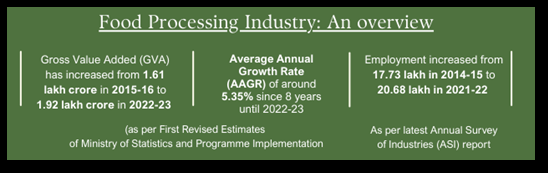

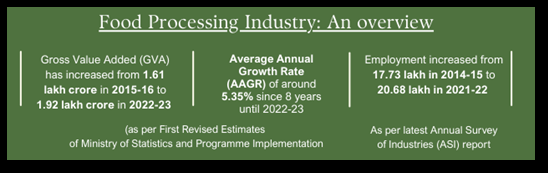

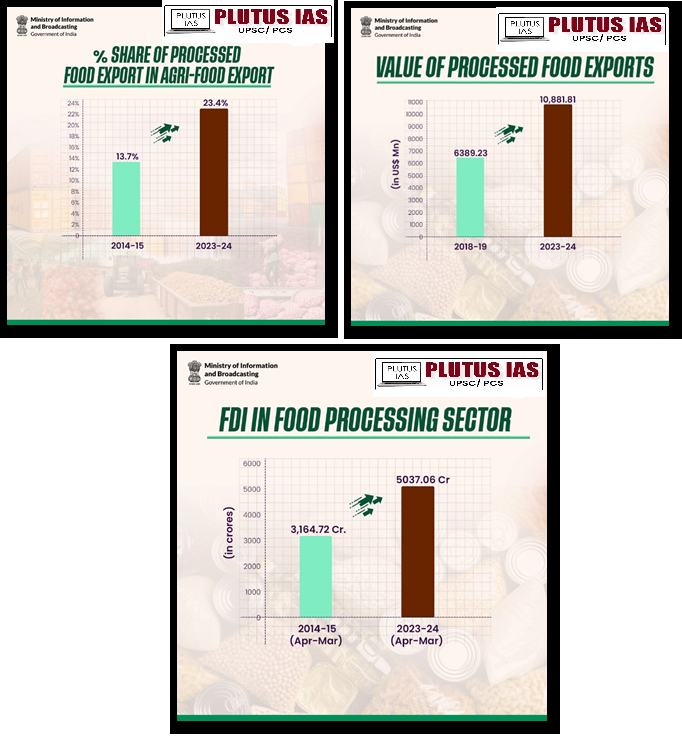

India’s food processing industry has undergone rapid transformation, driven by its vast agricultural base, rising domestic demand, and supportive government policies. India is poised to emerge as a global leader in the food processing sector, with an impressive growth trajectory. The agriculture sector forms the backbone of India’s food processing industry, India being the largest producer of fruits, vegetables, millet, tea, and food grains, as well as milk and livestock globally. The food processing sector is a priority under the Make in India initiative, with the Ministry of Food Processing Industries implementing schemes to attract investment and develop infrastructure. Mega Food Parks with essential utilities and common processing facilities are being established in agriculturally rich areas, offering a plug-and-play model for entrepreneurs. Investment in these parks is recognized under the Harmonized List of Infrastructure Sub-sectors (HLIS), enabling easier access to infrastructure lending.

Govt scheme for promotions of the food industry

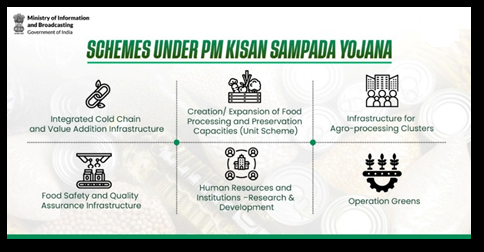

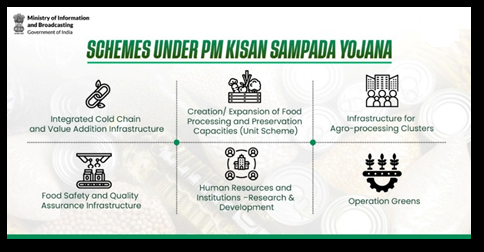

1. PM Kisan Sampada Yojana (PMKSY)

The umbrella Central sector scheme, SAMPADA Scheme for Agro-marine processing and Development of Agro-processing Clusters was approved in May 2017, with a total allocation of Rs.6000 crore for the implementation period. The continuation of the Central Sector Scheme Pradhan Mantri Kisan SAMPADA Yojana (Scheme for Agro-Marine Processing and Development of Agro-Processing Clusters) with an allocation of Rs. 4600 Crore has been further approved until March 31, 2026. As of February 28, 2025, MoFPI has sanctioned 1608 projects, including 41 Mega Food Parks, 394 Cold Chain projects, 75 Agro-processing Clusters projects, 536 Food Processing Units, 61 Creation of Backward & Forward Linkages and 44 Operation Greens projects under corresponding component schemes of PMKSY across the country. A total sum of ₹ 6198.76 crore has been disbursed as grants in aid/ subsidy since the inception of component schemes of PMKSY.

