25 Jan Sukanya Samriddhi Yojana: A Decade of Transforming Lives

This article covers “Daily Current Affairs,” and the topic details related to Sukanya Samriddhi Yojana: A Decade of Transforming Lives.

Syllabus mapping:

GS-1: Indian Society: Women and related issues.

For Prelims:

The Sukanya Samriddhi Yojana (SSY): features, implementation Ministry, etc.

For Mains:

What are the key achievements of the SSY? What are the challenges in its implementation? What makes schemes effective for women’s empowerment?

Why in the news?

The Sukanya Samriddhi Yojana (SSY), launched on 22nd January 2015 by Prime Minister Narendra Modi under the Beti Bachao, Beti Padhao campaign, recently marked its 10th anniversary on 22nd January 2025. This milestone highlights the scheme’s role in promoting financial security and social empowerment for young girls across India. Over the past decade, the SSY has encouraged families to invest in their daughters’ futures, fostering a culture of inclusion, progress, and empowerment and reinforcing the government’s commitment to nurturing the dreams and aspirations of millions of girls nationwide.

Key Facts About the Sukanya Samriddhi Yojana (SSY)

Objective: A Government of India-backed savings scheme aimed at encouraging parents to save for the future education and welfare of their girl child.

Launch Date: Launched on 22 January 2015 by Prime Minister Narendra Modi under the Beti Bachao, Beti Padhao campaign in Panipat, Haryana.

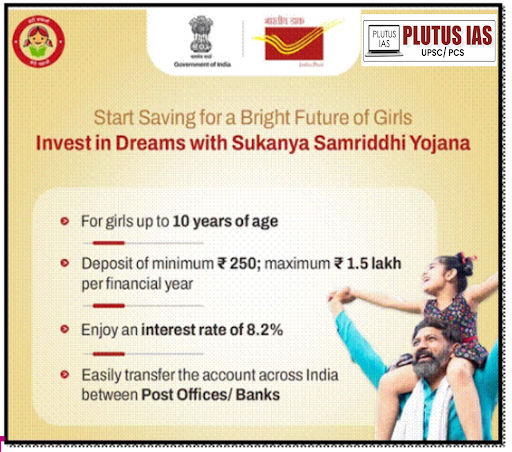

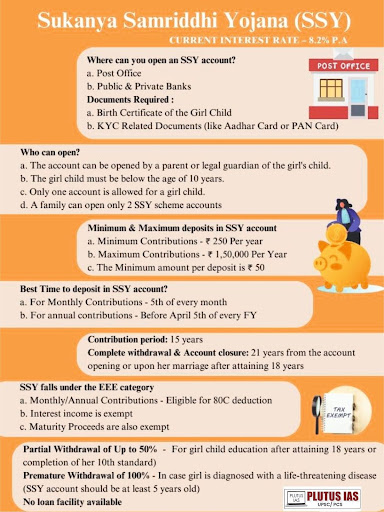

Account Opening: Accounts can be opened at any India Post office or authorised commercial bank branch.

Eligibility: A parent or legal guardian can open an account for a girl child aged below 10 years.

Interest Rate: Initially set at 9.1% (2015) and revised to 9.2% in March 2015 for FY2015-16. The current interest rate (as of January–March 2024) is 8.2%, compounded annually.

How Sukanya Samriddhi Yojana Works?

Key Achievements of Sukanya Samriddhi Yojana (SSY):

Increased Girl Child Education: The scheme has contributed to increased girl child education by providing a dedicated financial resource for their future studies. According to the National Sample Survey Office (NSSO), the female literacy rate in India has steadily increased, reaching 70.3% in 2021-22.

Financial Empowerment of Girls: By providing a substantial corpus upon maturity, SSY empowers girls with financial independence, enabling them to pursue higher education, start a business, or make other life choices.

Positive Impact on Gender Equality: By promoting girl child education and financial security, SSY contributes to breaking gender stereotypes and empowering girls within society. This can lead to increased female participation in the workforce, improved decision-making power within households, and greater social and economic equality.

Attractive Interest Rates: SSY has consistently offered competitive interest rates, making it an attractive investment option for parents seeking to secure their daughters’ future.

Tax Benefits: Tax benefits have undoubtedly played a crucial role in attracting investors to the scheme.

