30 Jan Prelims Bit: The Deep Dive into the ECB”

This article covers “Daily Current Affairs,” and the topic details related to “Prelims Bit: The Deep Dive into the ECB”

Syllabus mapping:

GS-1: Indian Economy: Financial market and money markets.

For Prelims:

What are ECB: features, criteria, regulations, and sectors allowed in ECB? What is the difference between FDI and ECBs?

Why in the News

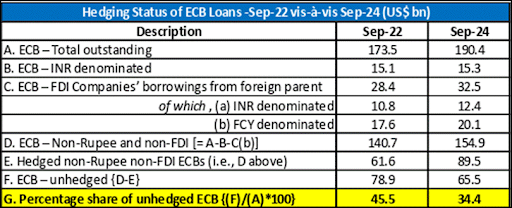

India’s investment ecosystem and external commercial borrowings (ECBs) have significantly developed over the past few years. The recent report by the State Bank of India (SBI) has highlighted trends in investment announcements, the private sector’s contribution, and the role of ECB in corporate financing.

Definition:

External Commercial Borrowings (ECB) are commercial loans raised by eligible resident entities from recognized non-resident entities. They adhere to regulatory parameters such as minimum maturity, all-in-cost ceiling, and permitted and non-permitted end-uses. ECBs are governed under FEMA Notification Nos. 3R & 8.

ECB Criteria:

Eligible Borrowers: All entities except Limited Liability Partnerships (LLPs) can raise ECB.

Eligible Lenders:

Resident of FATF (Financial Action Task Force) or IOSCO-compliant country.

Multilateral/regional financial institutions where India is a member.

Foreign equity holders (for specific ECB purposes).

Foreign branches/subsidiaries of Indian banks (only for FCY ECB).

Minimum Average Maturity Period (MAMP):

General ECB: 3 years.

Foreign equity holder ECB for specific purposes: 5 years.

Manufacturing sector ECB (up to INR 3.5 billion per FY): 1 year.

Currency Options:

ECB can be raised in Indian Rupees (INR) or any freely convertible foreign currency.

Modes of Raising ECB:

Automatic Route: AD Category-I Bank examines and approves the case. The application, along with Form ECB, is sent to RBI for Loan Registration Number (LRN) issuance.

Approval Route: The borrower applies through AD Category-I Bank to RBI for approval. The application is considered based on macroeconomic conditions and the merits of the proposal.

Types of ECB:

Loans

Securitized instruments

Buyers’ and Suppliers’ credit

Foreign Currency Convertible Bonds (FCCBs)

Foreign Currency Exchangeable Bonds (FCEBs)

Financial Lease

Allowed Sectors for ECB Use:

Infrastructure sector (as per the Harmonized Master List).

Shipping & airline companies (for import of second-hand vessels/aircraft under Track I).

Manufacturing sector (ECB up to INR 3.5 billion per FY can have a 1-year MAMP).

General corporate purposes & working capital (only under Track III).

Non-Permitted End-Uses of ECB:

Real estate activities.

Purchase of land.

Investment in the capital market.

Import of services.

Refinancing of Rupee-denominated ECB under Track II.

Payment of overdue import bills (Track I ECBs only).

Contribution to Limited Liability Partnerships (LLPs).

Regulatory Compliance & Reporting:

Loan Registration Number (LRN): Required before any ECB draw-down.

Changes in ECB Terms: Must be reported to RBI via Revised Form ECB within 7 days.

Hedging Requirements: Certain entities (NBFCs, Holding Companies, Core Investment Companies) must hedge 100% of ECB exposure if MAMP is less than 5 years old. AD Category-I Bank verifies compliance and reports to RBI via ECB 2 returns.

Conversion of ECB into Equity: Subject to FDI sectoral cap. Reported via Form FC-GPR and ECB 2 Return.

Monthly Reporting: ECB transactions must be reported via ECB 2 Return to RBI within 7 working days of the end of the month.

Comparison of ECBs and FDI

| Feature | External Commercial Borrowings (ECBs) | Foreign Direct Investment (FDI) |

| Type | Debt financing | Equity financing |

| Structure | Debt instrument raised from foreign investors | Foreign money invested in equity capital |

| Purpose | Used for capital expansion and modernization | Helps foster economic growth in both host and investing country |

| Permitted Uses | Infrastructure, manufacturing, corporate purposes | Investment in business operations and assets |

| Repayment | Has a fixed repayment schedule with interest | No fixed repayment; returns depend on business performance |

| Interest Cost | Interest payments required | No direct interest cost, but profit-sharing or dividends apply |

| Exchange Rate Risk | Can impact repayment costs | Shared between investor and investee company |

| Control & Ownership | No impact on ownership | Foreign investors may gain significant control |

| Maturity | Fixed maturity period | Long-term investment with no fixed maturity |

| Regulation | Subject to RBI regulations | Subject to government policies and sectoral caps |

| Impact on Balance of Payments | Increases external debt and impacts balance of payments | Improves capital account balance |

| Sectoral Focus | Various sectors as per RBI guidelines | Sector-dependent based on government policies and investor preference |

| Risk Factors | Exchange rate fluctuations, regulatory changes | Capital outflows if profits are not reinvested |

| Benefits | Access to foreign capital at competitive rates | Boosts job creation, infrastructure, and economic development |

| Examples | Indian companies raising loans from foreign banks or issuing bonds in overseas markets | Foreign companies setting up manufacturing facilities or acquiring stakes in Indian companies |

Prelims Questions:

Q. Consider the following statements:

1. External Commercial Borrowing (ECB) and FDI are both a debt investment in Indian markets.

2. The ECB is prohibited in the real estate sector, while the FDI is allowed in the Real estate sector.

3. The Ministry of Finance regulates the ECB, While the RBI regulates the FDI.

How many of the statements given above are correct?

(a). Only one

(b). Only two

(c). All three

(d). None

ANSWER: A

No Comments