25 Sep India’s Forex Reserves Hit Record High of USD 683.987 Billion

Posted at 25 Sep 2024

in

Current Affairs

by Ritik singh

SYLLABUS MAPPING:

GS-3- Economics-India’s Forex Reserves Hit Record High of USD 683.987 Billion

FOR PRELIMS:

What factors contributed to the recent record high of India’s foreign exchange reserves, which reached USD 683.987 billion.

FOR MAINS:

Discuss the implications of India’s foreign exchange reserves reaching a record high of USD 683.987 billion on the country’s economy, currency stability, and external trade. Additionally, analyze the factors that have contributed to this increase in reserves.

RECENT CONTEXT:

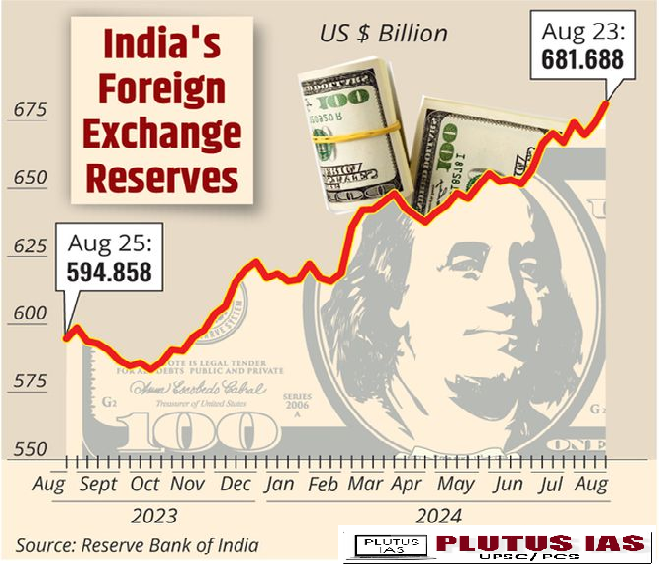

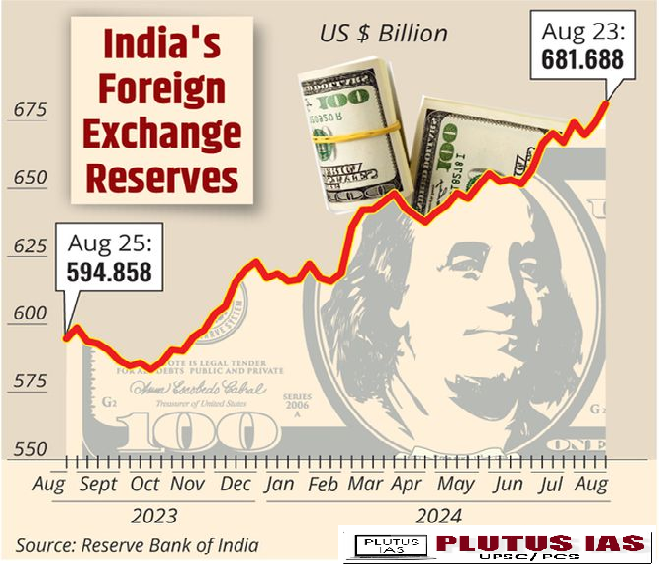

India’s foreign exchange reserves recently reached a historic peak of USD 683.987 billion, marking a significant milestone in the country’s economic journey. This development reflects not only the resilience of the Indian economy but also its growing stature in the global financial landscape. In this article, we will explore the implications of this record-high forex reserve, the factors contributing to its growth, and the potential challenges that India may face moving forward.

WhAT IS FOREIGN EXCHNAGE RESERVE?

Foreign exchange reserves are assets held by a country’s central bank in foreign currencies, gold, and other financial instruments. These reserves are crucial for a nation’s economic stability and play a significant role in international trade and finance.

