02 May The wrong way to fight inequality

THIS ARTICLE COVERS ‘DAILY CURRENT AFFAIRS’ AND THE TOPIC DETAILS OF ”The debate regarding wealth tax”. THIS TOPIC IS RELEVANT IN THE “ECONOMY” SECTION OF THE UPSC CSE EXAM.

Why in the news?

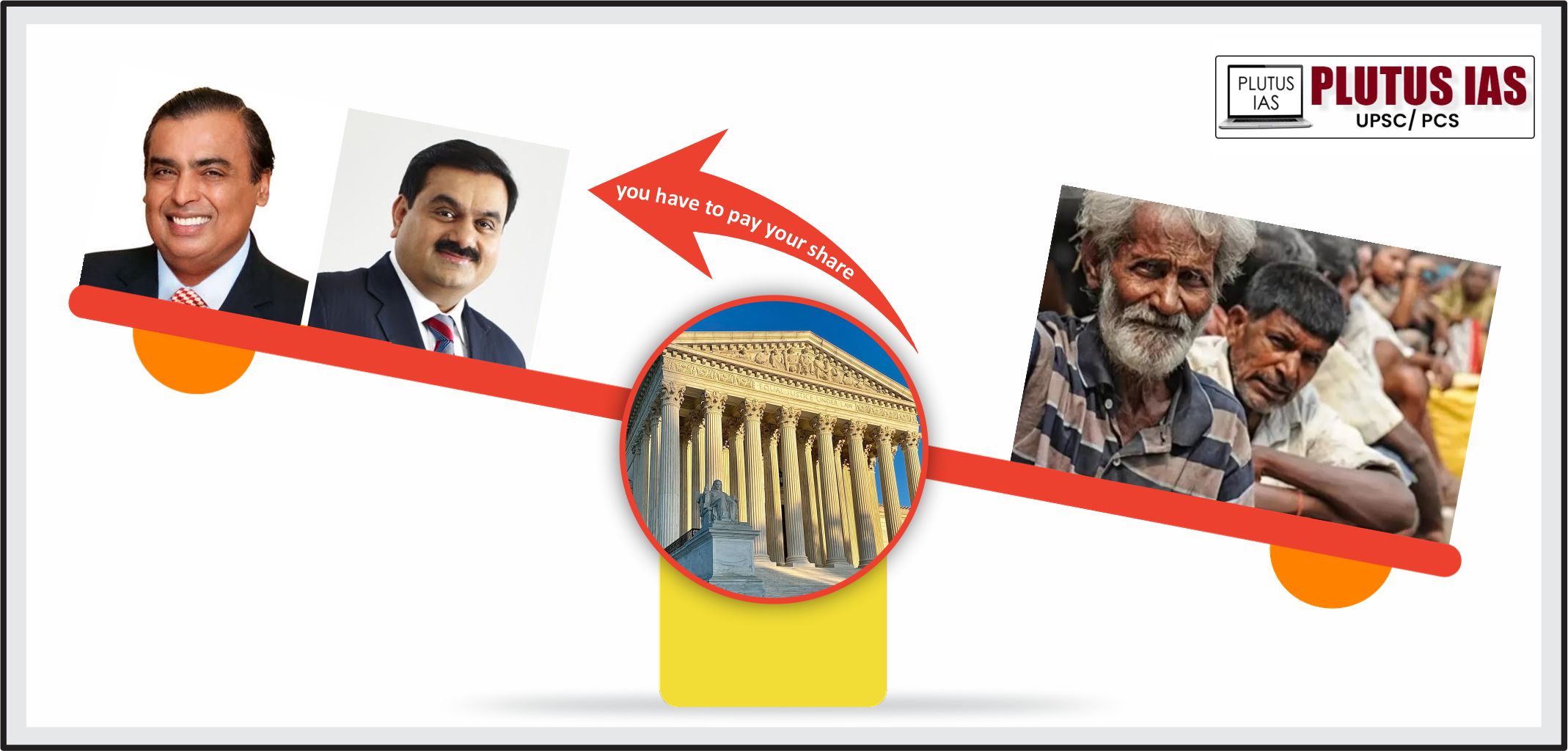

Recent research by French economist Thomas Piketty and his colleagues has shed light on concerning trends in economic inequality in India over the past century. Their study, titled “Income and Wealth Inequality in India, 1922-2023: The Rise of the Billionaire Raj,” reveals stark disparities, suggesting that current levels of inequality surpass those observed during British colonial rule.

According to their findings, as of 2022, the top 1% of India’s population owned a staggering 40.1% of total wealth and commanded 22.6% of total income. In stark contrast, the bottom 50% held a mere 6.4% of total wealth and earned just 15% of total income. These figures paint a grim picture, especially when compared to the top 10%, who possessed 65% of total wealth and garnered 57.7% of national income.

Piketty and his co-authors argue that India’s predominantly income-based tax system exacerbates this inequality, dubbing it regressive. They advocate for the implementation of a wealth tax targeting the affluent to address these disparities. However, while their data raises alarms, it prompts important discussions around the efficacy and implications of wealth redistribution measures.

More about the issue

Piketty and his collaborators highlight two significant trends that shed light on the dynamics of income and wealth inequality in India.

Firstly, they observe a sharp escalation in inequality starting from the 1980s, coinciding with India’s gradual shift towards market-oriented policies. During this period, the share of the bottom 50% in total national income plummeted from 23.6% in 1982 to a mere 15% by 2022. In contrast, the income share of the top 10% surged from 30.1% to 57.7% over the same timeframe.

