20 Mar Stagflation

STAGFLATION

This article covers “Daily Current Affairs” and the topic details Stagflation. Stagflation is an important concept in the Economy and has relevance for UPSC.

stagflation

Relevance for UPSC CSE

For Prelims:

- What is Stagflation?

- Reasons for the occurrence of Stagflation.

For Mains:

- GS 3: Economy

- Impact of Stagflation

- Measures to control Stagflation

Why in the news?

Recent economic developments both domestic and global have cast a dark spell on economic growth across the globe.

The rising inflation and its negative impact on growth can lead to stagnation in economic growth. The economic data points towards ensuing stagflation that can drown major economies across the globe.

What is stagflation?

The term “stagflation” was indeed coined by Iain Macleod, a Conservative Party MP in the United Kingdom, in November 1965.

Stagflation is a word composed of Stagnation and Inflation. Stagflation is a relationship that shows the coupling of high inflation and stagnation of economic growth. Both the parameters of inflation and stagnation have an impact on unemployment prospects. Stagflation is a concern for policymakers because actions to lower inflation can lead to low growth and high unemployment.

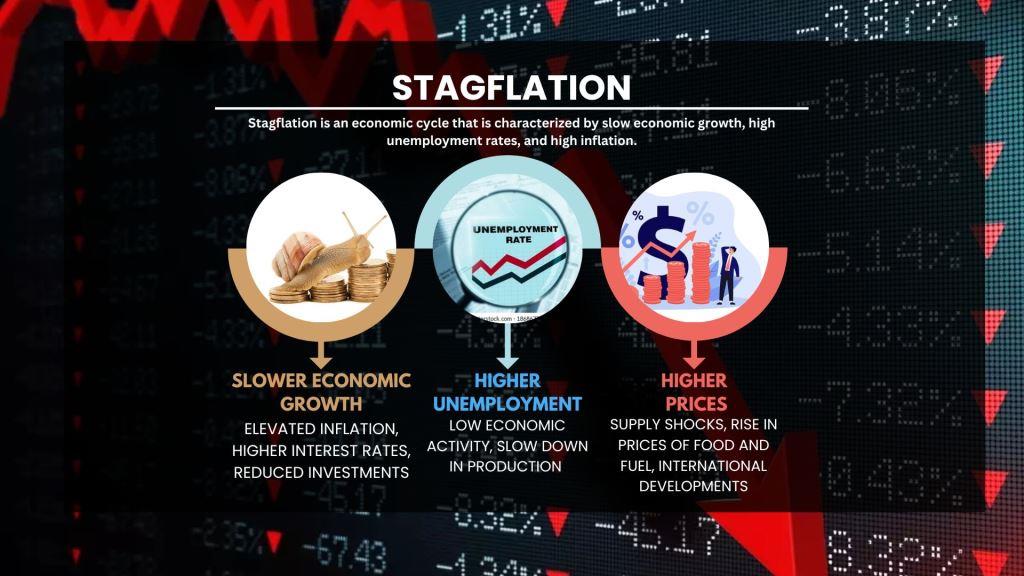

Thus in a nutshell, Stagflation is an economic cycle that is characterized by slow economic growth, high unemployment rates, and high inflation. Stagflation presents a challenging situation for policymakers because attempts to address one issue may worsen another.

stagflation meaning

Why there are fears of Stagflation?

- Retail inflation crossing the tolerance limit: The retail inflation recorded in February was at 44% which is outside the RBI’s inflation limits of 2-6 percent.

- Core inflation stuck around 6 percent: Core inflation which is the inflation excluding fuel and food prices stands high. The core inflation recorded in February was 6.2. It has hovered nearly 6 percent since May 2021. 2%

- Prediction of a likely El Niño this year: The weather uncertainty can hurt the food supply. Any kind of loss or below-normal production can drive food prices high which can further lead to inflation.

- Monetary tightening and low credit growth: The Central banks across the words have raised the policy rates to reign in inflation. This can lead to low credit growth which can further dampen growth prospects.

- High fuel prices: Fuel prices have a multiplier effect on the prices of commodities in the economy. This can lead to inflation.

What are the factors? (Economic Survey 2022-23)

- Global Economic Recovery impeded by the Russia-Ukraine conflict: The global economic recovery was happening until the Russia-Ukraine conflict broke out. The effect of the Russia-Ukraine conflict was:

- Broken Supply Chains: The conflict disrupted the restoration of the supply chains which were broken by the lockdown and limited trade.

- Rise in prices of critical commodities: The conflict raised prices of essential commodities like such as crude oil, natural gas, fertilizers, and wheat.

- Rise in Inflation: The rise in prices of critical commodities accompanied by the fiscal stimuli given by the governments to push growth (fiscal stimuli and expansionary monetary policies) led to inflationary pressures.

- Role of Central Banks: Central Banks across the world have been hiking policy rates and absorbing liquidity synchronously. The rise in inflation and subsequent monetary tightening by the central banks led:

- Rise in bond yields: The rise in bond yields led to the outflow of equity capital from most of the economies around the world into the traditionally safe-haven market of the US.

- Strong US dollar: The capital flight subsequently led to the strengthening of the US Dollar against other currencies.

- Impact of depreciation of currencies on local economies: The consequent depreciation of other currencies has been widening the Current Account Deficit and increasing inflationary pressures in the net importing economies.

What are the measures to control stagflation?

There is no single remedy to control inflation but a combination of measures can be adopted to deal with Stagflation :

- Contractionary Monetary Policy to control stagflation: The central bank can use a contractionary monetary policy to control inflation by raising interest rates. This can reduce demand in the economy, which can help to lower prices and control inflation. But this also has the danger to reduce consumption and investments resulting in Stagflation. Stagflation can lead to slower economic growth and may give rise to unemployment.

-

- Impact of Contractionary Monetary Policy: Monetary tightening is a contraction monetary policy in which a central bank raises (RBI in the case of India) interest rates and deposit ratios to make credit less easily available. It is done to absorb excess liquidity and cool down inflation. Rise in interest rates by Central Banks → Rise in borrowing costs → Stress on public and private debt and reduced investments → Fear of Stagflation

- Fiscal Policy to control stagflation:: The government can use fiscal policy to stimulate economic growth and reduce unemployment. This can be achieved through measures such as increasing government spending, cutting taxes, and providing subsidies to businesses. However, these measures can also lead to an increase in inflation.

- Supply-side Policies to control stagflation:: The government can use supply-side policies to improve the productivity of the economy, which can help to reduce costs and control inflation. This can be achieved through cutting excise duties on fuel, a buffer stock of food, capital investments to drive growth, etc.

- Wage and Price Controls to control stagflation: The government can implement wage and price controls to directly control inflation.

Source:

Daily Current Affairs for UPSC

Every UPSC aspirant should read current affairs daily for their UPSC exam preparation. The dream of the passing UPSC examination can be fulfilled when the aspirants read daily current affairs at the time of the UPSC exam preparation. Here, plutus IAS provides the latest and the best daily current affairs for the UPSC exam preparation for the UPSC examination. Also, collect the weekly and monthly current affairs for the IAS exam preparation.

Download the PDF now:

No Comments