10 Apr PM MUDRA YOJANA

PM MUDRA YOJANA

This article covers “Daily Current Affairs for UPSC” and the topic details “PM MUDRA YOJANA”. The topic has relevance in the “Polity and Governance” section for the UPSC CSE exam.

Mudra Yojna

PM MUDRA YOJANA

For Prelims:

- What is PM MUDRA Yojana?

What are the features of the Yojana?

For Mains:

GS 2: Polity and Governance

- What has been the performance of PM MUDRA Yojana?

- What are the challenges in the implementation of the Yojana?

- What are the measures for the successful implementation of the Yojana?

Why in the news?

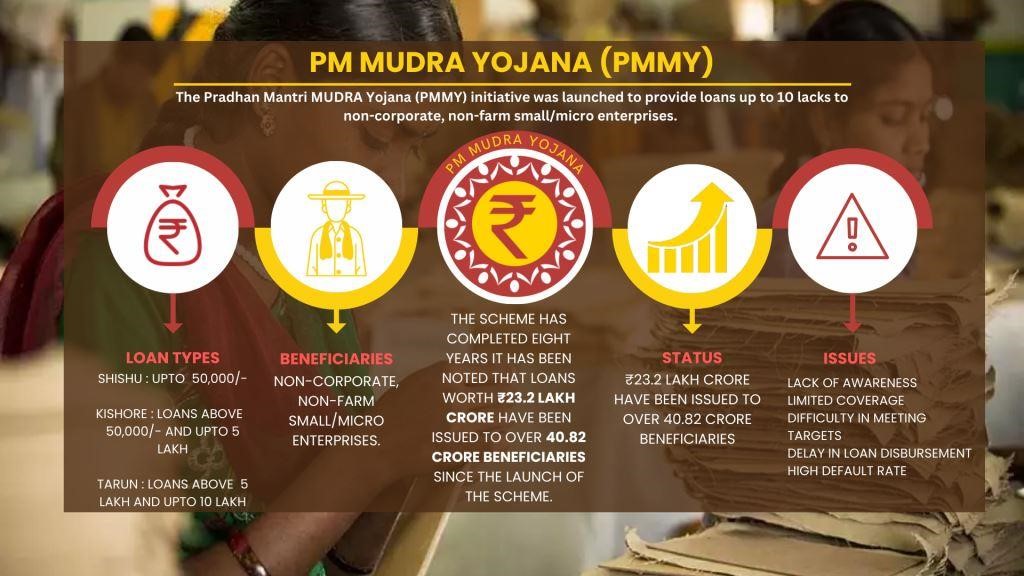

PM MUDRA Yojana (PMMY) has completed eight years. It has been noted that loans worth ₹23.2 lakh crore have been issued to over 40.82 crore beneficiaries since the launch of the scheme.

What is PM MUDRA Yojana?

what is mudra yojana

The PM MUDRA YOJANA is an initiative launched on April 8, 2015, to provide loans up to 10 lakhs to non-corporate, non-farm small/micro enterprises.

These loans are referred to as MUDRA loans and can be obtained from Commercial Banks, RRBs, Small Finance Banks, MFIs, and NBFCs.

Who are the beneficiaries of the Yojana?

The scheme is aimed at disbursing loans to non-corporate and non-farm small/micro enterprises. The MSME sector holds a large share of the GDP of India and also provides employment to over 11 crore people. It is important that the sector doesn’t face any kind of liquidity crisis. With this objective, the scheme was started.

What are the types of loans disbursed under PM MUDRA Yojana?

MUDRA has designed three products – ‘Shishu’, ‘Kishore’, and ‘Tarun’ – under PM MUDRA Yojana to signify the stage of growth/development and funding requirements of the micro unit/entrepreneur and also serve as a reference point for their next phase of graduation/growth.

- Shishu: Covering loans upto 50,000/-

- Kishore: Covering Loans Above 50,000/- And Upto 5 Lakh

- Tarun: Covering Loans Above 5 Lakh And Upto 10 Lakh

What has been the performance of PM MUDRA Yojana?

