18 Dec Special Category States in India

This article covers “Daily Current Affairs” and the topic details “ Special Category States in India”. This topic has relevance in the Polity and Governance section of the UPSC CSE exam.

GS 2: Polity and Governance

Why in the news?

The recent Supreme Court ruling clarified that Article 370 is solely a characteristic of asymmetric federalism, distinct from possessing internal sovereignty.

Background:

India, with its myriad regions, cultures, languages, and religions, is recognized for its diversity. The Constitution of India acknowledges this diversity, providing certain states and territories with autonomy and special status based on historical, geographical, political, or cultural factors.

Constitutional Basis:

Under Part XXI of the Indian Constitution titled “Temporary, Transitional and Special Provisions,” special provisions are outlined. While intended to be temporary, these provisions have endured for decades, triggering ongoing debates and analyses.

Special Category States (SCS) in India:

To address varying levels of development, resources, and challenges among states, the central government designates some as Special Category States. This concept was introduced in 1969 by the Fifth Finance Commission, employing the Gadgil formula to offer preferential treatment in terms of central assistance and tax benefits.

Criteria for SCS Designation:

The criteria for granting Special Category Status include:

- Hilly and difficult terrain

- Low population density or a large tribal population

- Strategic location along international borders

- Economic and infrastructural backwardness

- Non-viable nature of state finances

List of Special Category States:

Initially limited to Jammu and Kashmir, Assam, and Nagaland, the list expanded to include Himachal Pradesh, Manipur, Meghalaya, Sikkim, Tripura, Arunachal Pradesh, Mizoram, and Uttarakhand. Telangana, formed in 2014 after bifurcation from Andhra Pradesh, is the latest addition.

Benefits of Special Category Status:

The benefits afforded to Special Category States include:

- Higher share of central plan assistance (90% grant and 10% loan compared to 30% grant and 70% loan for non-SCS states).

- Increased allocation of funds for externally aided projects.

- Rebates in income tax rates and excise duty for industries.

- Preferential treatment in the devolution of central taxes and duties.

- Relaxation of norms for centrally sponsored schemes.

- Additional assistance for disaster relief.

Controversies Surrounding Special Category Status (SCS)

Issues Related to Special Category Status:

- Lack of Constitutional or Legal Basis:

-

-

- SCS lacks a constitutional or legal foundation and is subject to the discretionary decision of the National Development Council (NDC) or the central government.

-

- Criteria Lack Uniformity or Transparency:

-

-

- The absence of uniform or transparent criteria for granting SCS has led to claims from states like Bihar, Odisha, Rajasthan, and Chhattisgarh, asserting their eligibility based on backwardness indicators.

-

- Ambiguity in Duration or Review:

-

-

- Ambiguity surrounds the duration or review of SCS, with some states receiving it on a temporary basis (e.g., Jammu and Kashmir, Telangana), while others have enjoyed it for decades.

-

- Absence of Impact Assessment or Evaluation:

-

-

- There is a lack of clear evidence demonstrating that SCS has catalyzed faster growth or development in the beneficiary states.

-

- Fiscal Discipline and Accountability Concerns:

-

- Some states have faced accusations of misusing or diverting funds meant for specific purposes, raising questions about fiscal discipline and accountability.

Special Provisions in States:

- Jammu and Kashmir:

-

-

- Historically significant for its accession to India post the 1947 partition, it was granted special status under Article 370. However, in 2019, the central government revoked this status, reorganizing the state into two union territories.

-

- Nagaland:

-

-

- Characterized by a predominantly Naga population seeking self-determination, Nagaland was created in 1963 under Article 371A. It enjoys special rights to preserve customs, traditions, land, and resources. The Framework Agreement of 2015 aims to address the Naga issue through peaceful dialogue.

-

- Assam:

-

-

- Boasting a diverse, multi-ethnic society, Assam received special powers under Article 371B. The Assam Accord of 1985 addresses issues of identity, language, immigration, development, and autonomy.

