26 Jul Public Finance and its Role in Market Economy

Public Finance and its Role in Market Economy – UPSC Economics Optional

Introduction

In a modern market economy, characterized by private ownership of resources and decentralized decision-making, the role of the government is indispensable. While the market mechanism is generally efficient in allocating resources, it suffers from several limitations like income inequality, externalities, and the underprovision of public goods. This is where public finance becomes an essential tool for achieving economic efficiency, equity, and macroeconomic stability.

Public finance is a branch of economics that studies how governments raise and spend funds and the effects of these activities on the economy. It involves the identification of sources of revenue, planning of expenditures, management of debt, and the design and implementation of fiscal policies. From providing basic infrastructure and public goods to regulating economic activity, public finance acts as the fulcrum of governance in both developed and developing economies.

This article provides a comprehensive overview of public finance and critically analyses its role in a market-driven economy. It also offers insights into its significance in the Indian context, and aligns with the UPSC Civil Services Economics Optional Paper 1 syllabus, especially for aspirants aiming for a high-scoring conceptual understanding.

best economics optional test series

best teacher of economics optional

Best economics optional coaching

1. Meaning and Scope of Public Finance

Public finance deals with how a government manages its income and expenditures to ensure a balanced and growing economy. It encompasses several core areas, each contributing to a comprehensive understanding of fiscal functioning:

1.1 Public Revenue

This refers to the income generated by the government through taxes (income tax, GST, excise, customs) and non-tax sources (fees, fines, dividends from PSUs, interest on loans). An efficient and fair revenue system is fundamental for a healthy economy as it determines the government’s spending capacity.

1.2 Public Expenditure

This includes all types of government spending aimed at promoting welfare and economic development. Expenditure can be:

- Developmental: Health, education, infrastructure

- Non-developmental: Defense, salaries, pensions

- Planned: Allocated in Five-Year or Annual Plans

- Non-planned: Interest payments, subsidies

1.3 Public Debt

Public debt refers to borrowings by the government to meet fiscal deficits or finance capital expenditures. It can be:

- Internal: Market borrowings, T-bills, bonds

- External: Multilateral agencies, bilateral loans

Sustainable debt management is crucial to avoid a debt trap and ensure intergenerational equity.

1.4 Financial Administration

This involves budgeting, auditing, and monitoring of government financial activities. Institutions like the Comptroller and Auditor General (CAG), Public Accounts Committee (PAC), and Finance Ministry ensure transparency and accountability in fiscal operations.

1.5 Fiscal Policy

Fiscal policy is the use of government spending and revenue instruments to influence macroeconomic variables like GDP, inflation, unemployment, and balance of payments. It is a vital tool for economic stabilization and growth. Expansionary fiscal policy (deficit spending) is used during recessions, while contractionary policy (higher taxes/lower spending) is used during inflationary periods.

GS paper 4 syllabus and study plan

GS paper 3 syllabus and study plan

GS paper 2 syllabus and study plan

GS paper 1 syllabus and study plan

2. Fundamental Objectives of Public Finance

Public finance serves multiple purposes, particularly in a market-oriented system that prioritizes efficiency but may overlook equity and stability. The key objectives are:

2.1 Allocation Function

The allocation function relates to the role of public finance in the provision of public goods that the private sector fails to supply adequately. These goods are:

- Non-rivalrous: One person’s use does not reduce availability to others (e.g., street lighting)

- Non-excludable: Cannot prevent non-payers from using the service (e.g., national defense)

In such cases, government intervention through budgeting and taxation ensures optimal resource allocation.

2.2 Redistribution Function

The market economy tends to generate significant disparities in income and wealth. Public finance can reduce these inequalities through progressive taxation and targeted welfare programs (e.g., PDS, pensions, healthcare subsidies). The objective is not perfect equality but reasonable equity and social justice.

2.3 Stabilization Function

One of the most critical functions of public finance is to stabilize the economy against cyclical fluctuations. Through counter-cyclical fiscal policies, the government can:

- Increase spending and reduce taxes during recessions (stimulus)

- Reduce spending and increase taxes during booms (austerity)

This helps maintain full employment, control inflation, and support long-term growth.

2.4 Development Function

In developing economies like India, public finance plays a developmental role by promoting investments in infrastructure, health, education, and agriculture. Such investments not only create long-term productive capacity but also generate employment and enhance human capital.

