05 Sep Pradhan Mantri Jan Dhan Yojana (PMJDY)

This article covers “Daily Current Affairs” and the topic details “Pradhan Mantri Jan Dhan Yojana (PMJDY)”. The topic “Pradhan Mantri Jan Dhan Yojana (PMJDY)” has relevance in the economy section of the UPSC CSE exam.

For Prelims:

About Pradhan Mantri Jan Dhan Yojana (PMJDY)

For Mains:

GS 2: Economy

Significance of PMJDY?

Achievements of PMJDY?

Why in the news:

The Pradhan Mantri Jan Dhan Yojana (PMJDY) has now completed nine years of successful implementation, marking a substantial milestone in its efforts to promote financial inclusion and provide accessible financial services

About Pradhan Mantri Jan Dhan Yojana (PMJDY)

Launched on August 28, 2014, the Pradhan Mantri Jan Dhan Yojana (PMJDY) stands as one of the world’s most extensive financial inclusion initiatives. This initiative, led by the Ministry of Finance, is dedicated to offering affordable financial services to vulnerable and economically disadvantaged sections of society.

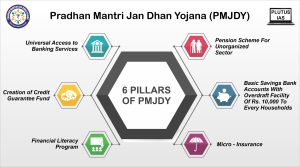

It aims to create a platform for universal access to banking services, ensuring that every household has at least one basic banking account. This program also focuses on promoting financial literacy and providing access to credit, insurance, and pension facilities.

Key features of PMJDY include:

- Expanding Banking Services: PMJDY seeks to expand banking services by establishing branches and Banking Correspondents (BCs) to reach both urban and rural areas.

- RuPay Debit Card: Individuals who open PMJDY accounts receive an indigenous Debit Card known as the RuPay card.

- No Minimum Balance Requirement: There is no requirement to maintain a minimum balance in PMJDY accounts.

- Accident Insurance Cover: PMJDY account holders receive accident insurance coverage of Rs. 1 lakh, which was increased to Rs. 2 lakh for new PMJDY accounts opened after August 28, 2018. This coverage is provided through the RuPay card issued to account holders.

- Overdraft Facility: Eligible adults can access an overdraft facility of up to Rs. 10,000.

- Access to Government Schemes: PMJDY accounts are eligible for various government schemes, including Direct Benefit Transfer (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), and Atal Pension Yojana (APY).

Significance of PMJDY:

- Promoting Inclusive Growth: PMJDY plays a crucial role in promoting equitable growth by facilitating Financial Inclusion (FI). This strategy ensures that affordable financial services are accessible to low-income and disadvantaged segments of the population, thereby contributing to inclusive economic development.

- JAM Architecture Benefits: The Jan Dhan–Aadhaar–Mobile (JAM) architecture has streamlined the transfer of government benefits directly to the accounts of common citizens. This seamless process ensures that welfare benefits reach the intended recipients efficiently and without intermediaries.

- Formalizing Savings: PMJDY has successfully integrated the savings of economically disadvantaged individuals into the formal financial system. This shift has liberated them from the clutches of usurious money lenders, offering them a safer and more secure means to manage their finances.

- Women’s Empowerment: Notably, approximately 55.5% of Jan Dhan accounts are held by women, contributing significantly to their financial empowerment. This encourages financial independence and greater participation in economic activities for women.

- Overdraft Accessibility: PMJDY allows for overdraft facilities, but they are limited to only one account per household, with a preference for the lady of the household. This provision ensures that financial resources are made available to households while promoting responsible financial management.

Achievements of PMJDY:

- Massive Financial Inclusion: PMJDY has successfully integrated over 50 crore people into the formal banking system through Jan Dhan accounts. This achievement signifies a significant stride towards financial inclusion in India.

- Rural and Semi-Urban Reach: Approximately 67% of these accounts have been opened in rural and semi-urban areas, demonstrating the program’s effectiveness in extending financial services to underserved regions.

- Widespread RuPay Card Issuance: Around 34 crore RuPay cards have been issued to these accounts, ensuring access to financial services and providing accident insurance coverage of ₹2 lakh to the account holders, enhancing financial security.

- Guinness World Records Recognition: PMJDY’s remarkable success has earned it recognition from Guinness World Records. It holds the record for the “Most bank accounts opened in one week as part of the Financial Inclusion Campaign,” with an astounding 18,096,130 accounts opened, achieving this milestone under the Department of Financial Services, Government of India.

Source:https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1952793

plutus ias current affairs eng med 5th Sep 2023

Q.1 Consider the following statements regarding Pradhan Mantri Jan Dhan Yojana (PMJDY):

- Its main aim is to provide finance for setting up of small businesses to disadvantaged sections of society.

- It excludes high income groups from opening accounts under the scheme.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ANSWER: D

Q.2 Consider the following statements regarding Pradhan Mantri Jan Dhan Yojana (PMJDY):

- It requires a minimum balance of Rs. 1,000 in every account.

- RuPay cards issued under PMJDY provide a maximum accident insurance cover of Rs. 5 lakh.

- PMJDY offers an overdraft facility of up to Rs. 10,000 to eligible adults.

How many of the above statement/s is/are correct?

(a) Only one

(b) Only two

(c) All three

(d) None

ANSWER: A

Q.3 Discuss the significance and impact of the Pradhan Mantri Jan Dhan Yojana (PMJDY) on financial inclusion and economic empowerment in India. How has PMJDY contributed to improving the socio-economic landscape of the country? Provide your insights and suggestions for further enhancing the effectiveness of this flagship financial inclusion program.

No Comments