24 Jul “Summary of Union Budget 2024-25”

“Summary of Union Budget 2024-25”

This article covers “Daily Current Affairs,” and the topic details related to the union budget and its major announcement.

Syllabus mapping: GS-3 Indian Economy: Government Budgeting.

GS-2:Variuos constitutional provisions related to the budget.

For Prelims: Various announcements and new schemes related to the particular sectors.

For Mains: major announcements and their significance for the Indian economy.

Why In News: The Union Finance Minister presented the Union Budget for the year 2024-25, in parliament.

What is the Budget?

- The Budget is recognized as the Annual Financial Statement of the Government under Article 112 of the Constitution. The Constitution makes no mention of the word “budget”.

- It is a summary of the government’s anticipated income (receipts) and outlays (expenditures) for a certain fiscal year.

- Revenue Budget which includes tax and non-tax revenue receipts and government expenditures.

- Capital Budget which includes capital receipts and payments of the state.

Historical Background:

British India: The Budget was first introduced in India on 7th April 1860 from the East-India Company to the British Crown.

Dominion of India: The first budget of Independent India was presented by RK Shanmukham Chetty, on November 26, 1947.

The Republic of India: Mr. John Mathai in 1949-50 The first budget of the Republic of India. It was the first Budget for a united India since it included the financial statements for the former Princely States and where the biggest news was the news of forming a Planning Commission and the need for having five-year plans was made.

Normal vs Interim Budget:

Normal Budget: This is a type of budget that includes receipts and expenditures for an entire year. This is presented every year except election year. this is also known as the full budget.

Interim Budget: An interim budget is a temporary budget presented by the union government usually ahead of the general elections or when the current government’s term is about to end and a new government is expected to take over. It serves to outline the government’s finances for the upcoming months until a full budget can be presented by the new government.

Constitutional provisions related to the budget:

Article 109: Special Procedure about Monetary Bills.

Article 110: Definition of Money Bills in Article 110.

Article 111:The President’s assent to Bills.

Article 112: Annual Financial Statement.

Article 113: Parliamentary Procedure Concerning Estimates.

Article 114: Bills for Appropriations.

Article 115: Parliament makes special grants that are Supplementary, Additional, or Excess.

Article 116: Account-based voting, credit-based voting, and exceptional grants.

Article 117: Particular Rules Concerning Financial Bills.

Article 265: Taxes may not be collected unless authorized by law

Article 266: Indian and State Consolidated Funds and Public Accounts

Article 267: Emergency Reserve

Article 275: Union Grants to Specific States

Article 280: Commission on Finance under Article 280

Article 281: Finance Commission Recommendations.

Article 292: The Indian Government’s Borrowing

Preparation and presentation of Budget:

- Department of Economic Affairs (DEA) Division: Within the Ministry of Finance, DEA is responsible for coordinating the entire budget-making process.

- Consultation Phase: The process starts several months before the beginning of the financial year (typically in February) with consultations between the Ministry of Finance and other ministries, departments, and stakeholders.

- Presentation to Parliament: According to Article 112. The President shall in respect of every financial year cause to be laid before both the Houses of Parliament a statement of the estimated receipts and expenditure of the Government of India for that year, referred to as the “annual financial statement”. The Finance Minister presents the budget in Parliament.

- Scrutiny stage: Standing Committees examine each ministry’s request for grants.

- Discussion and Voting: The budget is discussed and debated in both Houses of Parliament (Lok Sabha and Rajya Sabha). Only the Lok Sabha members have the power to vote on money bills. The RS can scrutinize budgetary allocations and may suggest amendments.

- Passage of Appropriation Bills: The Appropriation Bills, which authorize the government to withdraw funds from the Consolidated Fund of India to meet its expenditure, are passed by Parliament.

Key Budgetary documents:

In addition to the Finance Minister’s Budget Speech, Parliament gets shown the following documents:

- Annual Financial Statements

- Grant for Demands

- Bill of Finance

- Additional documents related to the receipts and spending.

Mandatory Fiscal Policy Statements under the FRBM Act 2003:

- The Macro-Economic Framework.

- Statement of Medium-Term Fiscal Policy and Fiscal Policy Strategy.

Key Highlights of the Union Budget 2024-25

PART-A

Budget Theme: particularly focus on:

- Employment

- Skilling

- MSMEs

- The middle class.

- The interim budgets four targeted groups: ‘Garib’ (Poor), ‘Mahilayen’ (Women), ‘Yuva’ (Youth), and ‘Annadata’ (Farmer).

Budget Priorities: To achieve the goal of ‘Viksit Bharat’ the budget has set out the following priorities.

