26 Jul Approaches to Employment Income and Interest Rate Determination

Approaches to Employment, Income and Interest Rate Determination – UPSC Economics Optional

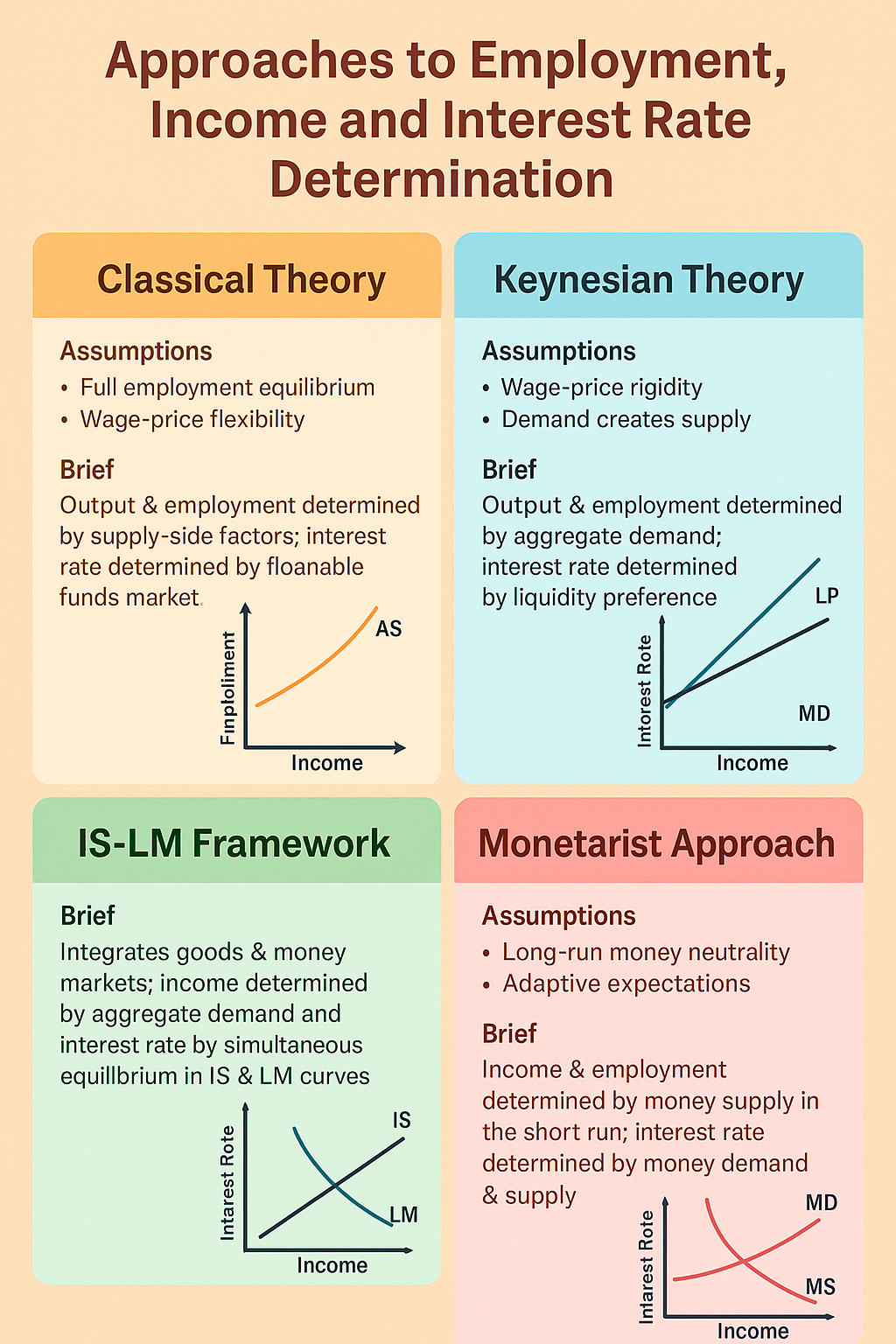

In the realm of macroeconomics, the interrelation between employment, income, and interest rates forms the bedrock of theoretical exploration and policy design. From the Classical school to Keynesianism, Monetarism, and beyond, various economic frameworks have attempted to explain how economies determine the levels of output, employment, and the rate of interest. This comprehensive guide is tailored for UPSC CSE aspirants with Economics as their optional, providing analytical depth and exam relevance.