Primarily, foreign exchange reserves are used to manage a country’s currency value and facilitate international transactions. They provide the central bank with the ability to intervene in the foreign exchange market, stabilizing the national currency against fluctuations. Adequate reserves help ensure that a country can meet its international payment obligations, making trade smoother and more predictable.

THE CRUCIAL ROLE OF THE RESERVE BANK OF INDIA (RBI):

1.Monitoring and Management: The RBI is responsible for monitoring the levels of forex reserves and ensuring their optimal management. This involves regular assessments of reserve adequacy in relation to the country’s needs and vulnerabilities.

2.Intervention in Forex Markets: To stabilize the Indian Rupee (INR), the RBI can intervene in the forex market by buying or selling foreign currencies. This intervention helps to mitigate excessive volatility and maintain investor confidence.

3.Investment Strategy: The RBI strategically invests a portion of the forex reserves in safe and liquid assets, such as government securities of other countries. This approach ensures that the reserves generate returns while maintaining liquidity.

4.Policy Formulation: The RBI plays a vital role in formulating policies that impact the balance of payments, foreign investment, and overall economic stability. These policies are essential for sustaining high levels of forex reserves.

5.Crisis Management and Preparedness: In times of economic uncertainty, the RBI’s management of forex reserves allows for effective crisis response. The reserves provide a safety net that can be utilized during unforeseen challenges, such as global economic downturns or geopolitical tensions.

6.Coordination with Government Agencies: The RBI works closely with various government departments to align monetary policy with fiscal measures, ensuring a coherent approach to economic management. This collaboration is essential for maintaining sustainable growth.

UNDERSTANDING FOREIGN EXCHANGE RESERVES:

Foreign exchange reserves consist of assets held by a country’s central bank in foreign currencies, gold, and other financial instruments. These reserves play a crucial role in ensuring a nation’s financial stability and are essential for various reasons:

1.Currency Stabilization: Reserves act as a buffer against currency fluctuations, helping to maintain exchange rate stability. A stable currency is vital for economic confidence and planning.

2.Facilitating International Trade: Adequate reserves ensure that a country can meet its international payment obligations, facilitating smoother trade relations.

3.Emergency Buffer: In times of economic distress, high reserves can provide a cushion against external shocks, helping to maintain investor confidence.

4.Investment Opportunities: Central banks can invest reserves in various assets, generating returns that can be reinvested in the domestic economy.

5.Creditworthiness: High levels of forex reserves enhance a country’s credit profile, making it easier and cheaper to borrow in international markets.

Historical Trend of India’s Forex Reserves:

| Year |

Forex Reserves (USD Billion) |

| 2018 |

424.9 |

| 2019 |

451.2 |

| 2020 |

585.1 |

| 2021 |

640.0 |

| 2022 |

607.0 |

| 2023 |

683.987 |

FACTORS CONTRIBUTING TO THE INCREASE IN FOREX RESERVES:

1. Robust Foreign Direct Investment (FDI)

India has become an attractive destination for foreign direct investment due to its vast market potential, demographic advantages, and government reforms. Initiatives such as “Make in India” and improved ease of doing business have significantly boosted FDI inflows. According to recent reports, FDI in India reached unprecedented levels, contributing substantially to the growth of forex reserves.

2. Strong Portfolio Investment

Foreign portfolio investors have increasingly turned to Indian equities, attracted by the country’s growth potential and relatively high returns compared to developed markets. This influx of capital has not only boosted the stock market but has also led to an increase in foreign currency reserves.

3. Growth in Exports

India’s exports have shown remarkable resilience, particularly in sectors such as information technology, pharmaceuticals, and textiles. The government’s focus on enhancing manufacturing capabilities and boosting export infrastructure has resulted in a favorable trade balance, thereby positively impacting forex reserves.

4. Remittances from the Diaspora

Indian expatriates continue to send significant remittances back home, which serve as a stable source of foreign currency. Despite global economic challenges, remittance inflows have remained robust, contributing to the increase in reserves.

