies. Rupee Trade will also include financial transactions on stock exchanges to be done in Rupees instead of a more prevalent currency like the dollar.

What is the need for Rupee Trade?

The need for Rupee Trade was felt because of the following reasons:

- Geopolitical tensions and global economic currents: The US has been putting sanctions on the use of the dollar for transactions with its hostile nations like Iran and Russia. This makes the case for ‘independence’ and getting out of currency restrictions.

- Weakening of the Indian Rupee: The weakening of the Indian Rupee is another reason. There is an impetus for global growth and emphasis on Indian exports.

What are the benefits of Rupee Trade?

The benefits of the Rupee Trade are as follows:

- Reduced Currency Risk: By using the Indian rupee as the currency of transactions, the transacting parties can avoid the currency risk associated with using a foreign currency.

- Lower Transaction Costs: When transactions are made using a foreign currency, there are often additional transaction fees and exchange rate costs involved. By using the Indian rupee, these costs can be reduced or eliminated, resulting in lower transaction costs.

- Increased Trade Volume: The use of the Indian rupee in trade can increase the volume of trade between countries. This is because it reduces the barriers to entry for smaller businesses and makes it easier for them to participate in international trade.

- Increased Economic Integration: The use of the Indian rupee in trade can help increase economic integration between countries. This can result in closer economic ties, greater economic growth, and increased employment opportunities.

- Diversification: For countries heavily reliant on a single currency for their international trade, the use of the Indian rupee can provide an alternative currency option, which can help diversify their currency risk.

What are the challenges in Rupee Trade?

Despite the potential benefits of the Rupee Trade, there are also several challenges that need to be addressed. Here are some of the challenges:

- Limited International Acceptance: The Indian rupee is not yet widely accepted as an international currency, which limits its use in cross-border trade. This can make it difficult for businesses to use the Indian rupee in their transactions with other countries.

- Currency Fluctuations: Like all currencies, the Indian rupee is subject to fluctuations in value due to economic and political factors. This can create currency risks for businesses that use the Indian rupee in their transactions.

- Exchange Rate Risk: Since the Indian rupee is not a widely traded currency, there is limited liquidity in the market for the Indian rupee, which can make it difficult to obtain competitive exchange rates.

- Limited Availability of Rupee Trade Financing: The availability of financing options for Rupee Trade is limited, which can make it difficult for businesses to finance their cross-border transactions in Indian rupees.

- Regulatory and Legal Framework: The regulatory and legal framework for Rupee Trade is not well-developed, which can make it difficult for businesses to navigate the regulatory landscape and comply with legal requirements.

What is the way forward?

The way forward for Rupee Trade lies in addressing the challenges and leveraging the opportunities to promote the use of the Indian rupee in cross-border transactions. This will require:

- Encourage International Acceptance

- Develop a Robust Financial Ecosystem

- Address Regulatory and Legal Framework

- Promote Trade Integration

There is a need for a calibrated approach to switch to transactions in the Rupee keeping in mind the vulnerabilities associated with the Indian Rupee and also leveraging on the strengths of international currencies that can be beneficial for Indian trade.

Sources:

https://thewire.in/economy/explainer-rbi-rupee-settlement-international-trade

No Comments