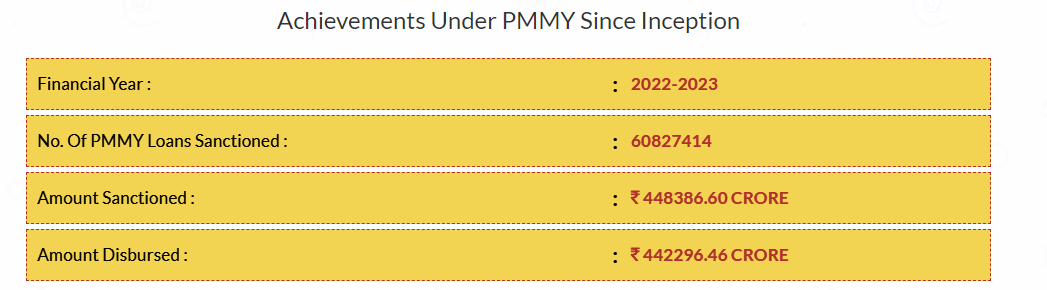

The scheme has done well in its span of 8 years. It has disbursed loans worth ₹23.2 lakh crore to over 40.82 crore beneficiaries since the launch of the scheme.

The performance of the scheme in 2022-23 is given below.

Details on Pradhan Mantri mudra yojana

What are the challenges in the implementation of the Yojana?

Apart from the ambitious vision the scheme carries with it it also faces a number of constraints as follows:

- Lack of Awareness: Many small business owners are not aware of the PMMY scheme and its benefits, which has led to a lower-than-expected uptake of loans.

- Limited Coverage: Despite the scheme’s broad coverage, it has been challenging to reach out to all eligible beneficiaries, particularly in remote and rural areas, due to poor infrastructure and connectivity.

- Difficulty in Meeting Targets: Meeting the ambitious lending targets set by the government has been a significant challenge for lending institutions, particularly for smaller banks and MFIs that lack the required resources and infrastructure.

- Delay in Loan Disbursement: Some borrowers have reported delays in loan disbursement due to the lengthy documentation process and the lack of adequate staff at lending institutions.

- High Default Rates: The PMMY scheme has faced a high default rate, particularly among small business owners who lack the necessary skills and experience to manage their businesses effectively.

What are the measures for the successful implementation of PM MUDRA Yojana?

To ensure the successful implementation of the Pradhan Mantri MUDRA Yojana (PMMY), the following measures can be taken:

- Awareness Campaigns: Conduct awareness campaigns to promote the scheme among the target audience, particularly in rural and remote areas.

- Simplified Application Process: Simplifying the loan application process by reducing the documentation requirements and making the process more accessible and user-friendly.

- Digital Technology: Leveraging digital technology to make the loan application process more streamlined and accessible, particularly in rural areas.

- Financial Literacy Programs: Conduct financial literacy programs to educate borrowers on the importance of financial planning, debt management, and proper utilization of loan funds.

- Timely Loan Disbursement: Ensuring timely loan disbursement to borrowers to avoid delays and improve the uptake of the scheme.

- Monitoring and Supervision: Setting up a robust monitoring and supervision mechanism to ensure the proper utilization of loan funds and timely repayment.

Way Forward

Learning from the success of the PM MUDRA Yojana there is also a need to invest in creating more awareness about the scheme, improving infrastructure and connectivity, providing technical assistance and training to small business owners, and enhancing the monitoring and supervision mechanisms.

Source:

Daily Current Affairs for UPSC

The study of daily current affairs helps the aspirant in preparation for the UPSC examination. So, It is very important for a UPSC examinee to read daily current Affairs for their UPSC exam preparation. Here, Plutus IAS serves the best and latest current Affairs for the UPSC examination free of cost. Also, read weekly and monthly current affairs for your UPSC exam preparation.

No Comments