Secondly, the researchers draw attention to India’s economic trajectory, emphasizing a shift from stagnant growth during the socialist era to a more robust expansion post-1990. They note that between 1960 and 1990, India’s economy sputtered along at a meager 1.6% annual growth rate. However, following economic reforms in the 1990s, growth accelerated significantly, averaging 3.6% per year up to 2022.

These findings underscore the complex interplay between economic policies, growth patterns, and inequality dynamics in India, prompting deeper examination into the impact of market reforms and their implications for income distribution.

The Importance of market system

- Efficient Allocation of Resources: Free markets allow resources to flow to their most valued uses through the forces of supply and demand. Prices serve as signals, guiding producers and consumers in making decisions about production, consumption, and investment. This efficiency promotes optimal allocation of resources, leading to higher productivity and economic growth.

- Innovation and Entrepreneurship: Free markets incentivize innovation and entrepreneurship by rewarding individuals and businesses for developing new products, services, and technologies. The prospect of earning profits motivates entrepreneurs to take risks, experiment, and invest in research and development, driving technological progress and long-term economic dynamism.

- Consumer Choice and Welfare: Free markets offer consumers a wide array of choices and options, allowing them to select goods and services that best meet their preferences and needs. Competition among producers fosters quality improvements, innovation, and price reductions, enhancing consumer welfare and standard of living.

- Job Creation and Economic Mobility: Free markets stimulate job creation by enabling the growth of businesses and industries. Entrepreneurs and investors create employment opportunities as they expand their enterprises to meet market demand. Moreover, the dynamic nature of free markets provides individuals with opportunities for upward economic mobility, allowing them to improve their living standards and socioeconomic status over time.

- International Trade and Integration: Free markets facilitate international trade and economic integration, enabling countries to specialize in the production of goods and services in which they have a comparative advantage. This specialization enhances global efficiency, promotes economic cooperation, and expands market access, leading to mutual gains for participating nations.

- Fiscal Discipline and Accountability: Free markets encourage fiscal discipline and accountability by limiting the role of government intervention in economic activities. Governments must operate within budget constraints and maintain sound fiscal policies to ensure market stability and investor confidence.

- Dynamism and Adaptability: Free markets are dynamic and adaptable, capable of responding to changing economic conditions, technological advancements, and consumer preferences. This flexibility allows economies to adjust efficiently to shocks and challenges, fostering resilience and sustainability over the long term.

Why inequality is inevitable in market system

- Differential Access to Resources: In free markets, individuals and businesses have varying levels of access to resources such as capital, education, and technology. This discrepancy can result in unequal starting points and opportunities, leading to divergent economic outcomes.

- Rewards for Scarcity and Talent: Free markets reward scarcity and talent. Scarce resources or skills command higher prices and thus contribute to wealth concentration among those who possess them. This can exacerbate inequality as those with access to scarce resources or exceptional skills accumulate more wealth.

- Meritocracy and Competition: Free markets often operate on principles of meritocracy and competition, where individuals and businesses compete for market share and profits based on their abilities and performance. While this can foster innovation and efficiency, it also means that those who excel are rewarded disproportionately, further widening the gap between the successful and the less successful.

- Accumulation of Wealth: In free market systems, individuals and businesses have the freedom to accumulate wealth through entrepreneurship, investment, and innovation. Over time, this accumulation can lead to the concentration of wealth in the hands of a few, as wealth tends to generate more wealth through compounding returns and economies of scale.

- Structural Inequalities: Free market systems can perpetuate structural inequalities stemming from historical factors such as discrimination, unequal access to education, and social networks. These structural inequalities can persist and even worsen in the absence of interventions to level the playing field.

Download plutus ias current affairs eng med 2nd May 2024

Negative consequence of wealth tax

- Capital Flight: Wealthy individuals may relocate their assets or even themselves to jurisdictions with lower or no wealth taxes, leading to capital flight. This outflow of capital can deprive the economy of investment and entrepreneurial activity, hindering economic growth.

- Reduced Investment: Wealth taxes can discourage investment by reducing the funds available for capital formation and entrepreneurship. When wealthy individuals have to pay a significant portion of their wealth in taxes, they may have less capital available to invest in businesses, innovation, and job creation.

- Wealth Erosion: Continuous taxation of wealth can erode the capital base of wealthy individuals over time. This reduction in wealth can limit their ability to make long-term investments or engage in philanthropic activities, which can have adverse effects on economic development and social welfare.

- Distortionary Effects: Wealth taxes can distort economic decision-making by incentivizing tax avoidance strategies such as asset concealment, income shifting, or relocation. This can lead to inefficiencies in resource allocation and undermine the effectiveness of the tax system.

- Negative Impact on Savings: Wealth taxes may discourage savings and capital accumulation by reducing the after-tax return on investment. This can disincentivize individuals from saving for retirement, education, or other long-term goals, potentially exacerbating future economic challenges.

- Administrative Complexity: Implementing and enforcing a wealth tax can be administratively complex and costly, requiring extensive resources for compliance monitoring and enforcement. The administrative burden may outweigh the revenue generated from the tax, leading to inefficiencies in the tax system.

- Potential Economic Stagnation: In extreme cases, excessive taxation of wealth can lead to economic stagnation by discouraging entrepreneurship, innovation, and risk-taking. This can result in a lack of dynamism in the economy, hampering productivity growth and overall prosperity.

Overall, while wealth taxes may be intended to address income inequality and generate revenue for government spending, they can also have unintended consequences that may undermine economic growth, investment, and innovation. Policymakers need to carefully consider these potential drawbacks when designing and implementing wealth tax policies.

No Comments