-

- Sikkim:

-

- Formerly an independent kingdom, Sikkim joined India in 1975. Article 371F protects its existing laws, land rights, religious practices, and democratic institutions. The Sikkim-Darjeeling Agreement of 1973 grants financial assistance and development schemes.

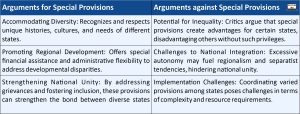

Objectives and Challenges of Special Provisions in India:

Objectives of Special Provisions:

- Respect and Protection of Identity:

-

-

- Upholding the distinct identity, culture, and rights of the people residing in states with special provisions.

-

- Promotion of Socio-economic Development:

-

-

- Facilitating socio-economic development and welfare in these states to bridge developmental gaps.

-

- Ensuring Participation in National Mainstream:

-

-

- Ensuring active participation and representation of these states in the national mainstream to foster inclusivity.

-

- Maintenance of Peace and Stability:

-

-

- Contributing to the maintenance of peace and stability in these regions, acknowledging their unique challenges.

-

- Strengthening National Unity and Integrity:

-

- Reinforcing national unity and integrity by recognizing and accommodating diversity within the constitutional framework.

Challenges and Limitations:

- Creation of Alienation or Discrimination:

-

-

- Special provisions may instigate a sense of alienation or discrimination among states or regions without similar privileges.

-

- Potential for Separatist Tendencies:

-

-

- There is a risk that some groups or individuals may exploit these provisions to fuel separatist or secessionist tendencies for personal gain.

-

- Conflicts Between Central and State Governments:

-

-

- Special provisions can lead to conflicts or disputes between the central and state governments, involving issues like jurisdiction, authority, resources, or policies.

-

- Impediment to Uniform Implementation of National Laws:

-

-

- The presence of special provisions may impede the uniform implementation or enforcement of national laws or schemes in these states.

-

- Influence by External Factors:

-

- External factors or pressures from neighboring countries or international organizations may influence the application or continuation of these provisions.

Beyond Constitutional Articles: Examining Fiscal Devolution, Administrative Flexibility, and Equal Representation

Fiscal Devolution:

The Finance Commission plays a vital role in allocating central taxes to states based on need and population, aiming to recognize and address fiscal disparities. Special Category States, including Jammu and Kashmir (previously) and certain Northeastern states, receive additional financial assistance due to their unique challenges.

Administrative Flexibility:

States possess the authority to customize their administrative structures and policies to local contexts, particularly in crucial areas like education, healthcare, and social welfare programs.

Equal Representation:

The Rajya Sabha ensures equal representation for each state irrespective of population size, providing smaller states with a more influential voice in national decision-making processes.

Way Forward:

The ongoing debate surrounding special provisions necessitates a thoughtful approach to strike the right balance between state autonomy and national unity. Addressing historical imbalances and regional needs remains a crucial challenge. Key steps include:

- Reviewing Existing Provisions:

-

-

- Regularly assessing the effectiveness and relevance of special provisions to ensure alignment with India’s evolving needs.

-

- Transparency and Accountability:

-

-

- Ensuring clear communication and responsible implementation of these provisions to address concerns about inequality and misuse.

-

- Finding Common Ground:

-

- Promoting communication and collaboration between states and the Central government to establish a more robust foundation for a unified and fair India.

Conclusion:

The special provisions outlined in Part XXI of the Constitution reflect India’s commitment to federalism, democracy, and diversity. Designed to address specific challenges and aspirations of certain states, these provisions aim to integrate them with the broader Indian framework without compromising their unique identities. They exemplify India’s flexibility and adaptability in navigating its intricate realities.

Download plutus ias current affairs eng med 18th Dec 2023

Q.1 Consider the following pairs:

- Nagaland : Article 371-A

- Assam : Article 371-B

- Sikkim : Article 371-E

How many of the above pairs are correctly matched?

(a) Only one

(b) Only two

(c) All three

(d) None

ANSWER: B

Q.2 Examine the significance associated with the special category status conferred upon certain states in India. Also, analyze the controversies surrounding special category states

No Comments