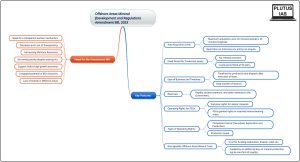

07 Aug Offshore Areas Mineral (Development and Regulation) Amendment Bill, 2023

This article covers “Daily Current Affairs” and the topic details “Offshore Areas Mineral (Development and Regulation) Amendment Bill, 2023”. The topic “Offshore Areas Mineral (Development and Regulation) Amendment Bill, 2023″ has relevance in the Economy section of the UPSC CSE exam.

For Prelims:

Salient Features of the Amendment Bill?

For Mains:

GS 2: Economy

Need for the Amendment Bill?

Offshore Areas Mineral (Development and Regulation) Act, 2002?

Why in the news:

The Offshore Areas Mineral (Development and Regulation) Amendment Bill, 2023, has been approved by the Rajya Sabha, aiming to introduce amendments to the existing Offshore Areas Mineral (Development and Regulation) Act, 2002 (OAMDR Act).

Salient Features of the Amendment Bill:

Types of Operating Rights:

- Two types of operating rights, production lease, and composite licence, will be granted exclusively to the private sector through auction by competitive bidding.

- The composite licence is designed as a two-phase operating right, enabling sequential activities of exploration first and then production operations.

Operating Rights for PSUs:

- PSUs will be granted operating rights in mineral-bearing areas reserved by the Central Government.

- Exclusive operating rights for atomic minerals will be granted only to PSUs.

Fixed Period for Production Lease:

- The provision for renewing production leases has been eliminated.

- The production lease period is fixed at 50 years, aligning with the MMDR Act.

Area Acquisition Limit:

- A limit is set on the total area one entity can acquire offshore.

- No individual or entity can acquire more than 45 minutes latitude by 45 minutes longitude in respect of any mineral or prescribed group of associated minerals under one or more operating rights combined.

Non-lapsable Offshore Areas Mineral Trust:

- To ensure availability of funds for various purposes, a non-lapsable Offshore Areas Mineral Trust will be established, maintaining a fund under the Public Account of India.

- The trust will receive funding through an extra levy on mineral production, which will not exceed one-third of the royalty, and the specific rate will be determined by the Central Government.

Ease of Business and Timelines:

- Provisions are made for easy transfer of composite licence or production lease to promote ease of doing business.

- Timelines are introduced for commencement of production and dispatch after the execution of production lease to ensure timely start of production.

Revenues:

- Royalty, auction premium, and other revenues generated from mineral production in offshore areas will accrue to the Government of India.

The Amendment Bill aims to enhance transparency and efficiency in the allocation of operating rights for mining in offshore areas. It promotes private sector participation, while also safeguarding the interests of affected parties and ensuring sustainable resource management. By harnessing the full potential of India’s maritime resources, the country can foster economic growth and development.

Need for the Amendment Bill:

Lack of Activity in Offshore Areas:

- Although the Offshore Areas Mineral (Development and Regulation) Act, 2002, has been implemented, offshore areas have not witnessed any mining activity, indicating either a lack of interest or successful utilization of these resources.

Discretion and Lack of Transparency:

- The existing Act exhibits a lack of transparency and discretion in the allocation of operating rights for mining in offshore areas.

- The Amendment Bill aims to introduce a transparent auction mechanism, inspired by successful amendments to the MMDR Act for onshore areas.

Harnessing Maritime Resources:

- India’s vast Exclusive Economic Zone (EEZ) contains significant recoverable resources, but their potential remains largely untapped.

- The Bill aims to harness these resources through private sector participation and support India’s high-growth economy

Offshore Areas Mineral (Development and Regulation) Act, 2002

India is abundantly rich in various mineral resources, including coal, copper, iron ore, and bauxite, owing to its diverse geological structure. The significant portion of valuable minerals dates back to the pre-palaeozoic age. Given the importance of mineral resources for export and internal trade, the Indian legislature recognized the need to regulate their development to safeguard against exploitation, illegal mining, and unauthorized export.

In response to this requirement, the Parliament passed the Offshore Areas Mineral (Development and Regulation) Act in 2002. This Act is designed to govern and manage the development of mineral resources in specific marine territories, such as territorial waters, the exclusive economic zone, continental shelf, and other maritime zones of India.

The primary objectives of the Offshore Areas Mineral (Development and Regulation) Act, 2002, include:

Regulation of Offshore Mining Sector:

- The Act primarily focuses on the regulation of offshore mining activities in India.

- It covers the development of mineral resources located in territorial waters, continental shelf, exclusive economic zone, and other maritime territories.

Central Legislation and Administrative Authority:

- Being a central legislation, the Act grants authority to the Union Government to oversee the mining of offshore resources.

- The Indian Bureau of Mines (IBM) is empowered to administer and regulate offshore mining operations.

- The Central Government can levy royalties and grant concessions for mining activities in offshore areas.

Safety and Environmental Concerns:

- The Act includes provisions for stringent punishment and fines in cases of safety standard violations, emphasizing the well-being of individuals involved in offshore mining and those impacted by it.

- It also addresses pollution prevention and control measures to safeguard the marine environment and protect marine life from adverse effects caused by offshore mining activities.

- The Offshore Areas Mineral (Development and Regulation) Act, 2002, officially came into effect from January 15, 2010, through an order issued by the Central Government on February 11, 2020.

SOURCE: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1945516

plutus ias current affairs eng med 7th August 2023

Q.1 Consider the following statements regarding Offshore Areas Mineral (Development and Regulation) Amendment Bill, 2023:

- Exclusive operating rights for atomic minerals are granted only to PSUs.

- The Amendment Bill grants operating rights exclusively to the public sector through competitive bidding.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ANSWER: A

Q.2 Consider the following statements regarding Offshore Areas Mineral (Development and Regulation) Amendment Bill, 2023:

- The provision for renewing production leases has been retained, and the production lease period can be extended beyond 50 years.

- The Amendment Bill introduces two types of operating rights, production lease, and composite licence, granted exclusively to the private sector through competitive bidding.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ANSWER: B

Q.3 Discuss the significance and potential impact of the Offshore Areas Mineral (Development and Regulation) Amendment Bill, 2023, in harnessing India’s maritime resources for sustainable economic growth. Analyze the key features of the Bill and their implications for private sector participation, transparency, and resource management.

No Comments