24 Jul Oligopoly

Oligopoly – UPSC Economics Optional Paper 1 Notes

Includes Models, Diagrams, Infographics, PYQs, and Probable Questions for Prelims and Mains

Introduction

Oligopoly is a market structure characterized by a few large firms that dominate the industry. It lies between monopoly and perfect competition and is marked by strategic interdependence. Firms are aware of each other’s actions and react accordingly, making it a key area of analysis for students of microeconomic theory and UPSC Economics Optional aspirants.

Defining Characteristics of Oligopoly

- Few dominant firms in the industry.

- Barriers to entry are high (cost, regulation, brand loyalty).

- Firms may produce homogeneous or differentiated products.

- Strategic interdependence in pricing and output decisions.

- Possibility of collusion or tacit cooperation.

Types of Oligopoly

- Pure Oligopoly: Firms produce identical products (e.g., steel, cement).

- Differentiated Oligopoly: Products are similar but not perfect substitutes (e.g., cars, smartphones).

GS paper 4 syllabus and study plan

GS paper 3 syllabus and study plan

Major Models of Oligopoly

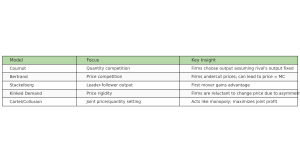

1. Cournot Model

Proposed by Antoine Cournot in 1838, this is a quantity-based model of duopoly. Firms simultaneously choose quantities and assume the rival’s output remains unchanged.

Equilibrium: Known as Cournot-Nash equilibrium. Each firm’s output is optimal given the rival’s choice.

Outcome: Total output is more than monopoly but less than perfect competition. Price is above marginal cost.

2. Bertrand Model

Proposed by Joseph Bertrand, it assumes firms compete on price rather than quantity.

Assumptions: Products are identical, and firms set prices simultaneously.

Outcome: Price equals marginal cost (Bertrand Paradox), which leads to zero economic profits.

3. Stackelberg Model

Introduced by Heinrich von Stackelberg, this model assumes sequential quantity decisions. One firm is the leader, and the other follows.

Result: The leader gains a strategic advantage and earns higher profits than the follower.

4. Kinked Demand Curve Model

This model explains price rigidity in oligopoly. It assumes that if a firm raises its price, others will not follow, but if it lowers the price, rivals will match it.

Outcome: A kink in the demand curve leads to discontinuity in the marginal revenue curve and sticky prices.

5. Cartel and Collusion

In this model, firms collude (explicitly or tacitly) to maximize joint profits by setting prices and outputs like a monopoly.

Example: OPEC in the oil industry.

Limitation: Collusion is illegal in many countries and unstable due to cheating incentives.

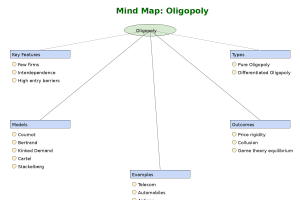

Mind Map – Oligopoly

Oligopoly_MindMap

Infographic – Oligopoly Models Comparison

Oligopoly Infographic

Game Theory and Oligopoly

Oligopolistic behavior is best studied using Game Theory. The Prisoner’s Dilemma is a classic example explaining why collusion fails despite being mutually beneficial. Nash Equilibrium helps predict stable outcomes under strategic interdependence.

Real-World Examples of Oligopoly

- Telecommunication: Airtel, Jio, and Vodafone-Idea in India.

- Automobile Industry: Maruti Suzuki, Hyundai, Tata Motors.

- Smartphones: Apple, Samsung, Xiaomi.

- Airlines: IndiGo, Air India, Vistara.

Advantages and Disadvantages

Advantages:

- Firms enjoy economies of scale.

- Stable prices in the short run.

- High expenditure on R&D due to competition.

Disadvantages:

- Price-fixing or collusion harms consumers.

- High entry barriers restrict competition.

- Non-price competition may mislead consumers.

Previous Year UPSC Questions (PYQs)

- UPSC 2023: Explain the kinked demand curve and its implication on price rigidity in oligopoly markets.

- UPSC 2020: Discuss how Game Theory is used to analyze behavior of firms in oligopolistic markets.

- UPSC 2017: Compare and contrast Bertrand and Cournot models of oligopoly.

Probable Questions for UPSC Prelims & Mains

- Mains: Discuss the effectiveness of Cartel arrangements in oligopolistic markets with examples.

- Mains: Evaluate the role of Stackelberg leadership model in real-world oligopolies.

- Prelims: The kinked demand curve in oligopoly results in:

a) Perfectly elastic demand

b) Perfectly inelastic demand

c) Price rigidity

d) Monopoly pricingAnswer: c) Price rigidity

Conclusion

Oligopoly is a dynamic and complex market structure that challenges classical economic theories. UPSC aspirants should master both the conceptual models and real-world applications of oligopolies. Emphasis should be laid on diagrammatic representation, inter-firm strategies, and game theory implications to write high-scoring answers in Economics Optional Paper 1.

No Comments