18 Mar RBI amended timeframe of Regulatory Sandbox

This article covers ‘Daily Current Affairs’ and the topic details of ”RBI amended timeframe of Regulatory Sandbox”. This topic is relevant in the “Economy” section of the UPSC CSE exam.

Why in the News?

The Reserve Bank of India (RBI) has recently extended the duration for accomplishing various stages of a Regulatory Sandbox (RS) from seven months to nine months. Additionally, the revised RS framework mandates sandbox entities to adhere to the provisions of the Digital Personal Data Protection Act of 2023.

About Regulatory Sandboxes

- Regulatory sandboxes are controlled environments where businesses can test new financial products or services under the watchful eye of regulators.

- They act as a “safe space” for businesses to experiment with potentially disruptive innovations without immediately facing the full weight of existing regulations.

- This allows regulators to observe these innovations firsthand and potentially adapt regulations to be more innovation-friendly while ensuring consumer protection.

Key benefits of Regulatory Sandboxes:

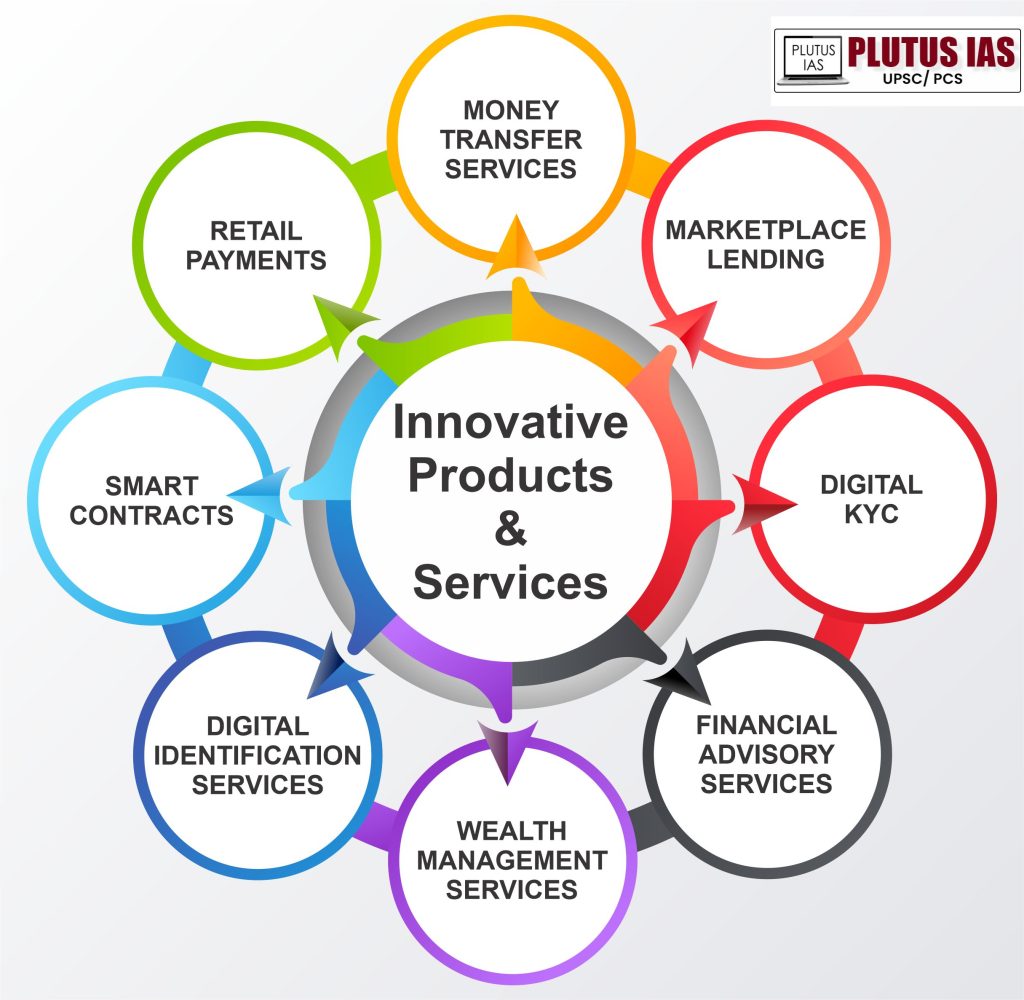

- Innovation Testing Ground: Regulatory sandboxes provide a platform for innovative technology-driven companies, especially fintech startups, to test their ideas with real customers in a limited setting. This allows them to gather valuable feedback and refine their products before a wider launch, accelerating the development cycle and time-to-market for new financial solutions.