The PMKSY scheme aims at the following:

1. A comprehensive package for modern infrastructure and efficient supply chain management, from farm gate to retail outlet

2. Aims to boost the food processing sector in India

3. Helps farmers get better returns and supports a doubling of farmers’ income

4. Creates huge employment opportunities, especially in rural areas

5. Reduces wastage of agricultural produce

6. Increases processing levels of food products

7. Enhances exports of processed foods

2. PLISFPI- Production Linked Incentive Scheme for Food Processing Industry

The Central Sector Scheme, Production Linked Incentive Scheme for Food Processing Industry (PLISFPI) was approved by the Union Cabinet in March 2021, with an outlay of ₹10,900 Crore. The Scheme is being implemented over a six-year period from 2021-22 to 2026-27.

The components of the Scheme are –

1. Incentivising manufacturing of four major food product segments viz. Ready to Cook/ Ready to Eat (RTC/RTE) foods, including Millet based products, Processed Fruits & Vegetables, Marine Products and Mozzarella Cheese (Category I)

2. Production of Innovative / Organic products of SMEs (Category II)

3. The third component related to support for branding and marketing abroad (Category III) to incentivize the emergence of strong Indian brands for in-store Branding, shelf space renting and marketing.

4. From the savings under PLISFPI, a component for the Production Linked Incentives Scheme for Millet Based Products (PLISMBP) was also carved out from the scheme to encourage the use of Millets in RTC/RTE products and incentivise them under the PLI Scheme to promote its production, value addition and sale.

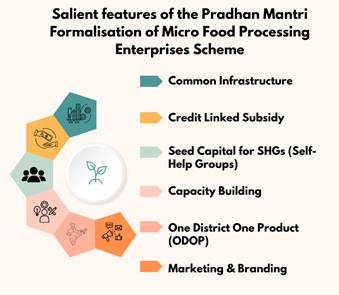

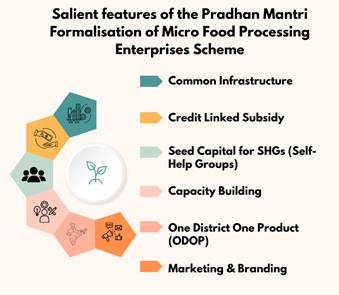

3. PMFME- Pradhan Mantri Formalisation of Micro Food Processing Enterprises Scheme

Launched in June 2020, the scheme aims to encourage ‘Vocal for Local’ in the sector in a total outlay of Rs. 10,000 crore in the period of FY 2020-2025 for this scheme. The scheme has been extended up to FY 2025-26. This is the first ever Government scheme for Micro Food Processing enterprises and is targeted to benefit 2 lakh enterprises through credit-linked subsidy and adopting the approach of One District One Product.

