02 Apr T+0 beta version of the settlement cycle released

This article covers ‘Daily Current Affairs’ and the topic details of the ”T+0 beta version of the settlement cycle released”. This topic is relevant in the “Economy” section of the UPSC CSE exam.

Why in the News?

The Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) have recently implemented an optional trading feature in the equity segment, known as the T+0 beta version of the settlement cycle. This development follows the issuance of operational guidelines by the Securities and Exchange Board of India (SEBI) for the introduction of this shorter tenure settlement cycle.

About the T+0 settlement cycle

- The Securities and Exchange Board of India (SEBI) took a bold step towards faster trade settlements in December 2023. They proposed a new, optional T+0 (same-day) settlement system alongside the existing T+1 cycle.

- This revolutionary system aims to complete trade settlements on the same day the market closes. Conversely, buyers would acquire their purchased shares within the same day. This would make India’s stock market the leader in settlement speed globally.

- Currently, the T+1 cycle poses a one-day wait between trade execution and settlement. This means sellers only receive 80% of their proceeds on the day of sale, with the remaining 20% arriving the next day. T+0 eliminates this delay, granting sellers full access to their funds instantly.

- While still in the proposal stage, the potential benefits of T+0 are significant. It could enhance market efficiency, boost liquidity, and give investors greater control over their finances. As India paves the way for faster settlements, the future of its stock market looks increasingly dynamic.

Features of the T+0 settlement cycle

- Faster Transactions: Unlike the current T+1 cycle that involves a one-day wait, T+0 allows for the immediate transfer of securities and funds. Buyers would receive their purchased shares within the same day. This eliminates delays and empowers investors with greater control over their finances.

- Early Pay: Interestingly, a significant portion of retail investors already make “early pay-ins” of funds and securities, demonstrating their comfort with a faster settlement system. T+0 capitalises on this existing trend, streamlining the process for a large investor segment.

- Reduced Risk: T+0 settlement minimises the risk of settlement failures often caused by delays or insufficient funds. With same-day completion, both buyers and sellers fulfil their obligations promptly, fostering greater confidence in the market.

- Instant Receipt: Beyond speed, T+0 offers the advantage of instant receipt of funds and securities. This eliminates settlement shortages, where discrepancies occur between the expected and received amount. This translates to a more transparent and reliable system for investors.

- Investor Protection: The proposed T+0 system prioritises investor protection. Funds and securities would be directly credited to investors’ accounts, particularly for those using UPI (Unified Payments Interface). This reduces the risk of intermediary mishandling and strengthens investor confidence.

Potential Benefits of the T+0 settlement cycle

- Enhanced Liquidity: Under the current T+1 system, funds from selling shares become available the next day. T+0 unlocks this liquidity instantly. Investors can then use these funds to reinvest in new opportunities or withdraw them quickly, making their portfolios more agile and responsive to market fluctuations.

- Faster Decision-Making: The ability to access funds and securities immediately empowers investors to react swiftly to market movements. They can capitalise on short-term trading opportunities that might disappear overnight under the T+1 system. This fosters a more dynamic and action-oriented investment environment.

- Reduced Settlement Risk: Settlement risk arises when a buyer or seller fails to fulfil their trade obligation due to delays or insufficient funds. T+0 minimises this risk by ensuring same-day completion of trades. Both parties fulfil their obligations promptly, leading to a more secure and stable trading environment.

- Cost Savings: Faster settlements could potentially lead to lower operational costs for brokers and exchanges. With less need to manage funds and securities overnight, streamlining the process could result in cost savings that could benefit investors in the long run.

- Increased Market Efficiency: T+0 settlement has the potential to streamline the overall trade execution process. Faster settlements could lead to increased trading volumes and a more efficient allocation of capital within the market. This could benefit the entire financial ecosystem in India.

Need of T+0 settlement cycle

The introduction of T+0 settlement is a strategic response to this changing landscape. Here’s how it aligns with current trends:

- Following the “Digital” Economy: Indian consumers have readily adopted UPI and other instant payment platforms, demonstrating a strong preference for speed and convenience. T+0 settlement extends this concept to the stock market, allowing for the immediate transfer of funds and securities.

- Serving Modern Investor Needs: Today’s investors prioritise reliability, cost-effectiveness, and lightning-fast transactions. T+0 addresses these needs by streamlining the settlement process, potentially lowering operational costs, and providing faster access to funds and securities. This could make equities a more attractive asset class for a wider pool of investors.

- More Market Efficiency: A shorter settlement cycle, like T+0, has the potential to optimise the entire trade execution process. Faster settlements could lead to increased trading volumes and a more efficient allocation of capital within the market. This efficiency could benefit all stakeholders in the Indian financial system.

