26 Jul Demand and Supply of Money

Demand and Supply of Money – UPSC Economics Optional

The demand and supply of money are core macroeconomic concepts that explain monetary equilibrium, price stability, and interest rate dynamics. These themes are particularly significant in the UPSC CSE Economics Optional Paper 1 syllabus, offering both theoretical foundations and practical relevance. This comprehensive guide covers the evolution of money demand and supply theories, institutional mechanisms, and policy tools, with reference to Indian and global experiences.

Table of Contents

- Introduction: What is Money?

- Demand for Money

- Supply of Money

- Money Market Equilibrium

- Evolution of Theories on Money Demand

- Keynesian vs Classical vs Monetarist View

- Role of RBI and Instruments of Control

- Modern Developments in Money Market

- Empirical Evidence and Critique

- Money in Indian Context – Case Studies

- Infographics and Mind Map

- Previous Year Questions (PYQs)

- Probable Questions for UPSC 2025

- Conclusion

1. Introduction: What is Money?

Money is an essential medium of exchange and a vital tool for facilitating economic transactions. Its evolution from the barter system to modern digital currencies reflects the advancement of economies. Money serves four key functions: (1) a medium of exchange, (2) a unit of account, (3) a store of value, and (4) a standard of deferred payment. In macroeconomics, the demand and supply of money determine interest rates, aggregate demand, inflation, and the overall performance of the economy.

In India, the Reserve Bank of India (RBI) manages money supply through monetary policy instruments, while the demand for money depends on factors like income levels, interest rates, and economic stability. For UPSC aspirants, understanding both the theoretical and practical aspects of money is crucial, as questions are frequently asked on the evolution of money demand theories, monetary policy, and the role of institutions.

2. Demand for Money

Demand for money refers to the desire of individuals and businesses to hold money for various purposes rather than spending or investing it immediately. Unlike other commodities, money is not demanded for its own sake but for what it can purchase. Money demand is influenced by income levels, interest rates, transaction needs, and expectations of future price levels.

2.1 Classical Approach: Quantity Theory of Money (QTM)

The classical economists, particularly Irving Fisher, viewed the demand for money through the lens of the Quantity Theory of Money. Fisher’s equation of exchange is expressed as:

MV = PT

Where M is the money supply, V is the velocity of circulation, P is the price level, and T is the volume of transactions.

According to the classical view, money demand is proportional to the value of transactions in the economy. It assumes that velocity (V) and transactions (T) are constant in the short run, meaning that any change in M directly affects P. This theory emphasizes the neutrality of money, suggesting that money only influences nominal variables and not real variables like output or employment.

2.2 Cambridge Cash-Balance Approach

Developed by economists like Alfred Marshall and A.C. Pigou, the Cambridge approach focuses on money demand as a portion of nominal income that people wish to hold. It is represented as:

Md = kPY

Here, k is the proportion of income (Y) that people want to hold in cash form, and P is the price level. This theory introduced the idea of money as a store of value, differing from Fisher’s transaction-focused view. It highlights that people may choose to hold money for precautionary or speculative reasons.

2.3 Keynesian Liquidity Preference Theory

John Maynard Keynes revolutionized the concept of money demand with his liquidity preference theory. He identified three motives for holding money:

- Transaction Motive: To meet day-to-day expenses and payments.

- Precautionary Motive: To address unforeseen circumstances.

- Speculative Motive: To take advantage of future investment opportunities.

Keynes emphasized the speculative demand for money, which depends on interest rates. When interest rates are low, people prefer to hold more cash, anticipating that bond prices will fall (interest rates will rise). Conversely, when interest rates are high, people hold less cash and invest in bonds. This theory connects the demand for money to monetary policy and interest rate determination.

2.4 Baumol-Tobin Model

The Baumol-Tobin model, developed in the 1950s, integrates the concepts of transaction cost and interest rate sensitivity. It suggests that individuals balance the opportunity cost of holding cash (foregone interest) with the cost of converting other assets into cash. The model highlights that the demand for money is inversely related to interest rates and positively related to income.

