20 May OPEC+, Peak Demand, and India: Decoding the Oil Price Puzzle

This article covers “Daily Current Affairs” and the Topic OPEC+, Peak Demand, and India: Decoding the Oil Price Puzzle.

SYLLABUS MAPPING:

GS-3-Economic- OPEC+, Peak Demand, and India: Decoding the Oil Price Puzzle

FOR PRELIMS

What is OPEC? What is the significance of the high-level energy dialogue between India and OPEC?

FOR MAINS

What is the primary objective of OPEC?

Why in the News?

The Organisation of the Petroleum Exporting Countries Plus (OPEC+) announced a production increase of 431,000 barrels per day, beginning June 2025. This decision comes amidst a global oil market struggling with oversupply, stagnating demand, and geopolitical volatility.

What is OPEC?

The Organisation of the Petroleum Exporting Countries (OPEC) is a permanent intergovernmental organisation established in 1960 by five founding members: Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. Its primary aim is to coordinate and unify petroleum policies among member countries to ensure fair and stable oil prices, a regular supply to consumers, and a fair return on capital to producers. Over the years, OPEC has expanded to include several other oil-exporting nations. It plays a significant role in the global oil market by regulating oil production levels among its members to influence global crude prices. OPEC’s decisions can impact global inflation, trade balances, and energy security. Since 2016, OPEC has coordinated with other oil producers like Russia under the OPEC+ framework.

Evaluations of OPEC and OPEC+

| Aspect | OPEC | OPEC+ |

|---|---|---|

| Formation | Established in 1960 by Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. | Formed in 2016 as a coalition of OPEC and non-OPEC oil producers. |

| Members | 13 member countries (mostly from the Middle East, Africa, and South America). | OPEC members + 10 non-OPEC countries, including Russia, Mexico, Kazakhstan, etc. |

| Objective | Coordinate oil production policies to stabilise oil markets and prices. | Enhance cooperation between OPEC and non-OPEC producers to manage oil supply and prices. |

| Key Role | A traditional leader in oil production management and price regulation. | The broader alliance that wields greater influence over global oil supply and pricing. |

| Influence on Oil Prices | Significant, especially in earlier decades. | Greater combined influence due to increased share of global oil production (~55%). |

| Decision-Making | Internal consensus among OPEC members. | Requires alignment between OPEC and non-OPEC partners, especially major producers like Russia. |

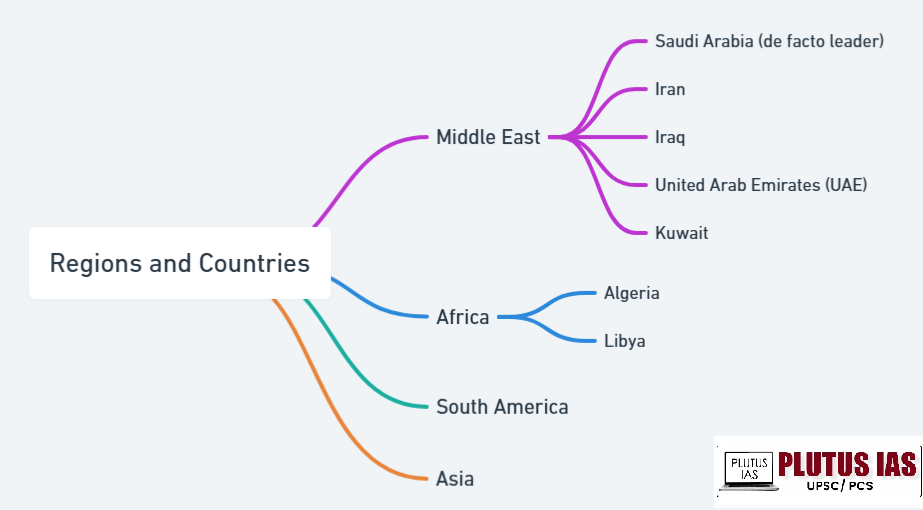

Members of OPEC

Mandate of an OPEC country

1. Oil Market Stabilization: OPEC countries aim to stabilize the international oil market by managing oil production levels and preventing extreme price volatility.

2. Coordinated Petroleum Policies: They work together to coordinate and unify petroleum policies to influence oil prices and maintain market balance.

3. Fair Pricing for Producers: OPEC ensures that oil-exporting nations receive fair and stable prices for their crude oil, safeguarding their economic interests.

4. Regular Supply to Consumers: Member countries are committed to providing a consistent and secure supply of oil to global consumers to avoid disruptions.

5. Investment and Revenue Security: They strive to offer fair returns on investment in the oil sector and ensure stable revenues for oil-producing economies.

6. Collective Output Management: Through agreed production quotas, OPEC countries adjust output levels collectively to match market demand and supply.

7. Promotion of Technical Cooperation: OPEC facilitates knowledge-sharing, training, and technical cooperation among members to boost operational efficiency and innovation.

