22 May Swift Justice: Govt Rolls Out e-Zero FIR Pilot to Combat Cyber Financial Frauds

This article covers “Daily Current Affairs” and the Topic. Swift Justice: Govt Rolls Out e-Zero FIR Pilot to Combat Cyber Financial Frauds

SYLLABUS MAPPING:

GS-3- Internal Security- Swift Justice: Govt Rolls Out e-Zero FIR Pilot to Combat Cyber Financial Frauds

FOR PRELIMS

What is the e-Zero FIR initiative launched by the Government of India? Discuss its key features, benefits, and challenges in tackling cyber financial frauds.

FOR MAINS

What are the main limitations of the e-Zero FIR system?

Why in the News?

The Government of India has recently launched the e-Zero FIR system as a pilot project in Delhi to bolster cybersecurity and ensure faster investigation in high-value cyber financial crimes. Initiated by the Indian Cybercrime Coordination Centre (I4C) under the Ministry of Home Affairs (MHA), the system automatically converts eligible cybercrime complaints into FIRs, specifically targeting financial frauds exceeding ₹10 lakh. Union Home Minister Amit Shah announced this on May 19, 2025, highlighting its role in enabling swift action against cybercriminals.

What is E-Zero FIR?

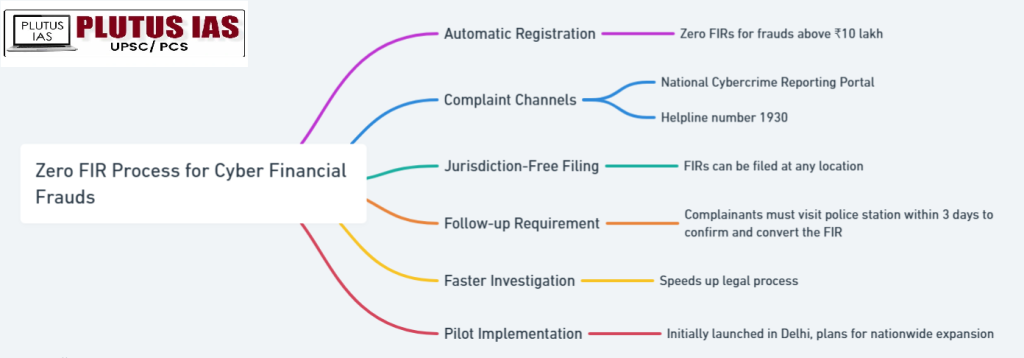

E-Zero FIR is a digital initiative launched by the Ministry of Home Affairs under I4C to combat high-value cyber financial fraud. It automatically converts complaints involving losses above ₹10 lakh into Zero FIRs. Complaints can be filed via the National Cybercrime Reporting Portal or helpline 1930. The FIR is jurisdiction-free and routed to the appropriate police station. Complainants must visit the station within 3 days to confirm the FIR. It aims to fast-track investigations and boost cybercrime response efficiency.

Key Features of e-Zero FIR

E-Zero FIR vs Conventional FIR

What are the challenges of the E-Zero FIR

1. Limited Coverage: Currently implemented only as a pilot project in Delhi, restricting nationwide access and benefits.

2. High Threshold: Applicable only to cyber financial frauds above ₹10 lakh, excluding many common lower-value frauds affecting the general public.

3. Digital Literacy Gaps: Many citizens, especially in rural areas, may lack awareness or ability to file complaints online or use digital platforms effectively.

4. Verification Concerns: Automatic registration may lead to misuse or false FIRs without initial manual verification.

5. Infrastructural Limitations: Some police stations may lack adequate digital infrastructure, trained personnel, or connectivity to process e-FIRs efficiently.

6. Mandatory Physical Visit: Despite being a digital initiative, complainants must still visit the police station within 3 days, which may be inconvenient.

7. Data Security Risks: Handling sensitive financial and personal information online poses risks if strong cybersecurity safeguards are not enforced.

8. Coordination Complexity: Requires seamless inter-agency coordination between cyber cells, local police, and national databases, which can face logistical and administrative hurdles.

Initiative of E- Zero FIR

1. Launched by MHA under I4C: Initiated by the Ministry of Home Affairs through the Indian Cyber Crime Coordination Centre (I4C) to combat high-value cyber financial crimes.

2. Automatic FIR Registration: Enables automatic conversion of eligible complaints (above ₹10 lakh) into Zero FIRs when lodged via the National Cybercrime Reporting Portal or helpline 1930.

