12 Feb Revolutionizing Agricultural Finance: Enhancing Credit Access for Farmers

This article covers “Daily Current Affairs,” and the topic details related to “Revolutionizing Agricultural Finance: Enhancing Credit Access for Farmers”

Syllabus mapping:

GS-3: Agriculture: Credit and finances to agriculture.

For Prelims:

KCC purpose and its use. RRB and its mandate, NABARD, etc.

For Mains:

What are the advantages of formal Credit to farmers and what is the role of KCC in granting such Credits? what are the challenges in accessing the formal Credit and what ways to alleviate such challenges?

Why in the News?

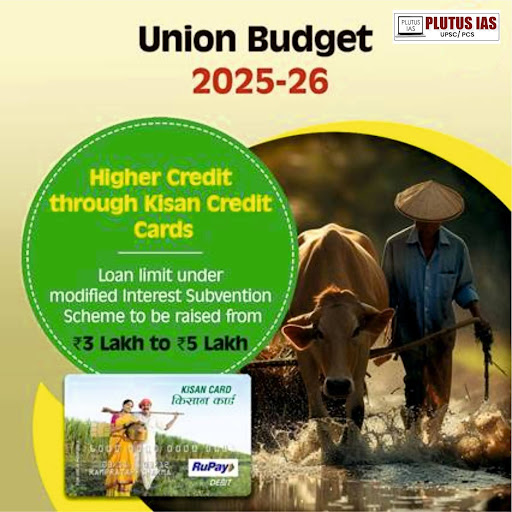

The Union Budget 2025-26 has introduced key measures to strengthen agricultural financing, particularly through the Kisan Credit Card (KCC) scheme. A major highlight is the increase in the loan limit under the Modified Interest Subvention Scheme from ₹3 lakh to ₹5 lakh, reflecting the government’s commitment to financial security for farmers and boosting agricultural productivity. With 46.1% of the population engaged in agriculture and allied activities, ensuring accessible credit remains a top priority.

What is the KCC

Kisan Credit Card (KCC) Scheme: The Kisan Credit Card (KCC) Scheme was introduced to ensure hassle-free and affordable credit for farmers. It provides easy access to institutional credit at lower interest rates, helping farmers meet various financial needs, including:

Short-term & long-term cultivation expenses

Post-harvest costs

Consumption needs

Working capital for allied agricultural activities

Background of the Kisan Credit Card (KCC) Scheme

The Kisan Credit Card (KCC) Scheme was introduced in August 1998 by Indian public sector banks to provide farmers with easy access to credit for their agricultural needs. The model scheme was formulated by the National Bank for Agriculture and Rural Development (NABARD) based on the recommendations of the R. V. Gupta Committee. The primary objective was to offer hassle-free credit facilities to farmers, ensuring timely financial support for crop cultivation, post-harvest expenses, and allied agricultural activities.

Objectives of the Kisan Credit Card (KCC) Scheme

Meeting Short-Term Credit Needs – Providing funds for crop cultivation and seasonal agricultural activities.

Covering Post-Harvest Expenses – Ensuring financial support for storage, transportation, and processing of produce.

Facilitating Produce Marketing Loans – Helping farmers bridge financial gaps until they sell their produce.

Supporting Household Consumption Needs – Preventing reliance on informal credit for essential family expenses.

Ensuring Working Capital for Farm Assets – Assisting in the maintenance and operation of farm equipment and machinery.

Providing Investment Credit for Allied Activities – Supporting animal husbandry, dairying, fisheries, and other agricultural extensions.

How KCC Helps Farmers

Easy Access to Institutional Credit – Provides timely and affordable loans, reducing farmers’ dependence on informal moneylenders.

Support for Cultivation & Post-Harvest Activities-This ensures the availability of funds for crop production, harvesting, and storage costs.

Marketing & Short-Term Loans – Helps farmers manage finances until they sell their produce at competitive market rates.

Household Consumption Needs – Offers financial support for essential household expenses, preventing reliance on high-interest loans.

Working Capital for Farm Assets – Assists in the maintenance of farming equipment, irrigation, seeds, and fertilizers.

Investment in Allied Activities – Supports animal husbandry, dairying, and fisheries, expanding income opportunities for farmers.

Collateral-Free Loans—This allows banks to offer loans up to ₹1.60 lakh without collateral, ensuring financial security and easy credit access.

Challenges faced by the farmers in accessing the formal credit:

Limited Access for Marginal & Small Farmers: Approximately 86.2% of India’s farmer population comprises small and marginal farmers. Of these, about half are unable to borrow from either formal or informal sources, indicating a substantial gap in credit accessibility.

High Dependency on Informal Credit: Despite efforts to enhance institutional credit, a significant proportion of small farmers still lack access, leading many to rely on informal lenders who charge exorbitant interest rates.

Lack of Collateral: Many farmers, especially tenant farmers and sharecroppers, lack land ownership documents, making them ineligible for institutional loans.

Cumbersome Loan Application Process: Farmers often face challenges in filling out the application forms required for accessing credit. This lack of knowledge may lead to farmers being unable to provide the necessary information or documents, resulting in their applications being rejected.

Regional Imbalance in Credit Distribution: There is a wide regional imbalance and unequal access by small farmers to institutional credit, with some regions receiving more institutional credit than others.