2.5 Friedman’s Modern Quantity Theory

Milton Friedman extended the classical QTM by treating money as one type of asset in an individual’s wealth portfolio. According to Friedman, the demand for money depends on:

- Permanent income (long-term income expectations)

- Rates of return on bonds, equities, and other assets

- Expected inflation

- Wealth composition and preferences

Friedman’s approach is more comprehensive and aligns with real-world observations by considering multiple asset choices and opportunity costs.

3. Factors Affecting Demand for Money

Key factors influencing money demand include:

- Income Levels: Higher income increases transaction needs and, consequently, the demand for money.

- Interest Rates: Higher interest rates discourage holding cash due to the opportunity cost of foregone interest.

- Price Level: A higher price level increases the nominal demand for money for the same real purchases.

- Uncertainty: In uncertain economic conditions, precautionary demand for money increases.

- Technological Advances: Digital payments and fintech innovations reduce the need to hold cash balances.

1. Introduction: What is Money?

Money is defined as any medium of exchange that is universally accepted in payment for goods and services and in settlement of debts. Beyond this, money acts as a unit of account, store of value, and a standard of deferred payments. The evolution of money from commodity-based forms like gold to modern fiat and digital currencies has fundamentally changed economic transactions.

In macroeconomic analysis, understanding the dynamics of money demand and money supply is essential. These concepts help explain price stability, inflation, deflation, and the functioning of monetary policy. For UPSC aspirants, a strong conceptual clarity of money demand and supply is crucial, as these topics frequently appear in both Prelims and Mains.

2. Demand for Money

The demand for money refers to the desire of households, businesses, and the government to hold a portion of their wealth in liquid form rather than investing it in physical assets or interest-bearing instruments. Various theories have been proposed to explain why individuals hold money and how this demand is influenced by factors like income, interest rates, and expectations.

2.1 Classical Quantity Theory of Money

Irving Fisher’s Quantity Theory of Money (QTM) is represented by the famous equation:

MV = PY

Where:

- M: Stock of Money

- V: Velocity of Money

- P: Price Level

- Y: Real Output

The classical view assumed V and Y are constant in the short run, implying that changes in money supply directly affect the price level. This theory treats money as a mere medium of exchange without intrinsic value.

2.2 Cambridge Cash Balance Approach

Unlike Fisher’s transactions approach, the Cambridge version (led by Marshall, Pigou) considered money as a store of value. It posited that individuals hold a fraction of their income as money for convenience:

M = kPY

where k is the proportion of income people wish to hold as cash balances. The approach highlighted the relationship between money demand and real income.

2.3 Keynesian Liquidity Preference Theory

John Maynard Keynes criticized the classical view and proposed that money demand is not just for transactions but also depends on interest rates, through three motives:

- Transactions Motive: Money needed for day-to-day expenses.

- Precautionary Motive: Money kept aside for unforeseen events.

- Speculative Motive: Money held as an alternative to bonds when interest rates are expected to rise.

Keynes introduced the concept of a liquidity trap, where interest rates become so low that monetary policy loses its effectiveness.

2.4 Baumol-Tobin Model

William Baumol and James Tobin refined the transactions theory by incorporating interest rates and transaction costs. They demonstrated that individuals choose an optimal money holding by balancing the cost of converting interest-bearing assets to cash with the foregone interest of holding money.

2.5 Friedman’s Modern Quantity Theory

Milton Friedman viewed money as one of many assets, similar to bonds and equities, that provide a flow of services. His demand function is:

Md/P = f(Yp, rb, re, πe, u)

Where:

- Yp: Permanent income

- rb, re: Returns on bonds and equities

- πe: Expected inflation

- u: Utility from holding money

This approach blends classical and Keynesian elements and emphasizes long-term stability in money demand.