3. Pilot Implementation in Delhi : Currently being tested as a pilot project in Delhi, with plans for pan-India rollout based on performance and feedback.

4. Jurisdiction-Free FIR Filing: Introduces Zero FIR mechanism, removing jurisdiction barriers and enabling faster registration and investigation.

5. Mandatory Follow-Up Requirement: Victims must visit the concerned cybercrime police station within 3 days to convert the Zero FIR into a regular FIR.

6. Integration with Cybercrime Databases: Connected to national cybercrime databases, ensuring real-time data sharing and improved inter-agency coordination.

7. Emphasis on Speed and Efficiency: Designed to reduce procedural delays and facilitate quick law enforcement response to cyber fraud.

8. Boosts Digital Governance: Supports the Digital India mission by strengthening cyber governance, enhancing public trust in cybercrime reporting systems.

Implementation of E- Zero FIR

1. Pilot Project in Delhi: The E-Zero FIR system was launched as a pilot on May 20, 2025, in Delhi by the Ministry of Home Affairs.

2. Operated under I4C: Implemented through the Indian Cyber Crime Coordination Centre (I4C), the nodal agency for cybercrime response.

3. Complaint Sources: Complaints are accepted via the National Cybercrime Reporting Portal (cybercrime.gov.in) and helpline number 1930.

4. Automatic FIR Registration: Eligible complaints involving cyber financial frauds above ₹10 lakh are automatically converted into Zero FIRs.

5. Routing to Jurisdiction: These FIRs are routed digitally to the appropriate cybercrime police station, bypassing the need for physical jurisdiction.

6. Mandatory Police Station Visit: The complainant is required to visit the concerned police station within 3 days to validate and convert the Zero FIR into a regular FIR.

7. Digital Integration: Integrated with existing cybercrime databases and police systems to enhance tracking and coordination.

8. Scalability Plan: Based on the outcome in Delhi, the system will be scaled up nationwide to cover more regions and types of cybercrime.

Way forward for Smooth implementation

1. Nationwide Expansion: Roll out the system beyond Delhi to all states and union territories to ensure uniform access and benefit across India.

2. Lowering the Threshold: Reduce the ₹10 lakh limit so that victims of smaller, but more frequent, cyber frauds can also benefit from the fast-track mechanism.

3. Enhancing Digital Infrastructure: Upgrade digital tools and systems in all police stations to handle automatic FIR registration, routing, and follow-up efficiently.

4. Capacity Building: Train police personnel, cyber cells, and technical staff to manage and respond to e-Zero FIRs swiftly and accurately.

5. Public Awareness Campaigns: Launch awareness drives, especially in rural and semi-urban areas, to educate citizens about filing complaints through NCRP or 1930.

6. Multi-agency Coordination: Strengthen coordination between central and state cybercrime agencies to streamline investigation, evidence sharing, and case tracking.

7. Robust Data Security Framework: Implement strong cybersecurity measures to protect sensitive personal and financial information in the e-FIR system.

8. Feedback and Grievance Mechanism: Establish a responsive system for user feedback, grievance redressal, and regular monitoring to improve the platform continuously.

Conclusion

The launch of the E-Zero FIR system marks a significant step forward in India’s fight against cyber financial frauds, particularly those involving high-value transactions. By enabling automatic, jurisdiction-free FIR registration, it aims to fast-track investigations and improve law enforcement responsiveness. While the pilot project in Delhi has shown promise, addressing challenges such as digital literacy, infrastructure gaps, and data security is essential for its success. With strategic expansion, capacity building, and robust coordination, E-Zero FIR can become a vital tool in enhancing cybercrime governance and strengthening public trust in India’s digital law enforcement framework.

Download Plutus IAS Current Affairs (Eng) 22nd May 2025

Prelims Questions

Q. With reference to the e-Zero FIR initiative launched by the Government of India, consider the following statements:

1. The e-Zero FIR system allows cybercrime victims to file jurisdiction-free complaints online.

2. It automatically converts complaints of financial frauds involving losses above ₹5 lakh into Zero FIRs.

3. Complainants are not required to visit any police station once the FIR is registered online.

How many of the above-given statements are correct?

(a) Only one

(b) Only two

(c) All three

(d) None

Answer: A

Mains Questions

Q. Discuss the significance, challenges, and way forward for the implementation of the e-Zero FIR system in India’s cybercrime landscape.

(250 words, 15 marks)

No Comments