- Safer Experimentation by Design: By offering a controlled environment with relaxed regulations, sandboxes allow for experimentation with potentially risky financial products or services. This can lead to faster development and deployment of innovative solutions that address financial inclusion gaps or improve efficiency in existing financial processes while minimising potential harm to consumers through close regulatory oversight and safeguards.

- Evolving Regulations for a Dynamic Landscape: Through observing the performance of new financial products within the sandbox, regulators gain valuable insights into emerging technologies and their impact on the financial landscape. This allows them to develop more dynamic and evidence-based regulations that keep pace with innovation, fostering a regulatory environment that is both supportive and responsible.

Recent Updates to India’s Regulatory Sandbox:

India’s Reserve Bank of India (RBI) established its Regulatory Sandbox framework in August 2019. A recent update to the framework reflects the evolving regulatory landscape and underscores India’s commitment to fostering a responsible and inclusive financial system:

Data Protection Compliance: The updated framework requires sandbox participants to ensure compliance with the Digital Personal Data Protection Act of 2023, highlighting the importance of data privacy in the financial technology sector. This ensures that innovative solutions are developed with robust data security and consumer privacy protections in place.

Extended Timelines: Acknowledging the complexities of developing innovative financial solutions, the timeline for navigating the sandbox process has been extended from seven to nine months. This provides participants with more time to refine their products and conduct thorough testing within the sandbox environment.

Broadened Eligibility: The updated framework expands the pool of potential sandbox participants to include not only fintech startups but also established banks, financial institutions, and partnerships supporting financial services businesses. This encourages wider participation and fosters collaboration within the financial ecosystem. By bringing together established players and innovative startups, the sandbox can act as a catalyst for more co-creation and knowledge sharing, accelerating the development of solutions that benefit a broader range of financial service users.

Challenges Regarding Regulatory Sandboxes

- Limited Agility: The controlled environment can restrict the experimentation pace, hindering rapid iteration crucial for startups.

- Lengthy Approvals: Obtaining permissions and relaxed regulations can be time-consuming, delaying experiments.

- Legal Uncertainty: The absence of clear legal protections within the sandbox discourages innovators from exploring potentially disruptive ideas.

- Post-Sandbox Hurdles: Even after successful testing, innovators might face additional regulatory hurdles before full market launch.

- Data Privacy: Balancing innovation with robust data security is paramount.

- Resource Constraints: Regulatory bodies may lack resources to efficiently oversee multiple sandbox participants.

- Global Harmonisation: The lack of harmonisation between sandboxes in different countries can create hurdles for innovators seeking to expand globally.

Way forward

Streamlined Approvals: Implement a tiered system based on complexity, leverage technology for online applications, and set clear timelines with accountability.

Regulatory Clarity: Provide guidance on eligible innovations and relaxed regulations. Explore a “sandbox-within-sandbox” approach for high-risk ideas and conditional approvals after successful testing.

Collaboration: Establish a dedicated sandbox support unit and facilitate knowledge sharing between participants, regulators, and experts. Encourage mentorship from successful alumni.

Global Harmonization: Participate in international discussions and explore mutual recognition of sandbox results with other countries.

Resource Optimization: Partner with universities or explore RegTech solutions to streamline oversight.

Download plutus ias current affairs eng med 18th March 2024

Prelims practise question

Q1. What is the primary purpose of a Regulatory Sandbox?

(a) To provide tax breaks for innovative businesses

(b) To offer a safe space for testing new financial products

(c) To simplify the process of company registration

(d) To establish new government regulations

ANSWER: B

Q2. Consider the following statements:

- Regulatory Sandboxes can be called as a form of Controlled innovation environment.

- A key benefit of a Regulatory Sandbox for consumers is that it reduces transparency in the financial system.

- Regulatory Sandboxes are most beneficial for Large, established corporations.

How many of the statements above are correct?

(a) Only one

(b) Only two

(c) All three

(d) None

ANSWER: A

Mains practise question

Q1. How important is it for India to focus on the global harmonisation of regulatory sandboxes with other countries? What are the potential benefits and drawbacks?

I am a content developer and have done my Post Graduation in Political Science. I have given 2 UPSC mains, 1 IB ACIO interview and have cleared UGC NET JRF too.

No Comments