Wide Accessibility: The availability of SSY accounts at post offices and banks across India ensures widespread accessibility, making it easier for families in both urban and rural areas to enrol their daughters.

Social Awareness: The SSY scheme has raised awareness about the importance of investing in the future of girl children, promoting a positive shift in societal attitudes towards girls’ education and empowerment.

Challenges Faced by the Scheme

Deep-rooted Cultural Norms: Societal preferences for male children are deeply ingrained, especially in regions with skewed sex ratios. India’s Child Sex Ratio (CSR) dropped from 945 in 1991 to 918 in 2011, reflecting the extent of the challenge.

Limited Awareness: Surveys indicate that only 53% of the rural population knows the scheme. Limited media outreach and ineffective communication strategies in certain regions hinder awareness.

Implementation Gaps: Reports from the CAG (Comptroller and Auditor General) revealed that 78.91% of funds allocated for the BBBP scheme (as of 2020) were spent on media campaigns rather than on-ground activities.

Lack of Proper Documentation: Many families, especially in rural and tribal areas, lack essential documents such as birth certificates and Aadhaar, making it challenging to access scheme benefits.

Child Marriage: Child marriage remains a prevalent issue, especially in rural and tribal communities. As per the National Family Health Survey (NFHS-5), about 23.3% of women aged 20–24 were married before the legal age of 18.

Low Penetration in Northeast India: Due to geographical and infrastructural challenges, the scheme has limited reach in the northeastern states.

Challenges for Tribal and Dalit Children: Tribal and Dalit girls face multiple layers of marginalisation due to caste-based and socioeconomic discrimination. Lack of access to quality education and entrenched biases hinder their participation in the scheme.

Socioeconomic Barriers: Over 22% of India’s population lives below the poverty line, making gender equality in education a lower priority for struggling families. Female literacy remains lower than male literacy; as of 2021, the female literacy rate was 70.3%, compared to 84.7% for males.

Recommendations to improve the SSY scheme performance:

Increased Awareness: Conduct focused campaigns in areas with low SSY penetration, emphasising its benefits for girls’ empowerment. Moreover, using digital platforms can improve awareness among the target group.

Process simplification: Facilitate online account opening to reduce paperwork and time spent at banks and post offices. Develop a user-friendly mobile app for account management, tracking deposits, and accessing information.

Enhanced Incentives: To make SSY more attractive compared to other savings options, consider offering slightly higher interest rates. Explore additional tax benefits for SSY contributions to incentivise parents to invest more.

Financial Literacy: Integrate financial literacy education into school curriculums to teach children about savings and investment.

Collaboration with NGOs: Collaborate with women’s empowerment and child development NGOs to promote SSY and support beneficiaries.

Integration with Other Schemes: Link the SSY scheme with programs like Beti Bachao Beti Padhao for a holistic approach to girl child empowerment. Collaborate with educational initiatives to encourage families to save for girls’ education.

Download Plutus IAS Current Affairs (Eng) 25th Jan 2025

Conclusion

The Sukanya Samriddhi Yojana is a transformative and forward-thinking initiative to safeguard the future of young girls in India. By instilling financial discipline among families and emphasising the critical importance of education and empowerment, the scheme has become a cornerstone for fostering social progress. The increasing number of account openings showcases this program’s growing awareness and acceptance, reflecting a positive shift in societal attitudes towards gender equity. As India continues pursuing inclusive growth, the Sukanya Samriddhi Yojana ensures that every girl is empowered to dream, excel, and thrive within a nurturing and equitable environment.

Prelims Question:

Q. In the context of the Sukanya Samriddhi Yojana, which of the following statements is/are correct?

1. The Sukanya Samriddhi Yojana primarily focuses on financial support for the girl child within a specific age limit.

2. The Ministry of Women and Child Development implements the Sukanya Samriddhi Yojana.

3. The Sukanya Samriddhi Yojana allows premature withdrawal of money in cases.

Select the correct answer using the code given below:

A. 1 and 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

ANSWER: C

Mains question:

Q. Discuss the objectives, achievements, and challenges of the Sukanya Samriddhi Yojana. Suggest measures to improve its implementation.

(Answer in 250 words)

No Comments