1) Productivity and Resilience in Agriculture

2) Employment & Skilling

3) Inclusive Human Resource Development and Social Justice

4) Manufacturing & Services

5) Urban Development

6) Energy Security

7) Infrastructure

8) Innovation, Research & Development and

9) Next Generation Reforms

| Priorities | Main focused areas and initiatives |

| Priority 1: Productivity and Resilience in Agriculture | Transforming agriculture research

Release of new varieties Natural Farming Missions for pulses and oilseeds. National Cooperation Policy |

| Priority 2: Employment & Skilling | Employment Linked Incentive schemes

Participation of women in the workforce Skilling programme:1000, ITI institutions upgradation. The Model Skill Loan Scheme. |

| Priority 3: Inclusive Human Resource Development and Social Justice | Saturation Approach: To the all-round, all-pervasive, and all-inclusive development of people, particularly, farmers, youth, women, and the poor through schemes like PM Vishwakarma, PM SVANidhi, National Livelihood Missions, and Stand-Up India.

Purvodaya: For the all-round development of the eastern region of the country covering Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh. Projects: Amritsar Kolkata Industrial Corridor, (1) Patna-Purnea Expressway, (2) Buxar-Bhagalpur Expressway, (3) Bodhgaya, Rajgir, Vaishali and Darbhanga Expressway. |

| Priority 4: Manufacturing & Services | Credit Guarantee Scheme for MSMEs in the Manufacturing Sector

The limit of Mudra loans will be enhanced to ₹ 20 lakh from the current ₹ 10 lakh. TReDS: Reduced the turnover threshold of buyers for mandatory onboarding on the TReDS platform from ` 500 crores to ` 250 crores. Development of investment-ready “plug and play” industrial parks. Critical Mineral Mission for domestic production, recycling of critical minerals, and overseas acquisition of critical mineral assets. |

| Priority 5: Urban Development | Development of ‘Cities as Growth Hubs’.

Creative redevelopment of cities. Transit Oriented Development plans for 14 large cities. PM SVANidhi Scheme in transforming the lives of street vendors. |

| Priority 6: Energy Security | PM Surya Ghar Muft Bijli Yojana has been launched to install rooftop solar plants to enable 1 crore households to obtain free electricity up to 300 units every month.

Pumped Storage Policy for renewable energy. Research and development of small and modular nuclear reactors: Bharat Small Reactors. Advanced Ultra Super Critical Thermal Power Plants. ‘Indian Carbon Market for hard to abate industries. |

| Priority 7: Infrastructure Infrastructure investment by Central Government | Phase IV of PMGSY will be launched to provide all-weather connectivity to 25,000 rural habitations.

Vishnupad Temple Corridor and Mahabodhi Temple Corridor in Bihar. Development of Nalanda as a tourist centre. |

| Priority 8: Innovation, Research & Development | Operationalization of the Anusandhan National Research Fund for basic research and prototype development.

Emphasis on expanding the space economy by 5 times in the next 10 years, |

| Priority 9: Next Generation Reforms | The government proposed reforms in the following fields.

Land-related reforms by state governments: rural and urban area land reforms. Labor-related reforms: Shram Suvidha and Samadhan portals will be revamped to enhance ease of compliance for industry and trade. Capital and entrepreneurship-related reforms NPS-Vatsalya, a plan for contribution by parents and guardians for minors will be started. |

PART-B

Indirect Taxes:

Custom duty:

- The Government of India levies a Customs Duty on all the imports within and some of the exports from the country.

- The amount to be paid as customs duty can be determined by several factors such as value, weight, dimensions, etc.

- The Customs Act of 1962 defines customs duty in India

- The Central Board of Excise & Customs is responsible for all things about customs duty (CBEC).

- The Department of Revenue inside the Ministry of Finance in turn houses the CBEC.

- Proposed changes: Exempted goods: exempt three more medicines from customs duties. Reduced custom duty on 25 critical minerals, mobile phones, mobile PCBA, mobile chargers, Marine products, Leather, and Textiles. Custom duty increased on: ammonium nitrate, PVC flex banners

Direct Taxes:

Capital Gain Tax: Capital Gains Tax is a tax levied on the profit or gain arising from the sale or transfer of capital assets during a financial year. It is imposed under the Income Tax Act of 1962. Unlisted bonds, debentures, and debt MFs from now onwards attract the capital gain tax.

Angel Tax: The tax imposed on cash raised by startups from angel investors is known as the “angel tax,” formally known as Section 56 (2) (vii b) of the Income Tax Act. This tax was started in 2012. The principal aim was to scrutinize money laundering activities utilizing startup investments and identify fraudulent companies after the emergence of such instances. Applicability: Angel tax on foreign investments in start-ups abolished in recent budget.