Food processing industry in India

| Aspect |

Details |

| Economic Importance |

Significant contributor to GDP, employment, and exports. |

| Growth Projections |

Expected CAGR of 8.8% from 2023 to 2032. |

| Sectoral Contribution |

8.8% of manufacturing GDP and 8.39% of agriculture GDP. |

| Market Size (2023) |

Valued at US$ 336.4 billion. |

| Government Initiatives |

MOFPI oversees policies, investments, and regulations. |

| Expansion |

Growth in Tier-2 and Tier-3 cities due to rising incomes. |

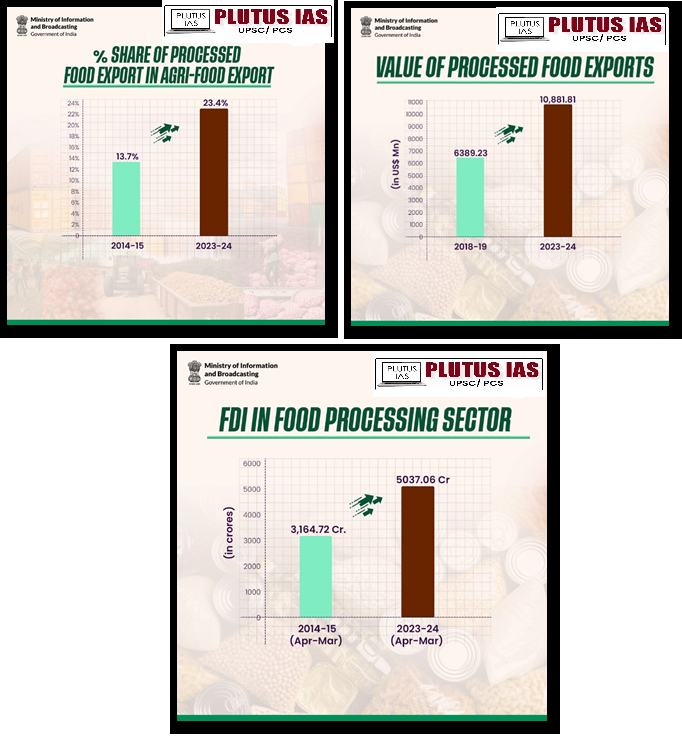

| Exports (FY 2023-24) |

Agricultural exports reached USD 48.15 billion. |

| AAGR (2015-2022) |

Average Annual Growth Rate of 7.26%. |

| Global Ranking |

6th largest food processing industry in the world. |

| Contribution to GVA |

9% of Gross Value Added (GVA) in the agriculture sector. |

| Employment Generation |

Provides jobs to over 11 million people. |

| Foreign Direct Investment |

USD 11.79 billion received (April 2000 – March 2023). |

| Food Parks & Infrastructure |

23 Mega Food Parks were established for modern processing facilities. |

| E-commerce & Retail Growth |

Online food delivery and retail chains boosting processed food demand. |

Challenges to India farm to retail food

1. Post-Harvest Losses: Around 30-40% of perishable food is wasted due to inadequate storage, poor handling, and transportation issues.

2. Cold Storage & Infrastructure Gaps: Limited cold chain facilities lead to spoilage of fresh produce, especially fruits, vegetables, and dairy products.

3. Middlemen & Price Exploitation: Farmers rely on intermediaries, leading to low farm-gate prices while consumers pay higher prices.

4. Logistics & Transportation Issues: Poor road networks, lack of refrigerated trucks, and high fuel costs increase food wastage and delivery delays.

5. Regulatory Hurdles: Complex licensing, food safety laws, and taxation policies create barriers for small businesses and retailers.

6. Inconsistent Quality & Standards: Lack of standardized grading and packaging affects food quality, making exports and retail operations challenging.

7. Limited Food Processing Facilities: Low investment in food processing reduces value addition and leads to higher food wastage.

8. E-commerce & Retail Challenges: Issues like last-mile delivery, perishability, and consumer trust make online food retail difficult to scale.

Way to strengthing farm to retail chain

1. Improve Cold Storage & Warehousing: Invest in cold chains, refrigerated trucks, and modern warehouses to reduce post-harvest losses.

2. Enhance Logistics & Transportation: Develop better road networks, rail connectivity, and efficient supply chains to ensure faster delivery of perishable goods.

3. Promote Farmer Producer Organizations (FPOs): Encourage FPOs and cooperatives to help farmers sell directly to retailers, reducing dependency on middlemen.

4. Increase Food Processing Capacity: Set up more food processing units to add value to raw produce and extend shelf life.

5. Adopt Digital & Smart Technologies: Use AI, blockchain, and IoT for real-time tracking, quality control, and better supply chain management.

6. Encourage Direct-to-Consumer (D2C) & E-commerce Models: Strengthen farm-to-fork platforms to help farmers sell directly to consumers and retailers.

7. Streamline Government Policies & Regulations: Simplify food safety laws, licensing, and tax structures to encourage private investment and innovation.

8. Expand Financial Support & Credit Access: Provide subsidies, low-interest loans, and insurance to farmers and small retailers for better infrastructure development.

Conclusion

India’s food processing industry is undergoing rapid transformation, driven by strong agricultural production, increasing consumer demand, and favourable government policies. With initiatives like PMKSY, PLISFPI, and PMFME, the government is focusing on enhancing infrastructure, boosting investments, and promoting value addition in the sector. Despite challenges such as supply chain inefficiencies, post-harvest losses, and regulatory hurdles, the industry holds immense potential for growth. Strengthening cold storage, logistics, and digital technologies, along with empowering Farmer Producer Organizations (FPOs) and promoting direct-to-consumer models, will be crucial in making the farm-to-retail supply chain more efficient.

No Comments