8. Support for Economic Development: By leveraging oil revenues and policies, member countries use OPEC as a platform to support national development goals and diversify their economies.

Recent issue in the OPEC Country

1. Quota Non-Compliance: Countries like Kazakhstan, Iraq, and UAE are exceeding production limits, causing tensions within OPEC+ and prompting compensation mechanisms.

2. Falling Global Oil Demand: OPEC cut its 2025 oil demand growth forecast due to economic slowdown, trade issues, and renewable energy adoption.

3. Saudi Arabia’s Crude Burn: To meet high summer electricity demand, Saudi Arabia is increasing crude use for power, reducing export potential.

4. Delayed Policy Decisions: Output policy meetings are being postponed due to internal disagreements, creating market uncertainty.

5. Economic Impact of Cuts: Continued voluntary production cuts have reduced GDP forecasts for Gulf nations (GCC) by 1.4 percentage points.

6. Declining Market Control: Rising non-OPEC oil production, especially from the U.S., is weakening OPEC+’s influence on global oil prices.

India’s Role in OPEC

1. Major Oil Importer: India is the world’s third-largest oil importer, sourcing over 80% of its crude needs, with ~71% from OPEC nations.

2. Rising Energy Demand: India’s oil demand is projected to grow by 3.39% in 2025 and may double by 2045, reaching 11.7 million barrels/day.

3. Strategic Energy Dialogue: India and OPEC hold regular high-level meetings (since 2015) to promote energy security, affordability, and market stability.

4. Refining Expansion: India, the fourth-largest refiner, plans to expand refining capacity to 9 million barrels/day by 2030 to meet rising demand.

5. Energy Diversification: India is investing in renewables, hydrogen, and efficiency to reduce dependence on fossil fuel imports.

6. Global Market Influence: India’s growing consumption impacts global oil demand and shapes OPEC’s supply and pricing strategies.

7. Investment Collaboration: OPEC countries are investing in India’s refining and energy infrastructure, deepening bilateral ties.

8. Price Stability Advocacy: India supports stable oil prices through OPEC dialogue to protect economic growth and consumer interests.

How OPEC countries contribute to India’s oil dependency

1. Major Supplier of Crude Oil: OPEC countries supply around 71% of India’s total crude oil imports, making them the largest source of India’s imported oil.

2. Meeting Growing Demand: With India’s rising energy needs, OPEC countries play a vital role in fulfilling the increasing volume of crude oil required.

3. Energy Security Partner: OPEC nations are key stakeholders in ensuring India’s energy security by providing a steady and reliable flow of crude oil.

4. Price Influence: Production decisions by OPEC influence global oil prices, which directly affect India’s import costs and fuel prices domestically.

5. Strategic Dialogue and Cooperation: India engages in high-level dialogues with OPEC to discuss market stability, supply reliability, and cooperative strategies for energy security.

6. Investment and Infrastructure Collaboration: OPEC countries invest in India’s refining and energy infrastructure, helping boost India’s capacity to process crude oil efficiently.

7. Refining Capacity Support: OPEC oil supports India’s expanding refining sector, which is essential for meeting both domestic and export fuel demands.

8. Diversification Encouragement: Through collaborations, OPEC supports India’s efforts to diversify energy sources while still maintaining crude oil supply stability.

9. Geopolitical and Economic Impact: OPEC’s production policies and geopolitical dynamics affect India’s oil import strategy, trade balances, and economic planning.

Conclusion

OPEC and the broader OPEC+ alliance continue to play a crucial role in shaping the global oil market by managing production levels to balance supply and demand. Despite recent challenges like quota non-compliance and fluctuating demand, OPEC’s influence on oil prices and energy security remains significant. For India, OPEC countries are indispensable partners, supplying the majority of its crude oil imports and engaging in strategic dialogues to ensure market stability and energy security. As India’s energy needs rapidly grow, collaboration with OPEC countries not only supports its refining and infrastructure expansion but also helps India navigate global price volatility.

Download Plutus IAS Current Affairs (Eng) 20th May 2025

Prelims Questions

Q. With reference to the Organisation of Petroleum Exporting Countries (OPEC), consider the following statements:

1. OPEC was established in 1960 by five founding members.

2. OPEC+ includes both OPEC and non-OPEC oil-producing countries.

3. Saudi Arabia is the largest oil producer within OPEC.

4. OPEC’s primary objective is to increase oil production without regulating prices.

How many of the above statements are correct?

(a) Only one

(b) Only two

(c) Only three

(d) All four

Answer: C

Mains Questions

Q. Discuss the role of OPEC and OPEC+ in stabilising the global oil market and how their decisions impact India’s energy security and economy. In your answer, highlight recent challenges faced by OPEC countries and India’s strategic engagement with OPEC.

(250 words, 15 marks)

No Comments