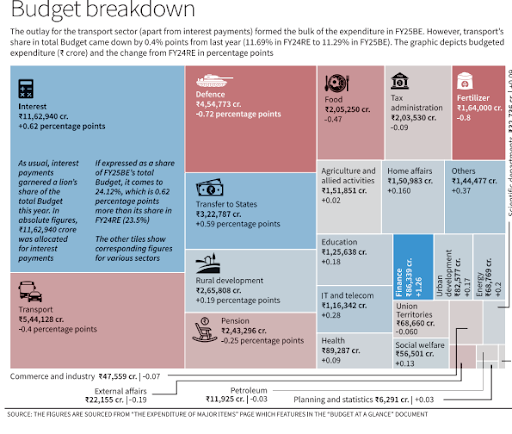

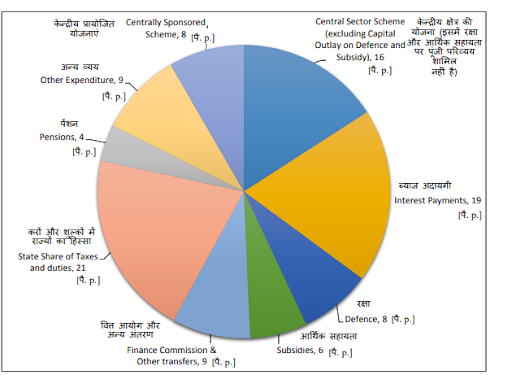

Rupee Goes to….

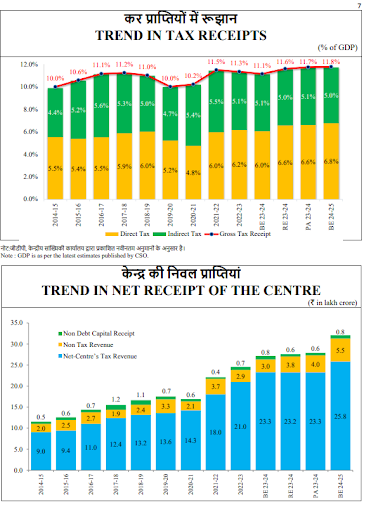

TAX SCENARIO: Buoyancy in revenues continues in FY24 1.23 Significant fiscal consolidation post-pandemic could be achieved largely due to buoyant revenues. Revenue receipts of the union government consisting of tax revenue (net to centre) and non-tax revenue (NTR) increased YoY by 14.5 percent in FY24 (PA), with robust growth in both tax and non-tax revenues:

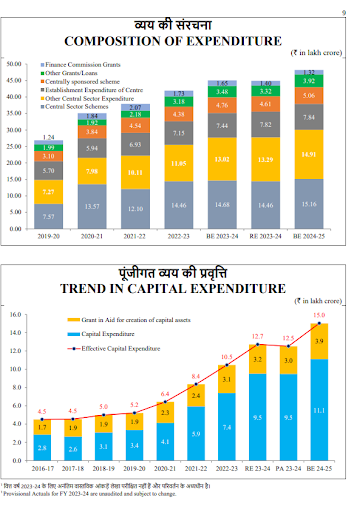

Expenditure trends:

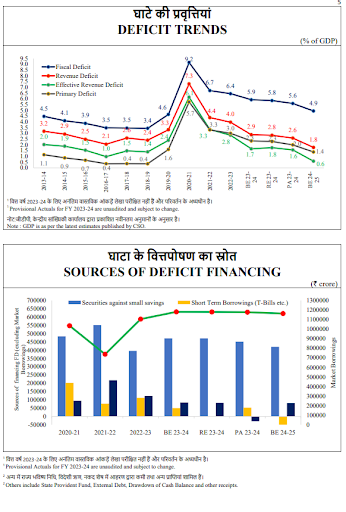

Fiscal Deficit Scenario: Fiscal Deficit is the difference between total expenditure and the Revenue Receipts (including Non-Debt Capital Receipts). FD is reflective of the total borrowing requirement of the Government. Revenue Deficit refers to the excess of revenue expenditure over revenue receipts. Effective Revenue Deficit is the difference between a Revenue Deficit and a Grant-in-Aid for the Creation of Capital Assets. Primary Deficit is measured as Fiscal Deficit less interest payments. Effective Capital Expenditure (Eff-Capex) refers to the sum of Capital Expenditure and Grants-in-Aid for Creation of Capital Assets.

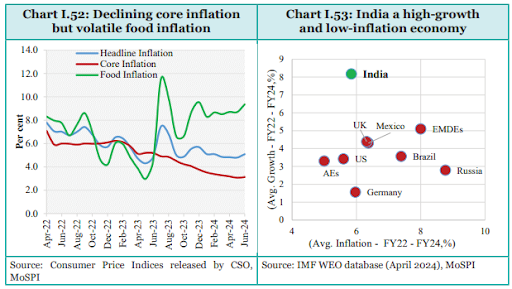

Moderation in inflation pressure:

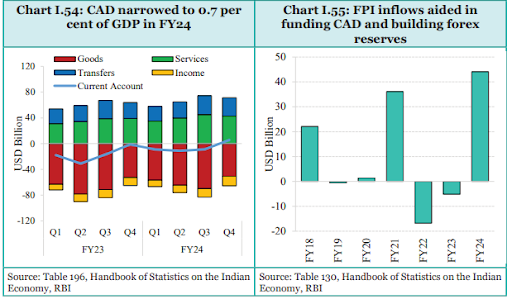

India’s external sector:

Arjun

Posted at 20:50h, 24 JulyEverything at once…easy to understand