2.6 Post-Keynesian Approaches

Post-Keynesian economists, including James Tobin and Don Patinkin, expanded on Keynesian theories by focusing on portfolio balance and real balance effects. They argue that wealth allocation between money and other assets drives money demand.

3. Determinants of Demand for Money

- Level of Income: Higher income increases transaction balances.

- Interest Rate: A key determinant of speculative money demand.

- Price Level: Higher prices increase the nominal need for money.

- Economic Uncertainty: Leads to higher precautionary balances.

- Technology: Digital payments and UPI reduce the need for physical cash.

1. Introduction: What is Money?

Money is defined as any medium of exchange that is universally accepted in payment for goods and services and in settlement of debts. Beyond this, money acts as a unit of account, store of value, and a standard of deferred payments. The evolution of money from commodity-based forms like gold to modern fiat and digital currencies has fundamentally changed economic transactions.

In macroeconomic analysis, understanding the dynamics of money demand and money supply is essential. These concepts help explain price stability, inflation, deflation, and the functioning of monetary policy. For UPSC aspirants, a strong conceptual clarity of money demand and supply is crucial, as these topics frequently appear in both Prelims and Mains.

2. Demand for Money

The demand for money refers to the desire of households, businesses, and the government to hold a portion of their wealth in liquid form rather than investing it in physical assets or interest-bearing instruments. Various theories have been proposed to explain why individuals hold money and how this demand is influenced by factors like income, interest rates, and expectations.

2.1 Classical Quantity Theory of Money

Irving Fisher’s Quantity Theory of Money (QTM) is represented by the famous equation:

MV = PY

Where:

- M: Stock of Money

- V: Velocity of Money

- P: Price Level

- Y: Real Output

The classical view assumed V and Y are constant in the short run, implying that changes in money supply directly affect the price level. This theory treats money as a mere medium of exchange without intrinsic value.

2.2 Cambridge Cash Balance Approach

Unlike Fisher’s transactions approach, the Cambridge version (led by Marshall, Pigou) considered money as a store of value. It posited that individuals hold a fraction of their income as money for convenience:

M = kPY

where k is the proportion of income people wish to hold as cash balances. The approach highlighted the relationship between money demand and real income.

2.3 Keynesian Liquidity Preference Theory

John Maynard Keynes criticized the classical view and proposed that money demand is not just for transactions but also depends on interest rates, through three motives:

- Transactions Motive: Money needed for day-to-day expenses.

- Precautionary Motive: Money kept aside for unforeseen events.

- Speculative Motive: Money held as an alternative to bonds when interest rates are expected to rise.

Keynes introduced the concept of a liquidity trap, where interest rates become so low that monetary policy loses its effectiveness.

2.4 Baumol-Tobin Model

William Baumol and James Tobin refined the transactions theory by incorporating interest rates and transaction costs. They demonstrated that individuals choose an optimal money holding by balancing the cost of converting interest-bearing assets to cash with the foregone interest of holding money.

2.5 Friedman’s Modern Quantity Theory

Milton Friedman viewed money as one of many assets, similar to bonds and equities, that provide a flow of services. His demand function is:

Md/P = f(Yp, rb, re, πe, u)

Where:

- Yp: Permanent income

- rb, re: Returns on bonds and equities

- πe: Expected inflation

- u: Utility from holding money

This approach blends classical and Keynesian elements and emphasizes long-term stability in money demand.

2.6 Post-Keynesian Approaches

Post-Keynesian economists, including James Tobin and Don Patinkin, expanded on Keynesian theories by focusing on portfolio balance and real balance effects. They argue that wealth allocation between money and other assets drives money demand.

best economics optional test series

best teacher of economics optional

Best economics optional coaching

3. Determinants of Demand for Money

- Level of Income: Higher income increases transaction balances.

- Interest Rate: A key determinant of speculative money demand.

- Price Level: Higher prices increase the nominal need for money.