1. Classical Theory: Say’s Law and the Self-Correcting Economy

Core Assumptions:

- Perfect competition and full employment equilibrium

- Flexible wages and prices

- Say’s Law: “Supply creates its own demand”

- Neutrality of money: money only affects prices, not real variables

Employment and Income Determination:

The Classical theory asserts that full employment is a natural state. If any unemployment exists, wage adjustments ensure that labor markets clear. Aggregate output is supply-driven, with markets always tending toward equilibrium due to price flexibility.

Interest Rate Mechanism:

According to the Loanable Funds Theory (initially Classical), the interest rate equilibrates saving and investment. If savings exceed investment, interest rates fall to encourage investment and reduce savings, restoring equilibrium.

Criticisms:

- Fails to explain prolonged unemployment (e.g., Great Depression)

- Over-reliance on flexible wages and prices

- Neglects demand-side shocks

2. Keynesian Revolution: The Role of Effective Demand

John Maynard Keynes challenged classical assumptions during the Great Depression, emphasizing the role of aggregate demand in determining employment and income.

Key Concepts:

- Effective Demand: Determines the level of employment

- Consumption Function: C = a + bY (marginal propensity to consume)

- Investment Function: Dependent on marginal efficiency of capital and interest rate

Employment and Income:

In the Keynesian framework, income and employment are determined where aggregate demand equals aggregate supply. A deficiency in demand leads to underemployment equilibrium, contradicting the Classical full employment hypothesis.

Interest Rate Determination:

Interest rate is not governed by savings and investment but by the interaction between money supply and liquidity preference (demand for money):

- Transaction Motive

- Precautionary Motive

- Speculative Motive

The liquidity trap scenario (horizontal LM curve) explains the ineffectiveness of monetary policy in certain situations.

Importance:

- Introduced the concept of involuntary unemployment

- Laid the foundation for fiscal activism

- Explains economic downturns and need for government intervention

3. IS-LM Model: Integration of Goods and Money Market

The IS-LM framework, developed by Sir John Hicks and Alvin Hansen, blends Keynesian demand analysis with Classical monetary theory to determine income and interest rates simultaneously.

IS Curve (Investment-Saving):

- Represents equilibrium in goods market (Y = C + I + G)

- Downward-sloping: lower interest rates stimulate investment → increase output

LM Curve (Liquidity-Money):

- Represents equilibrium in money market (M/P = L(Y, r))

- Upward-sloping: higher income increases money demand, pushing interest rates up

Joint Equilibrium:

The intersection of IS and LM curves determines the equilibrium income and interest rate for the economy. It offers a comprehensive view of macroeconomic equilibrium in the short run.

Policy Insights:

- Monetary Policy: Shift LM curve

- Fiscal Policy: Shift IS curve

Limitations:

- Short-run model, ignores inflation and supply constraints

- Assumes fixed price level

- Fails to explain stagflation

4. Monetarist Perspective: Friedman and the Quantity Theory of Money

Milton Friedman’s Monetarist theory revived the Classical emphasis on the money supply while criticizing Keynesianism for its instability and discretionary policies.

Core Propositions:

- Money is not neutral in the short run – affects real output

- In the long run, money is neutral and only affects price level

- Demand for money is a stable function of income and interest rate

Friedman’s Restatement of Quantity Theory:

MV = PY

- M = Money supply

- V = Velocity of money (assumed stable)

- P = Price level

- Y = Output or real GDP

Monetarists advocate for steady growth of money supply to ensure stable economic growth, criticizing frequent interventionist policies by governments.

5. Loanable Funds Theory

The Loanable Funds Theory extends the classical explanation of interest rate determination and considers the supply and demand of loanable funds.

Supply Side Includes:

- Savings by households

- Dishoarding and disinvestment

- Bank credit

Demand Side Includes:

- Investment by firms

- Government borrowing

- Consumption credit

Equilibrium interest rate is where the supply of loanable funds equals demand. It incorporates both real and monetary influences unlike the purely classical model.

6. Liquidity Preference Theory

Keynes’ Liquidity Preference Theory suggests that interest rate is the reward for parting with liquidity.

Motives for Holding Money:

- Transaction Motive: Routine expenditures

- Precautionary Motive: For emergencies

- Speculative Motive: Based on expectations about future interest rates

According to Keynes, when people expect bond prices to fall (interest rates to rise), they prefer to hold money, causing interest rates to rise due to higher demand for liquidity.