5. Strategic Gold Purchases

The Reserve Bank of India (RBI) has strategically increased its gold reserves to diversify its asset portfolio. Gold is considered a safe haven during economic uncertainties, and its inclusion in forex reserves enhances overall financial stability.

6. Central Bank Interventions

To manage volatility in the foreign exchange market, the RBI has intervened by purchasing foreign currencies. Such interventions directly increase the country’s forex reserves and help stabilize the Indian rupee.

7. Favorable Global Economic Conditions

A low-interest-rate environment in developed countries has led to increased capital flows into emerging markets like India. The search for higher returns has prompted foreign investors to direct funds into the Indian economy, further bolstering forex reserves.

IMPLICATIONS OF RECORD FOREX RESERVES:

1. Enhanced Currency Stability

High levels of forex reserves instill confidence in the Indian rupee, helping to stabilize its value against other currencies. This stability is crucial for businesses and consumers, as it reduces uncertainty in international transactions and investment planning.

2. Improved Sovereign Credit Ratings

A strong reserve position can enhance India’s credit ratings, making it easier for the government to borrow in international markets. Improved ratings typically result in lower borrowing costs, benefiting both the public and private sectors.

3. Greater Investment Flexibility

With a robust level of reserves, India can explore investment opportunities abroad. These investments can yield returns that can be reinvested into domestic projects, further stimulating economic growth.

4. Buffer Against External Shocks

A high level of forex reserves provides a cushion against external vulnerabilities such as global financial crises, capital outflows, and geopolitical tensions. This resilience is particularly important in an interconnected global economy.

5. Trade Negotiation Leverage

Countries with substantial forex reserves often enjoy greater leverage in international trade negotiations. India can utilize its reserves to negotiate better terms in trade agreements, promoting its interests on the global stage.

6. Increased Funding for Development Initiatives

The government can utilize its strong reserves to finance critical infrastructure and social projects. Investments in health, education, and infrastructure can contribute to long-term economic development and social progress.

POTENTIAL CHALLENGES AHEAD:

1. Inflationary Pressures

An increase in forex reserves, if not managed prudently, could lead to inflationary pressures in the domestic economy. If the RBI’s interventions in the forex market lead to excessive liquidity, it may result in rising prices for goods and services.

2. Dependence on External Factors

India’s forex reserves are influenced by global economic conditions, commodity prices, and geopolitical developments. Any adverse changes in these external factors could result in capital outflows, negatively impacting reserves.

3. Effective Management of Reserves

The effective management of forex reserves becomes crucial as their size grows. The RBI must balance maintaining adequate reserves with ensuring that these funds are utilized effectively for national growth and development.

4. Sustainability of Growth Rates

Maintaining the current growth rates of FDI, FPI, and exports is essential for sustaining high forex reserves. A slowdown in these areas could have adverse implications for the overall economy.

5. Global Economic Volatility

The interconnectedness of global markets means that India is vulnerable to economic volatility abroad. Fluctuations in global capital flows can significantly impact the stability of forex reserves.

CONCLUSION:

The achievement of a record high in India’s foreign exchange reserves is a remarkable milestone that reflects the country’s economic resilience and growth potential. It underscores the effectiveness of government policies aimed at attracting investment and enhancing trade. However, as India celebrates this achievement, it must remain vigilant about the challenges that accompany it.

Effective management of forex reserves, coupled with strategic planning and policy formulation, will be key to harnessing their full potential for sustainable economic growth. As India continues to navigate the complexities of the global economic landscape, maintaining a balanced approach toward forex reserves will be crucial for ensuring long-term stability and prosperity.

PRELIMS QUESTION:

Q.Which of the following factors significantly contributed to the increase in India’s foreign exchange reserves?

A.Decrease in foreign direct investment

B. Increase in foreign portfolio investment

C. Reduction in exports

D.Lower remittances

ANSWER :B

MAINS QUESTION:

Q.Analyze the key factors that contributed to the recent surge in India’s foreign exchange reserves. In your response, evaluate the roles of foreign direct investment, portfolio investment, and export growth in this context?

No Comments