30 Oct Empowering India’s Space Economy: Rs. 1,000 Crore Venture Capital Fund Initiative for Innovation and Growth

SYLLABUS MAPPING:

GS-3-Economic–Empowering India’s Space Economy: Rs. 1,000 Crore Venture Capital Fund Initiative for Innovation and Growth

FOR PRELIMS:

What is the primary objective of the Rs. 1,000 crore venture capital fund initiative announced by the Indian government for the space sector?

FOR MAINS:

Discuss the potential economic impact of the venture capital fund on local economies and job creation in the space sector.

Why in the news?

The Union Cabinet, led by Prime Minister Narendra Modi, has approved the establishment of a Rs.1,000 crore Venture Capital (VC) Fund dedicated to supporting India’s space sector. This pioneering initiative, developed under the aegis of IN-SPACe (Indian National Space Promotion and Authorization Center), aims to propel the growth of space startups, strengthen India’s space economy, and position the country as a global leader in space technology. The establishment of this fund aligns with the government’s broader vision of promoting innovation, ensuring economic growth, and fostering self-reliance in high-tech industries, thus supporting the goals of Atmanirbhar Bharat.

Objectives and Strategic Vision of the Fund:

The Rs. 1,000 crore VC Fund is structured to align with India’s strategic vision for the space sector and supports the goals set forth in the 2020 space reforms. The fund is designed to address the unique needs of private companies operating in the high-risk, high-reward field of space technology. The fund aims to achieve the following objectives:

1. Capital Infusion: The capital fund is expected to encourage additional funding for later-stage development, instilling market confidence and providing early-stage financial support critical for growth.

2. Talent Retention and Domestic Development: Many Indian startups relocate abroad due to better financial opportunities. The fund will work to retain talent within India, preventing brain drain and fostering the growth of homegrown space companies.

3. Five-Fold Expansion of Space Economy: The government aims to grow India’s space economy by five times over the next decade, supporting the establishment of India as a major global player in space technology.

4. Technological Advancements: Investment in innovation will help advance space technology, supporting the development of sophisticated solutions for both domestic and international markets.

5. Boosting Global Competitiveness: Enabling Indian companies to develop unique space-based solutions will reduce dependency on foreign technology and allow for stronger competition on a global scale.

6. Supporting Atmanirbhar Bharat: By investing in indigenous startups, the fund underscores India’s commitment to self-reliance, fostering a robust domestic space economy with fewer dependencies on external technology.

7. Creating a Vibrant Innovation Ecosystem: The fund seeks to foster a dynamic space innovation ecosystem by nurturing startups and fostering collaborations between various sectors. This environment encourages the development of new ideas, products, and technologies, stimulating a continuous cycle of innovation in the Indian space industry.

8. Driving Economic Growth and Job Creation: By supporting startups and entrepreneurs in the space sector, the fund is expected to boost economic activity, leading to the creation of thousands of direct and indirect jobs. It will enable companies across the supply chain to scale operations, thus enhancing India’s competitive position in the global space economy.

Financial Implications and Deployment Structure:

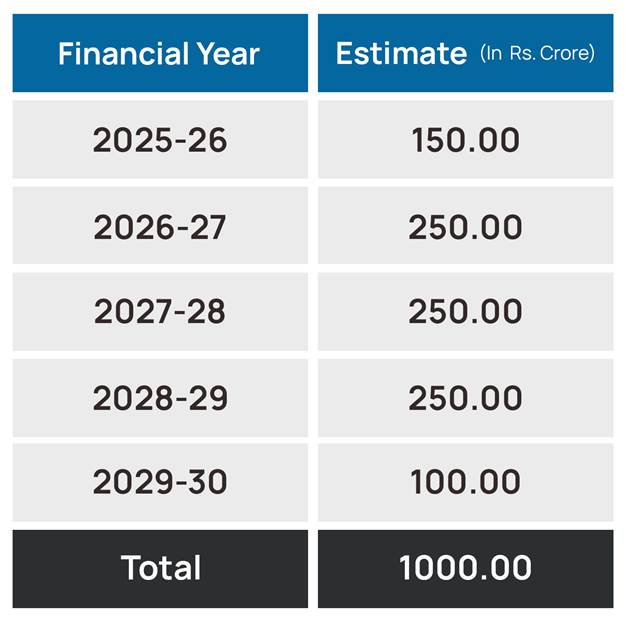

The Rs. 1,000 crore VC Fund will be deployed strategically over five years, supporting startups in various stages of growth. The annual investment range is projected to be between Rs.150 crore and Rs. 250 crore, depending on the industry’s needs and growth opportunities. The proposed break-up financial year-wise is as follows:

Deployment is structured in two tiers, based on the company’s growth stage and the projected impact on India’s space capabilities:

Growth Stage: Investments will range from Rs. 10 crore to Rs. 30 crore, depending on the startup’s development trajectory and long-term potential.

Later Growth Stage: Investments will range from Rs. 30 crore to Rs. 60 crore, supporting more established companies that have shown significant progress and have a strong growth trajectory.

