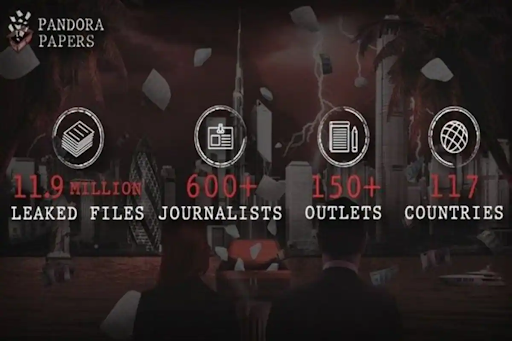

04 Oct It is Pandora after Panama: Hidden riches of world leaders and billionaires ‘exposed’ in ‘unprecedented’ leak (GS 3, Economics, The Hindu, Indian Express)

News/Context: In one of the biggest leaks of financial documents, the Pandora papers exposed the secret wealth and dealings of many world leaders, politicians, and billionaires. Around 12 million leaked files have been discovered, from the Investigation of 14 Global corporate services firms, showing the financial transactions. These transactions are done through the setup of thousands of shell companies and private trusts. It is not just to obscure tax jurisdiction but also to attract clients across the countries like United States, Singapore, and New Zealand. More than 300 public officials and some 35 current and former leaders around the world are featured in the files.

What it reveals: These documents reveal the ultimate ownership of overseas settled/placed assets and the investments including cash, shareholding, and real estate properties held by the offshore entities. There are at least 380 persons of Indian nationality in the Pandora Papers. Pandora papers revealing set up complex multilayer trust structures for asset planning by the famous notorious and rich people in the tax haven countries characterized by air-tight secrecy law. It reveals how businesses and individuals are pushing the structure to evade detection, using loopholes in the law at home and the negligent jurisdiction of tax havens.

Scrutiny of the papers shows that the objective of setting up private Offshore trusts is twofold. One that owners could hide their real identity and distance themselves from the trusts so that tax authorities could never reach them. The second is to safeguard investments like cash, shareholding, real-estate, yachts, and aircraft from creditors and Law enforcement agencies.

What is an offshore trust? It is a kind of overseas fiduciary arrangement where a third party, referred to as the trustee, holds assets on behalf of resident organizations or individuals that are to benefit from it. It is generally used for purposes of planning the estate and succession. It helps large business families to consolidate their assets like shareholding, financial investments, and real estate property.

A trust like this comprises three key parties: one who sets up, creates, or authors a trust, referred to as “Settlor”; the Second one who holds the assets for the benefit of a set of people named by the ‘settlor’ referred to as ‘trustee’; and the third one to whom the benefits of the assets are bequeathed, referred as beneficiaries’.

The legal nature of this kind of trust comes from the ‘trustee’, but it is not a separate legal entity. The Protector (appointed by the Settlor) has the powers to manage and supervise the trustee, and even remove the trustee and appoint a new one.

Distinct patterns emerged: In the Post-Panama scenario several Offshore entity owners found ways to hide their foreign assets and started the reorganization of their foreign assets when several countries including India tightened regulations. Indians started setting up of offshore trusts to distance themselves from their offshore wealth and to insulate their assets from creditors. They insured their near ones to live abroad as the caretaker of the created offshore trusts.

Many alleged Indians accused of economic offenses and are under scrutiny, have created an offshore network in tax havens like the Cook Islands, Samoa, or Belize besides larger tax havens like Panama and the British Virgin Islands. There is a fairly long list of Indian offenders who are currently under the scanner of agencies like the Enforcement Directorate, the Central Bureau of Investigation, and the Serious Fraud Investigation Office.

Indians with huge debts to Indian banks diverted sizable assets into a network of offshore companies. Those in debt of thousands of crores of rupees to Indian banks have, as the Pandora Papers show, diverted a sizable section of their assets into a maze of offshore companies. Many promoters, as the paper reveals, parked their assets in offshore trusts, effectively protecting themselves from personal guarantees to loans being defaulted by their businesses. Politically Exposed Persons who have held public office in India, were engaged in sensitive and risky trades. For instance the confidential data of the 14 offshore service providers shows a former Revenue Service officer, a former tax commissioner, a former senior Army officer, a former top law officer set up offshore entities. Actually there have been fear among Indian industries and business families of a return of the estate duty which till its abolition in 1985, was as high as 85 percent. Former finance minister Arun Jaitley in view of reducing the inequality, hiked the surcharge on the super-rich with income more than Rs 1 crore to 12%, while doing away with the 1% wealth tax in the Budget for 2015-16.

In popular imagination, the offshore system is often seen as a far-flung scattering of palm-shaded islands. The Pandora Papers show that the offshore money machine operates in every corner of the world, including financial capitals of the richest and most powerful economies including the United States of America.

Although India with various countries, has signed information exchange agreements. It seems that they exist only on paper. It is still difficult to pierce the corporate veil.

No Comments