- Economic Uncertainty: Leads to higher precautionary balances.

- Technology: Digital payments and UPI reduce the need for physical cash.

4. Supply of Money

The supply of money refers to the total stock of monetary assets available in an economy at a particular point in time. It is determined by the central bank and the commercial banking system.

4.1 Definitions of Money Supply

In India, the Reserve Bank of India (RBI) defines four monetary aggregates:

- M1: Currency with the public + demand deposits + other deposits with RBI

- M2: M1 + savings deposits with post offices

- M3: M1 + time deposits with banks (broad money)

- M4: M3 + total deposits with post offices (excluding NSCs)

4.2 High Powered Money and Money Multiplier

High Powered Money (H) is the base money created by RBI. It includes currency in circulation and bankers’ deposits with the central bank. The money multiplier (m) is the ratio of total money supply to high-powered money.

Money Supply = High Powered Money × Money Multiplier

4.3 Factors Affecting Money Supply

- CRR and SLR: Higher ratios reduce loanable funds

- Open Market Operations: Buying government securities adds liquidity

- Repo and Reverse Repo: Influence cost of borrowing for banks

- Government Borrowing: Monetization of deficits affects money base

- Foreign Capital Flows: Affect currency in circulation

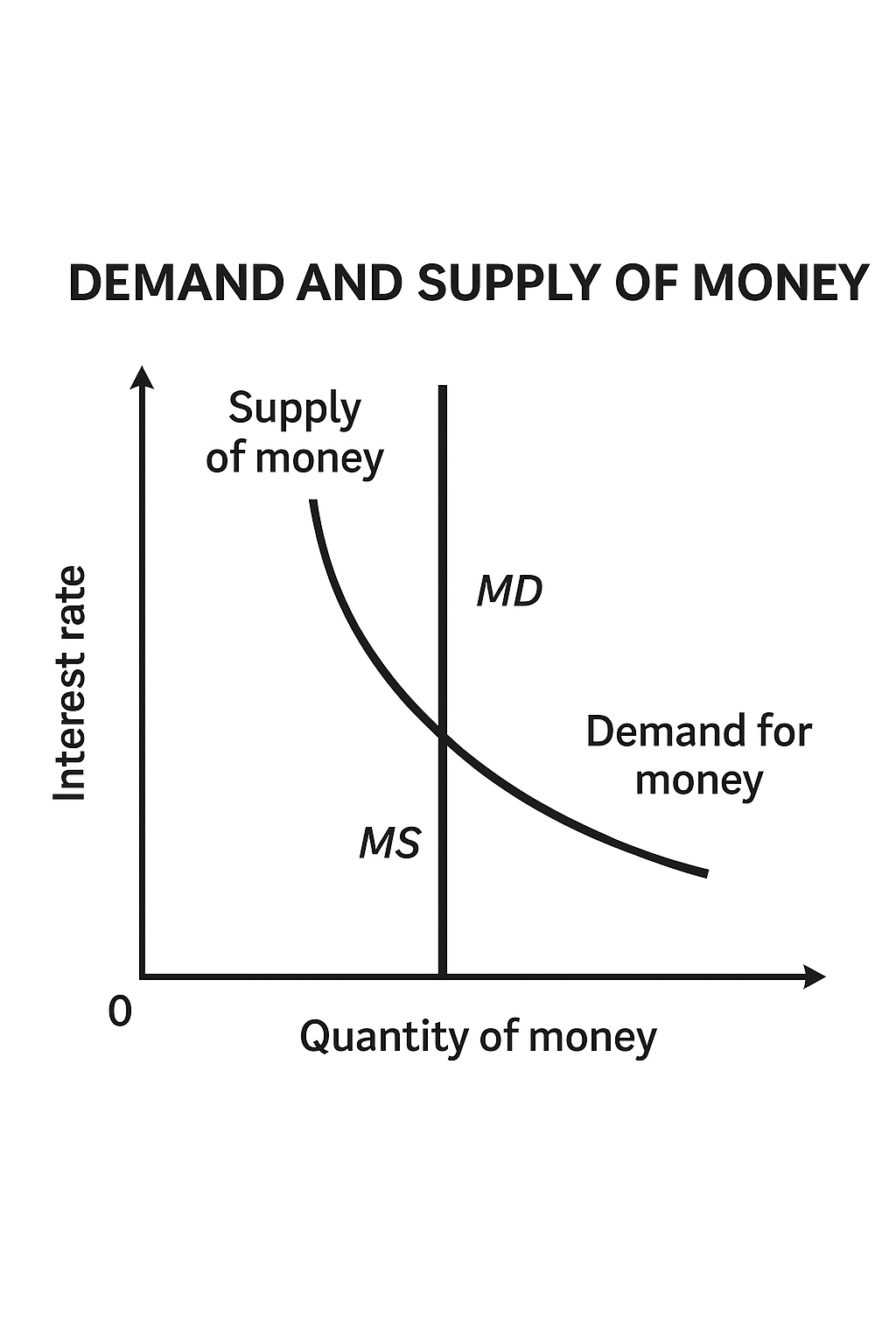

5. Money Market Equilibrium

Equilibrium in the money market occurs when money demand equals money supply. The intersection determines the interest rate, influencing investment and output in the economy.

Graphically, this is captured in the LM curve (in IS-LM framework), where the supply of money (controlled by central bank) intersects with the liquidity preference (demand for money).

6. Role of the Reserve Bank of India (RBI)

RBI uses quantitative and qualitative tools to regulate money supply and influence inflation, growth, and liquidity:

- Cash Reserve Ratio (CRR)

- Statutory Liquidity Ratio (SLR)

- Open Market Operations (OMO)

- Bank Rate, Repo, Reverse Repo

- Marginal Standing Facility (MSF)

7. Contemporary Issues and Digital Money