3. Instruments of Public Finance in a Market Economy

Governments use various instruments of public finance to influence market outcomes and ensure economic stability. These instruments are essential for correcting market failures, achieving social equity, and guiding the macroeconomic direction of the economy.

3.1 Taxation

Taxes are the most direct way of influencing the distribution of resources. They are classified into:

- Direct Taxes: Imposed on income and wealth (e.g., Income Tax, Corporate Tax)

- Indirect Taxes: Imposed on goods and services (e.g., GST, customs duties)

Tax policies influence both consumer behavior and producer incentives. A well-designed tax system ensures vertical and horizontal equity while minimizing distortions.

3.2 Government Spending

Public expenditure is directed towards the provision of public goods, economic infrastructure, subsidies, and social welfare programs. It also includes investment in capital goods, which crowd-in private investment and boost employment and demand.

3.3 Public Borrowing

When revenue falls short of expenditure, governments resort to borrowing from internal (bond markets) or external (international institutions) sources. While borrowing is crucial for financing capital-intensive projects, sustained deficits may lead to inflation and interest rate pressures.

3.4 Deficit Financing

In times of economic crisis or stagnation, governments may finance their deficits through central bank borrowing. While it injects liquidity and boosts demand, excessive deficit financing can lead to inflationary pressure and erosion of fiscal credibility.

3.5 Fiscal Rules and Institutions

Frameworks such as the Fiscal Responsibility and Budget Management (FRBM) Act in India aim to maintain fiscal discipline. Independent institutions like the CAG, Finance Commission, and Public Accounts Committees strengthen accountability in fiscal operations.

4. Public Finance and Market Failures

Market economies are prone to failures due to issues like imperfect information, monopolies, externalities, and under-provision of public goods. Public finance plays a corrective role in addressing these failures.

4.1 Public Goods

Markets underprovide public goods due to the free-rider problem. Public finance ensures their provision through taxation and collective action, such as national defense, law enforcement, and basic infrastructure.

4.2 Externalities

Negative externalities like pollution are overproduced, and positive ones like education are underproduced. The government uses corrective taxes (carbon tax) and subsidies (scholarships, research grants) to align private decisions with social optimality.

4.3 Natural Monopolies

Utilities like water, power, and railways involve high fixed costs and naturally evolve into monopolies. Government regulation and public sector undertakings prevent exploitation and ensure accessibility.

5. Public Finance in India: Institutional Framework

5.1 Budget Process

The Union Budget, presented by the Finance Minister every year, outlines revenue and expenditure for the upcoming fiscal. It includes fiscal deficit targets, tax proposals, and sectoral allocations. It is governed by the Articles 112–117 of the Indian Constitution.

5.2 Finance Commission

A constitutional body set up every five years, it recommends the formula for sharing central taxes with states, grants-in-aid, and measures to augment state finances.

5.3 Goods and Services Tax (GST)

GST subsumed multiple indirect taxes and established a uniform indirect tax regime. The GST Council ensures cooperative federalism in fiscal policy decisions.

6. Case Studies: Role of Public Finance in Indian Economy

6.1 Demonetization (2016)

Led to temporary shrinkage of money supply and forced formalization of the economy. Public finance was used for demand stimulus and digital infrastructure investment to manage deflationary pressures.

6.2 COVID-19 Fiscal Response (2020–21)

The government launched the Aatmanirbhar Bharat package amounting to nearly ₹20 lakh crore, involving direct transfers, credit guarantees, and healthcare expenditure. Fiscal stimulus complemented monetary easing by the RBI.

6.3 National Infrastructure Pipeline (NIP)

A ₹111 lakh crore initiative to fund infrastructure projects through a combination of public and private capital, with the government providing viability gap funding and interest subvention.