A Phased Approach Towards T+0 Settlement

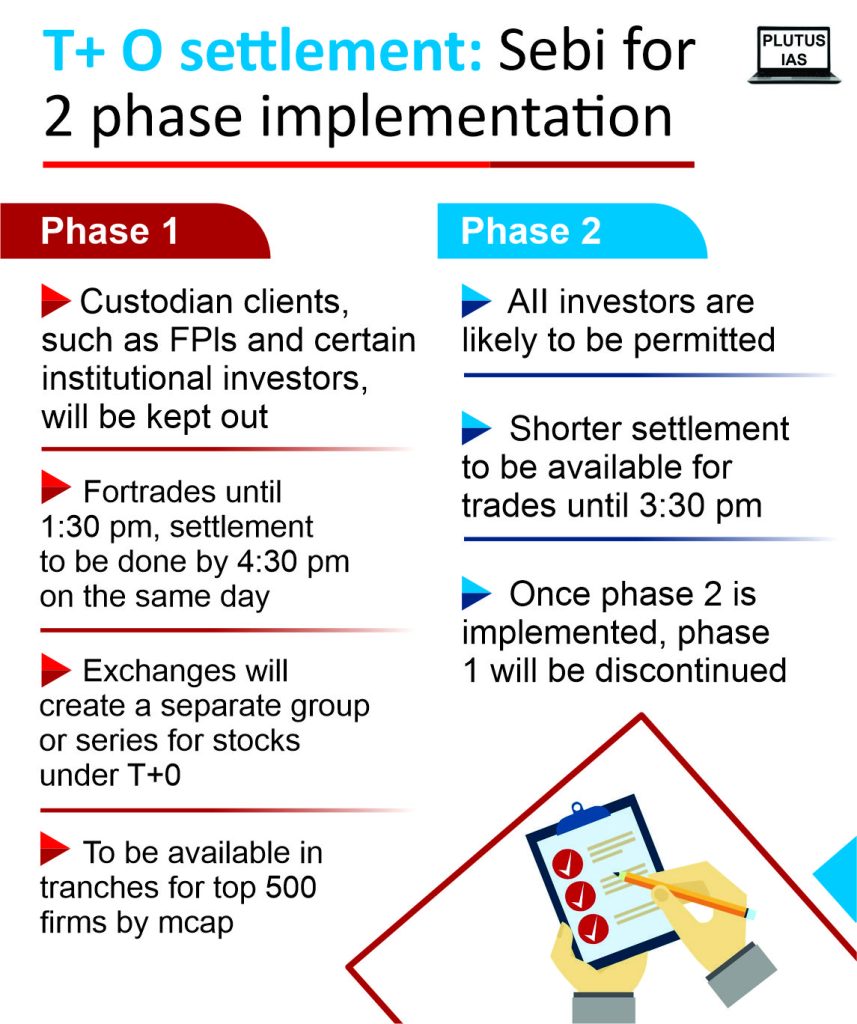

India’s rollout of the T+0 settlement will be a cautious two-stage process designed to ensure a smooth transition for the market.

- Dual Phases for Settlement: The system will operate in two phases. Trades executed up to 1:30 pm will be settled by 4:30 pm on the same day (Phase 1). After 1:30 pm, trading will continue until 3:30 pm (Phase 2), but settlement for these trades will likely occur later. This phased approach allows for proper management of the initial trading rush and ensures timely settlement for early trades.

- Gradual Expansion: SEBI plans to introduce T+0 settlement initially for the top 500 listed equities, divided into three tranches based on market capitalisation (200, 200, 100). This phased rollout allows regulators to monitor the system’s impact and make adjustments if necessary before expanding it to encompass the entire market.

Download plutus ias current affairs eng med 2nd April 2024

Prelims practise questions

Q1. With reference to India, consider the following:

- Nationalisation of Banks

- Formation of Regional Rural Banks

- Adoption of Village by Bank Branches

How many of the above can be considered as steps taken to achieve “financial inclusion” in India?

(a) Only one

(b) Only two

(c) Only three

(d) None

Answer: C

Q2. How does the T+0 settlement cycle differ from the existing T+1 cycle?

(a) T+0 involves a one-day wait for trade settlements.

(b) T+0 allows for the immediate transfer of securities and funds.

(c) T+0 increases delays in accessing funds and securities.

(d) T+0 extends the settlement duration beyond the market closing time.

Answer: B

Mains practise questions

Q1. Assess the potential risks associated with the adoption of T+0 settlement in India, particularly in terms of market volatility, liquidity management, and investor protection.

Q2. Explore the long-term implications of T+0 settlement on the efficiency and resilience of the Indian financial ecosystem, considering factors such as market liquidity, operational costs, and capital allocation.

I am a content developer and have done my Post Graduation in Political Science. I have given 2 UPSC mains, 1 IB ACIO interview and have cleared UGC NET JRF too.

No Comments