Inadequate Loan Amounts: Many farmers receive lower loan amounts than required, limiting their ability to invest in better technology, machinery, and equipment.

Delayed Loan Disbursement: The slow processing of loans affects farmers’ ability to purchase inputs like seeds, fertilizers, and pesticides on time.

High Interest Rates on Unsubsidized Loans: Approximately 75% of farmers cited interest rates as a challenge in obtaining formal financing, indicating that high interest rates remain a significant barrier.

Limited Financial Literacy: Many farmers lack awareness about available credit schemes, interest subsidies, and financial management, restricting their access to formal credit benefits

KCC-Related Issues and Limitations

Loan Limit Restrictions – The loan limit for KCC is determined by the District Level Technical Committee (DLTC) or State Level Technical Committee (SLTC), which may not always align with the actual financial needs of farmers.

Margin Requirements – Farmers must maintain a margin based on the loan amount. For instance, loans above ₹1,60,000 to ₹10 lakh require a 10% margin, making access to higher credit more challenging.

Security & Collateral – Loans up to ₹1,60,000 require hypothecation of crops or assets created from the loan. However, for loans exceeding ₹1,60,000, a charge on land is required, limiting access for farmers without land ownership.

Insurance Period Constraints – The insurance period for KCC loans depends on the annual or three-year premium paid, which can be an additional financial burden for small farmers.

Recommendations of the Vijay Shankar Vyas Committee(2003) to Expand Credit Flow to Agriculture

Expansion of Direct Agricultural Lending: Banks should increase direct agricultural lending to 12% of net bank credit within two years and 13.5% in the following two years. Indirect lending should be 6% initially, reducing to 4.5% thereafter.

Integration of Investment and Production Credit: Merging investment and production credit would improve the overall credit flow. District-level scales of finance should be revised to align with modern, market-driven agriculture.

Strengthening Marketing and Warehouse Financing: Pledge financing and advances against warehouse receipts should be promoted. Credit for marketing and post-harvest storage should be expanded.

Human Resource & Training Development in Rural Banks: The lack of trained personnel is a major bottleneck in rural financial institutions. Posting technical staff at branch and head offices is necessary for efficient credit delivery.

Leveraging Technology & Local Institutions for Credit Outreach: Use of SHGs, NGOs, Panchayati Raj Institutions, and Farmers’ Clubs as development agents to increase credit outreach. Implementing village information kiosks for agriculture and credit dissemination.

Legal & Institutional Reforms for Credit Access: Recognising tenant’s and sharecroppers’ rights in land records to facilitate access to institutional credit. Treating cooperatives and banks equally regarding charges and stamp duties for loan recovery.

Key Recommendations of the Ashok Dalwai Committee( 2016):

Enhanced Credit Access for Small & Marginal Farmers: Improve credit availability for tenant farmers, sharecroppers, and landless labourers. Small and marginal farmers hold 80% of total land holdings but receive only 27% of total credit disbursements. Their credit share should be raised to 40%. Expand Kisan Credit Card (KCC) coverage with simplified procedures.

Strengthening Institutional Credit Mechanisms: Improve Regional Rural Banks (RRBs) and Cooperative Banks to ensure last-mile credit delivery. Encourage NBFCs and fintech participation in rural credit.

Targeted Interest Subvention & Subsidies: Shift from universal interest subsidies to a targeted benefit approach for small farmers. Implement Direct Benefit Transfer (DBT) in loan-linked subsidies.

Integration of Digital Technology in Credit Disbursement: Link credit access to Aadhaar and digital banking for faster and transparent loan disbursal. Use AI-based risk assessment to reduce loan defaults.

Improving Risk Management & Credit-Linked Insurance: Ensure all farmer loans are linked to crop insurance (PMFBY) for financial security. Promote warehouse receipt financing to help farmers avoid distress sales.

Download Plutus IAS Current Affairs (Eng) 12th Feb 2025

Conclusion

The Kisan Credit Card (KCC) Scheme has played a pivotal role in enhancing agricultural credit accessibility, ensuring that farmers receive timely and affordable financial assistance. With the increased financial support under the Union Budget 2025-26, the government reaffirms its commitment to empowering farmers and strengthening rural economies. These initiatives contribute to agricultural growth, financial security, and sustainable rural development, paving the way for a resilient and self-sufficient farming community in India.

Prelims Question:

Q. The Kisan Credit Card loan is mandatorily used for which of the following purposes?

1. Meeting short-term credit requirements for crop cultivation.

2. Covering post-harvest expenses.

3. Availing produce marketing loans.

4. Fulfilling household consumption needs of farmers.

5. Providing working capital for farm assets and allied agricultural activities.

6. Meeting investment credit requirements for agriculture and allied sectors.

Select the correct answer using the code given below:

(a). 1, 2, and 6 only

(b). 2, 3, 4 and 6 only

(c). 1, 2, 3, and 4 only

(d). 1, 2, 3, 4, 5 and 6

ANSWER: D

Mains question:

The Kisan Credit Card (KCC) scheme has been instrumental in providing timely and affordable credit to farmers, making it the backbone of agricultural financing in India. Discuss the significance of KCC in ensuring financial inclusion for farmers and suggest measures to enhance its effectiveness.

(Answer in 250 words)

No Comments