17 Oct Empowering Rural India: NABARD Survey on Rural Financial Inclusion

SYLLABUS MAPPING:

GS-3 Economics-Empowering Rural India: NABARD Survey on Rural Financial Inclusion

FOR PRELIMS

What are the key findings of the NABARD survey on rural financial inclusion in India, and how do they highlight the challenges and opportunities for empowering rural communities?

FOR MAINS:

Analyze the trends in rural financial inclusion based on the NABARD survey. What factors contribute to the observed changes in financial access among rural populations?

Why In the News?

NABARD has published the findings from its second All India Rural Financial Inclusion Survey (NAFIS) for 2021-22, which offers primary data based on a survey of 1 lakh rural households, covering various economic and financial indicators in the post-COVID period.

What is the NABARD Survey on Rural Financial Inclusion?

The NABARD Survey on Rural Financial Inclusion, conducted by the National Bank for Agriculture and Rural Development, assesses financial inclusion in rural India. It examines access to banking services, usage patterns, and barriers to inclusion. Key findings indicate that many rural households lack basic financial services, and low financial literacy hinders the effective use of available products. Self-help groups (SHGs) are crucial for improving credit access, particularly for rural women. Geographical and cultural barriers further impact inclusion.

Key findings:

1. Survey Overview:

Conducted by NABARD (National Bank for Agriculture and Rural Development) to assess financial inclusion in rural India.

Focuses on access to financial services, usage, and barriers faced by rural populations.

2. Access to Financial Services:

Approximately 66% of rural households have access to banking services.

Increase in the number of banking correspondents and micro ATMs in rural areas.

3. Financial Literacy:

Financial literacy among rural populations is low, with only about 30% understanding basic financial concepts.

NABARD has initiated various programs to enhance financial literacy.

4. Usage of Financial Products:

Around 58% of rural households maintain savings accounts.

Approximately 40% of farmers have access to formal credit, relying significantly on informal sources.

5. Self-Help Groups (SHGs):

Over 8.5 million SHGs were formed, benefiting around 100 million women.

SHGs linked to banks, improving access to credit for members.

6. Barriers to Financial Inclusion:

Difficulties in accessing banking facilities due to distance and poor infrastructure.

Gender disparities and social norms hinder women’s access to financial services.

7. Digital Financial Inclusion:

Growing adoption of mobile banking, with over 50% of rural households using mobile phones for transactions.

Government initiatives like PMGDISHA aim to enhance digital literacy.

8. Impact on Livelihoods:

Financial inclusion positively impacts income generation, asset building, and improving living standards for rural families.

9. Future Recommendations:

Strengthening banking infrastructure and expanding the reach of financial services.

Enhancing financial literacy programs targeting diverse demographics, especially women and marginalized communities.

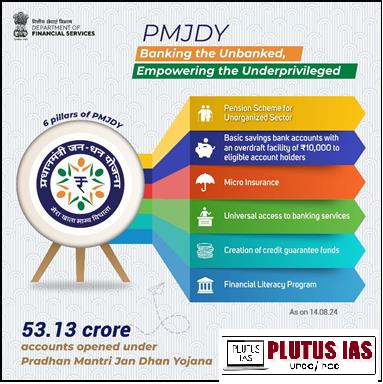

Government Initiatives:

1. Pradhan Mantri Mudra Yojana (PMMY): Provides micro-financing support to small entrepreneurs in rural areas, enabling them to start or expand their businesses.

2. Deendayal Antyodaya Yojana: National Rural Livelihoods Mission (DAY-NRLM): Aims to reduce poverty by promoting self-employment and organization of rural poor into Self-Help Groups (SHGs).

3. Pradhan Mantri Awaas Yojana: Gramin (PMAY-G): Focuses on providing affordable housing for the rural poor, ensuring secure living conditions that support economic activities.

4. Financial Literacy Initiatives: NABARD and the government implement various programs to enhance financial literacy among rural populations, enabling better use of financial services.

5. National Rural Livelihood Mission (NRLM): Encourages skill development and self-employment opportunities in rural areas to improve livelihoods and financial stability.

6. Digital India Initiative: Promotes digital literacy and the use of technology in financial services, making banking more accessible to rural communities.

7. Rural Credit Schemes: Various credit schemes are provided through NABARD and commercial banks to facilitate easy access to loans for agricultural and non-agricultural activities.

Key issues still persist:

1. Limited Access to Banking Infrastructure: Many rural areas still lack sufficient banking facilities, leading to difficulties in accessing financial services.

2. Low Financial Literacy: A significant portion of the rural population lacks basic financial knowledge, hindering their ability to utilize financial products effectively.

3. Dependence on Informal Sources: Rural households often rely on informal lenders for credit, which can lead to high interest rates and increased debt burdens.

4. Cultural and Social Barriers: Gender disparities and social norms can restrict women’s access to financial services, limiting their economic empowerment.

5. Geographical Challenges: Remoteness and poor transportation infrastructure make it difficult for rural residents to reach banking facilities.

6. Inadequate Product Offering: Financial products may not be tailored to the specific needs of rural populations, leading to lower usage rates.

7. Economic Vulnerability: Rural economies are often susceptible to shocks from climate change, market fluctuations, and health crises, affecting their financial stability.

Way forward:

1. Strengthening Banking Infrastructure: Increase the number of banking outlets and mobile banking units in remote areas to enhance access to financial services.

2. Enhancing Financial Literacy: Implement targeted financial literacy programs, particularly for women and marginalized groups, to improve understanding and usage of financial products.

3. Promoting Digital Financial Services: Leverage technology to provide digital banking solutions, making it easier for rural populations to access services remotely.

4. Tailoring Financial Products: Develop customized financial products that cater specifically to the needs of rural communities, including micro-loans and insurance options.

5. Encouraging Self-Help Groups (SHGs): Strengthen the SHG movement by providing training and resources to enhance their capacity to provide financial services and support to members.

6. Policy Support and Regulation: Create favourable policies and regulatory frameworks that encourage financial institutions to invest in rural areas and offer affordable services.

7. Collaboration with NGOs and Community Organizations: Partner with NGOs and local organizations to reach underserved populations and facilitate access to financial services.

8. Building Resilience Against Economic Shocks: Develop programs that provide financial safety nets and support mechanisms to help rural populations withstand economic shocks, such as crop insurance and emergency funds.

Conclusion:

The NAFIS 2021-22 results show significant advancements in rural financial inclusion since 2016-17, with improvements in income, savings, insurance coverage, and financial literacy. Key government schemes, such as the Pradhan Mantri Kisan Samman Nidhi and MGNREGS, have greatly enhanced rural livelihoods. As access to financial services expands, the outlook for economic empowerment in these households is positive. The survey emphasizes the need for continued investment in rural development to ensure a financially secure and prosperous future for India’s rural communities.

Download plutus ias current affairs eng med 17th Oct 2024

Prelims Question:

Q. Which of the following statements are true regarding the NAFIS 2021-22 results and rural financial inclusion?

1. The survey indicates significant improvements in income, savings, insurance coverage, and financial literacy among rural households since 2016-17.

2. Government welfare schemes have had no impact on the lives of the rural population.

3. The survey emphasizes the need for ongoing support and investment in rural development.

Select the correct answer using the code given below:

A. 1 only

B. 2 only

C. 1 and 3 only

D. All of the above

Answer: C

Mains Question:

Q. Examine the role of technology in promoting financial inclusion in rural India as highlighted in the NABARD survey. What are the potential benefits and challenges of using technology in this context?

(250 words, 15 marks)

No Comments