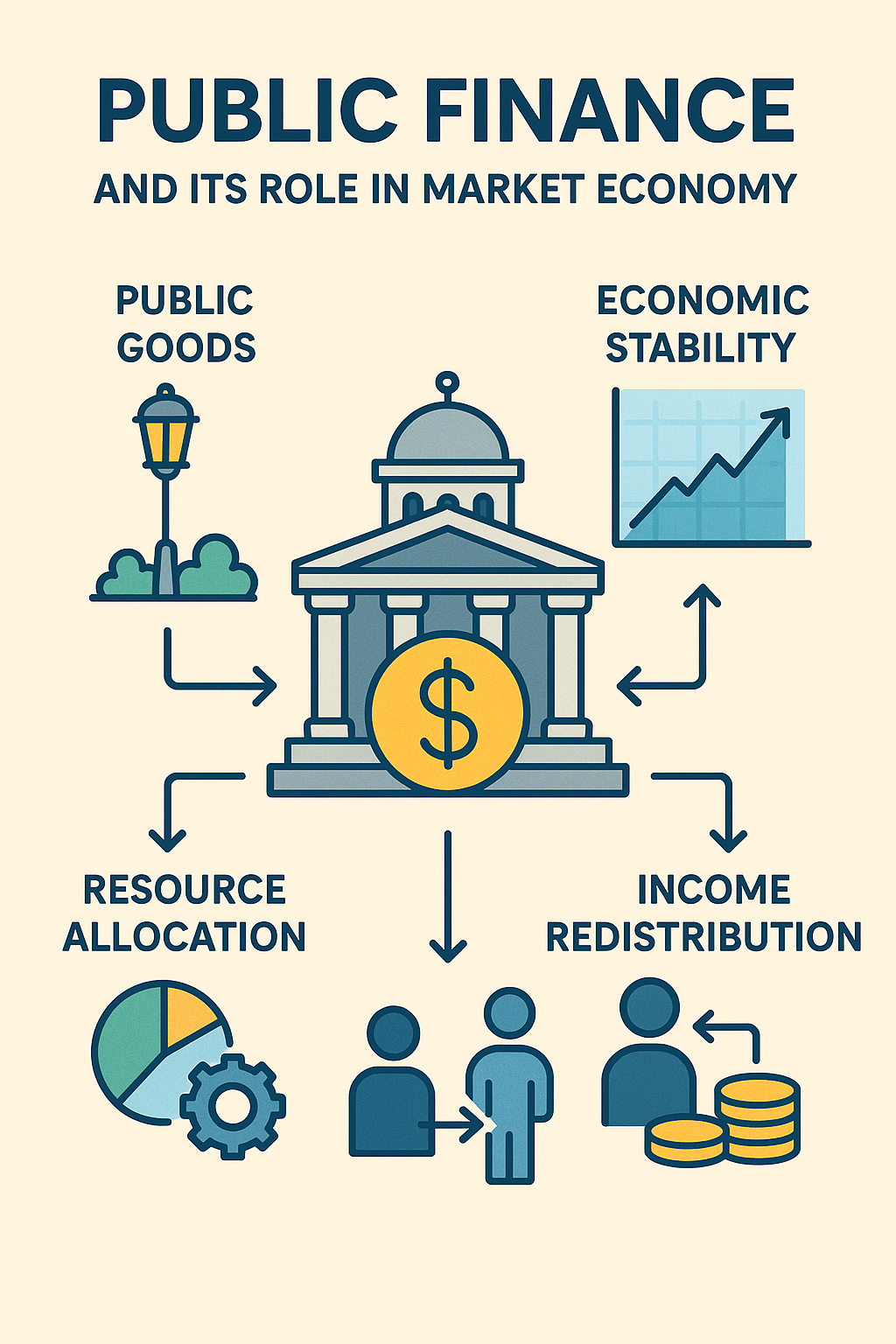

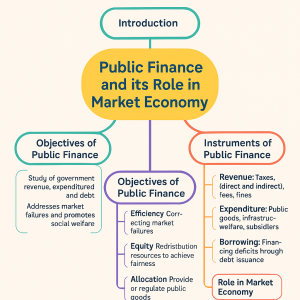

7. Infographic & Mind Map

Public Finance and its Role in Market Economy

8. Previous Year Questions (PYQs)

- 2022: Discuss the role of public finance in addressing economic inequality.

- 2020: Differentiate between public goods and merit goods. How does the government ensure their optimal supply?

- 2018: Explain the significance of fiscal rules in promoting macroeconomic stability.

9. Probable Questions for UPSC 2025

- Analyze the role of fiscal policy in managing post-pandemic recovery in India.

- Discuss how public finance influences the allocation of resources in a market economy.

- Evaluate the importance of fiscal decentralization in India’s federal structure.

10. Conclusion

Public finance is a cornerstone of modern economic governance. Its multidimensional role—allocative, distributive, and stabilizing—is vital for bridging the gap between individual rationality and social optimality. In market economies, especially in a complex democracy like India, public finance ensures that growth is not only efficient but also inclusive and sustainable. For UPSC aspirants, a sound understanding of public finance enriches the ability to critically analyze fiscal policies and enhances performance in both mains and interview stages.

No Comments