30 Dec The Current Account Deficit Widens Again

The Current Account Deficit Widens Again

This article discusses “Daily current Affairs for UPSC” about current account deficit “news about Polity and Governance. In GS-2 and the following content has relevance for UPSC.

For Prelims: Current account deficit, the balance of payment

For Mains: GS-3, various factors are responsible for the Current account deficit

Why in news:

India reported CAD of 3.3% of GDP for the first half ended in September, again due to a substantial increase in the merchandise trade deficit, compared to 0.2% a year earlier. Increasing trade imbalance causes the current account deficit to reach a nine-year high.

Key Points:

- In the three months ending in September, India’s current account balance reported a deficit of $36.4 billion (or a nine-year high of 4.4% of GDP), up from $18.2 billion (2.2% of GDP) in the prior quarter.

- According to information made public by the Reserve Bank of India (RBI) on Thursday, the deficit for the preceding twelve months came in at $9.7 billion (1.3% of GDP).

- According to the RBI, the merchandise trade deficit increased to $83.5 billion in Q2 from $63.0 billion in the April-June quarter, and increased net outgo under investment income was the primary cause of the CAD.

- India’s current account deficit increased from 0.2% a year earlier to 3.3% of GDP during the first half of the fiscal year that ended in September, again as a result of a substantial rise in the merchandise trade deficit.

- On a year-over-year (y-o-y) basis, net invisible receipts were higher in the first half of this year due to greater net receipts of services and private transfers.

- According to the RBI, the current account deficit for the first quarter of this fiscal year has been reduced from $23.9 billion (2.8% of GDP) as a result of a downward adjustment to customs statistics.

- When compared to the first half of the previous year, net FDI inflows were nearly unchanged at $20 billion, down from $20.3 billion.

- Compared to inflows of $4.3 billion, portfolio investment saw a net outflow of $8.1 billion in the first half.

- There was a loss of $25.8 billion in foreign exchange reserves in the first half of the year that concluded in September (on a BoP basis).

About the Current Account deficit

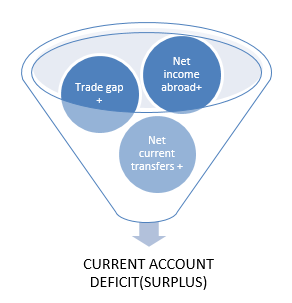

- A country experiences a current account deficit when the value of its imports and exports of goods and services exceeds that of its imports.

- The term “trade balance” refers to the balance between items exported and imported. A component of “Current Account Balance” is “Trade Balance.”

- The flow of investments, services, and goods into and out of a country is tracked by the current account. The transactions that the nation has with foreign nations are tracked by it.

- When imports outpace exports of goods and services, a deficit exists in the nation.

- A current account deficit occurs when an economy spends more than it takes in

| Consumption = domestic consumption + investment + government spending. |

- An increase in the CAD suggests that a nation has lost its competitive edge, which may make investors hesitant to make investments there.

- There are times when it is beneficial. The reason for a CAD is the private sector’s agents participating in mutually beneficial commerce, hence it is unimportant if the private sector is the driving force behind it.

Current account deficit

- It is only possible for this to occur if other economies are lending it their money (via loans or direct or portfolio investments in the economy) or if the country is exhausting its foreign assets, such as its official foreign currency reserve.

- Balance of Payment

- A country’s balance of payments (BoP) is a comprehensive accounting of all of its economic dealings with the rest of the world during a given time frame, often one year.

- It shows if the nation has a trade surplus or deficit.

- There is a trade surplus when exports exceed imports and a trade deficit when imports exceed exports.

Reason for calculation:

- BoP calculations are done to reveal a country’s financial and economic situation.

- It can be used as a gauge to detect if a nation’s currency is strengthening or weakening.

- It helps the government make decisions on its trade and fiscal policies.

- Provides crucial data to examine and comprehend a country’s international trade relations.

Components:

- BoP account components include the current account, capital account, and errors and omissions categories for grouping economic transactions between a nation and the rest of the world. Changes in foreign exchange reserves are also shown.

- Current Account: It displays visible (also known as items or merchandise, which indicates trade balance) and Invisibles, including export and import (also called non-merchandise). (Services, transfers, and income are examples of invisible.)

- Capital Account: It displays a nation’s capital outlays and revenues.

The net flow of both private and public investment into an economy is summarized.

Foreign Direct Investment, Foreign Portfolio Investment, and other types of foreign investment are included in the capital account.

- Errors & Omissions: On occasion, the payment balance is out of balance. The BoP’s faults and omissions illustrate this disparity. It illustrates the nation’s incapacity to precisely account for all foreign transactions.

- Changes in Foreign Exchange Reserves: The Reserve Bank of India’s (RBI) foreign currency holdings and the balances of Special Drawing Rights (SDR) both vary over time. This is referred to as a change in reserves.

The BoP account as a whole may be in excess or deficit.

A deficit can be closed by withdrawing funds from the Foreign Exchange (Forex) Account. The BoP crisis refers to a situation where there are insufficient reserves in the foreign exchange account.

Source:

Download the PDF Now:

Plutus IAS current affairs eng med 30 Dec 2022

Daily Current Affairs for UPSC

Current Affairs are a source of important news in the national and international world. For enhancing general knowledge, Current affairs play an important role. So It is very crucial to read daily current affairs regularly for passing the UPSC examination.

Plutus IAS provides the best and latest daily current affairs for the UPSC examination free of cost. Also, read weekly, and monthly current affairs for the IAS exam preparation.

No Comments