Recent developments such as UPI, digital wallets, and Central Bank Digital Currency (CBDC) are redefining both the demand and supply side of money. Digital payments reduce transaction demand for money while increasing the velocity of circulation.

8. Case Studies from Indian Economy

Demonetization (2016)

The sudden removal of ₹500 and ₹1000 notes contracted M1 and disrupted liquidity. While digital transactions surged, rural cash shortages highlighted reliance on currency. It provided insights into behavioral aspects of money demand.

COVID-19 Liquidity Measures

RBI injected over ₹8 lakh crore via LTROs, OMOs, and repo operations to ease credit conditions. Simultaneously, the precautionary demand for money increased sharply due to economic uncertainty.

Inflation Targeting and MPC Regime

Since 2016, India’s flexible inflation targeting has made money supply decisions data-driven, focusing on CPI inflation and output gap analysis.

9. Infographics and Mind Map

Infographic:

demand and supply of money

Mind Map:

Money Demand and Supply

10. Previous Year Questions

- 2022: Discuss the liquidity preference theory of interest rate and its relevance today.

- 2019: Explain the role of money multiplier in the process of money creation.

- 2016: Compare the classical quantity theory with the Keynesian approach to money demand.

- 2014: What determines the demand for money in Friedman’s view?

11. Probable Questions for UPSC 2025

- Explain the evolution of money demand theories from classical to modern monetarist views.

- How does the RBI manage the supply of money in the economy?

- Discuss the implications of CBDC and digital wallets on monetary policy.

- Differentiate between Baumol-Tobin and Keynesian theories of money demand.

12. Conclusion

The interplay of money demand and supply shapes the monetary foundation of any economy. From classical theories to modern-day digital finance, understanding these concepts is critical for UPSC aspirants seeking to master macroeconomic frameworks. With central banks adapting to changing payment behaviors and inflation dynamics, these theories remain crucial to interpreting and evaluating economic policy.

Graduation degree with IAS coaching

No Comments