7. Real Balance Effect – Pigou’s Extension

Arthur C. Pigou argued that a fall in prices increases the real value of money holdings, thereby boosting consumption and restoring full employment. This mechanism was suggested to address deficiencies in Keynesian theory, especially the liquidity trap scenario.

The real balance effect (also known as Pigou effect) suggests that deflation could, in theory, restore aggregate demand and output by increasing consumers’ purchasing power.

8. Rational Expectations and New Classical Approach

The Rational Expectations Hypothesis, pioneered by Robert Lucas and others, posits that economic agents use all available information to form expectations about the future. This has profound implications for employment and interest rate dynamics.

Key Features:

- Markets clear continuously

- Unanticipated policy changes can affect output and employment temporarily

- Anticipated policies are neutralized by rational expectations

Policy Implications:

- Systematic monetary/fiscal policy is ineffective in influencing real variables

- Emphasizes credibility, transparency, and rules-based policies

9. New Keynesian Models

New Keynesians incorporate microfoundations into Keynesian macroeconomics, explaining rigidities such as sticky prices and wages.

Key Contributions:

- Menu costs and staggered price setting explain price stickiness

- Efficiency wages explain involuntary unemployment

- Supports short-run monetary non-neutrality with long-run neutrality

These models bridge the gap between Classical and Keynesian ideas and support activist policy, especially during recessions.

10. Comparative Table

| Approach | Employment Determination | Income Determination | Interest Rate |

|---|---|---|---|

| Classical | Self-correcting labor market | Supply-side (Say’s Law) | Loanable Funds |

| Keynesian | Effective demand | Aggregate demand | Liquidity Preference |

| IS-LM | Intersection of IS and LM | Joint equilibrium | Endogenous |

| Monetarist | Money supply driven | MV = PY framework | Money market equilibrium |

| New Classical | Natural rate, rational expectations | Real factors + surprises | Flexible and expectations-based |

| New Keynesian | Sticky wages, involuntary unemployment | Aggregate demand with frictions | Monetary non-neutrality in short-run |

11. Relevance to Indian Economy and Policy Implications

India, as a mixed economy with both capitalist and socialist characteristics, has applied lessons from various macroeconomic theories over decades:

Post-Independence:

- Heavy reliance on public investment and Five-Year Plans reflected Keynesian thinking

- Fiscal policy played a central role in employment generation (e.g., MGNREGA)

Post-1991 Liberalization:

- Monetarist ideas gained prominence with inflation targeting and monetary discipline

- Role of RBI evolved towards managing interest rates through repo operations

Post-COVID Response:

- Massive liquidity injection by RBI (LM Curve shift)

- Government fiscal packages and direct transfers (IS Curve stimulus)

Thus, Indian policymakers draw from a blend of Keynesian, Monetarist, and New Keynesian theories to address contemporary challenges.

12. Previous Year Questions (UPSC Economics Optional)

- 2022: Explain the IS-LM framework for determining income and interest rate.

- 2020: Discuss the classical theory of interest and its relevance in modern macroeconomic thinking.

- 2018: What is liquidity preference? How does it affect the interest rate determination?

- 2016: Compare the Keynesian and Monetarist approaches to income and employment.

- 2014: Explain the Loanable Funds Theory of interest rate. How does it differ from Keynes’ Liquidity Preference Theory?

13. Probable Questions for UPSC

- Compare Classical and New Keynesian views on employment determination.

- Critically examine the relevance of Pigou’s real balance effect in modern policy making.

- Evaluate the efficacy of interest rate as a tool to combat inflation in the Indian context.

- Discuss how IS-LM analysis explains the effectiveness of fiscal policy during a liquidity trap.

- Explain how Rational Expectations challenge the effectiveness of discretionary monetary policy.

14. Conclusion

Understanding the diverse theoretical approaches to employment, income, and interest rate determination is fundamental for any serious student of economics. Each framework, from Classical to New Keynesian, offers insights suited to different economic environments. For UPSC aspirants, these models not only help decode past economic crises but also build a nuanced view of current macroeconomic policies in India and globally.

Tags: Employment Theories, Classical Economics, Keynesian Theory, IS-LM Framework, Monetarist Approach, Loanable Funds, Liquidity Preference, Rational Expectations, UPSC Economics Optional,

Best economics optional coaching for upsc

Best economics optional teacher for upsc

best economics optional test series

No Comments