Based on these funding ranges, the VC Fund aims to support around 40 startups, providing the necessary financial foundation to stimulate growth and innovation across India’s space industry.

Expected Impact on Employment and Economic Growth:

One of the primary goals of the fund is to create a robust ecosystem that promotes job creation and enhances India’s standing in the space technology sector.

1. Generate Direct Employment: Jobs in engineering, data analysis, software development, manufacturing, and other technical fields are expected to increase. Each investment could potentially generate hundreds of direct job opportunities within these high-skill areas.

2. Indirect Employment Opportunities: Additional employment will also be generated in fields associated with logistics, professional services, and supply chain management. These jobs will arise from the increased demand created by scaling businesses and manufacturing units.

3. Strengthening India’s Space Workforce: By fostering a skilled workforce in the space sector, the fund aims to build a sustainable talent pool, enhancing India’s global standing and driving innovation through skilled professionals.

The fund will not only create jobs but also drive economic growth by expanding the space ecosystem and building an innovation-centric economy that supports self-reliance and sustainable development.

Positioning India as a Global Space Economy Leader:

1 . Current Market Overview:

Indian space economy is valued at approximately USD 8.4 billion.

Represents a 2% share of the global space market.

2. Future Vision:

The government aims to scale the space economy to USD 44 billion by 2033.

Target includes USD 11 billion in exports, aiming for a 7-8% global market share.

3. Private Sector Participation:

Strong growth is expected from the increased involvement of private companies.

Approximately 250 startups are currently operating in various segments of the space economy.

4. Global Trends in Space Investment:

Many countries recognize the strategic importance of space, establishing VC funds.

Examples of such funds include:

UK: GBP 30 million Seraphim Space Fund

Italy: EUR 86 million Primo Space Fund

Japan: USD 6.7 billion Space Strategic Fund

Saudi Arabia: Neo Space Group by Public Investment Fund (PIF)

5. India’s VC Fund Initiative:

India plans to create a dedicated VC fund to support space startups.

Focus on fostering innovation and strengthening national capabilities in space technology.

6. Ecosystem Development:

Aims to create a robust space innovation ecosystem.

Encourages local development of space technologies and related services.

7. Strategic Importance:

Enhancing India’s position in the global space race.

Building partnerships and collaborations for technological advancements.

What are the challenges in India’s space sector :

1. Access to Capital: Many space startups struggle to secure funding from traditional financial institutions due to the high-risk nature of space technology investments. The perception of long payback periods further deters investment.

2. Talent Shortage: While there is a growing interest in space technology, there is a limited pool of skilled professionals. The need for specialized training programs and educational initiatives is critical to nurture talent in fields such as engineering, software development, and data analysis.

3. Regulatory Hurdles: Complex regulatory frameworks can hinder the rapid development and deployment of space technologies. Streamlining regulations and ensuring clear guidelines for private participation is essential for fostering innovation.

4. Infrastructure Limitations: Adequate infrastructure is vital for the growth of the space sector. Investment in testing facilities, launch pads, and research institutions is needed to support the increasing number of startups.

5. Market Competition: With many countries investing heavily in their space sectors, Indian companies face stiff competition. They need to develop unique technologies and solutions to carve out a niche in the global market.

6. Intellectual Property Issues: Protecting intellectual property rights in a rapidly evolving tech landscape is crucial for startups. Ensuring that innovators can safeguard their inventions will encourage more private investment.

7. Dependency on Global Supply Chains: A significant portion of space-related components is imported. Strengthening domestic manufacturing capabilities is essential for self-reliance and reducing vulnerability to global supply chain disruptions.

Way forward:

1. Enhanced Funding Mechanisms: Establish innovative funding models that include grants, equity, and convertible notes, making it easier for startups to access diverse capital sources.

2. Skill Development Initiatives: Launch training programs and partnerships with academic institutions to develop a skilled workforce. Collaborations with international space agencies can also enhance knowledge transfer.

3. Regulatory Simplification: Work with IN-SPACe and other regulatory bodies to create a conducive environment for startups, ensuring that policies are transparent and supportive of innovation.

4. Investment in Infrastructure: Allocate resources towards developing testing and launch facilities, research centres, and collaborative workspaces that foster innovation and partnership.

5. Focus on R&D: Encourage startups to invest in research and development through tax incentives and grants, promoting the creation of proprietary technologies.

6. Strengthen IP Protection: Create awareness and provide resources for startups on intellectual property rights, ensuring they can protect their innovations.

7. Encourage Domestic Supply Chains: Promote initiatives that incentivize the local manufacturing of components and technologies, reducing reliance on imports and enhancing self-sufficiency.

Conclusion:

Prelims Question:

Q. Which of the following is NOT one of the stated objectives of the Rs. 1,000 crore VC Fund?

A. Boosting global competitiveness

B. Encouraging brain drain

C. Supporting Atmanirbhar Bharat

D. Driving economic growth and job creation

Answer: B

Mains Question:

Q. Evaluate the role of IN-SPACe in facilitating private sector participation in the space industry. How can this organization further enhance its effectiveness in promoting innovation and investment?

(250 words, 15 marks)

No Comments