27 May Bharat Bill payment: RBI lowers networth bar for non-bank units

Bharat Bill payment: RBI lowers networth bar for non-bank units – Today Current Affairs

Context

The Reserve Bank of India (RBI) has reduced the minimum networth requirement for non-bank Bharat Bill Payment Operating Units (BBPOUs) from ₹100 crore to ₹25 crore.

This move is aimed at facilitating more bill payments through Bharat Bill Payment System (BBPS) and to encourage participation of non-bank Bharat Bill Payment Operating Units (BBPOUs) in BBPS.

Today Current Affairs

What is BBPS?

Bharat Bill Payments System is an integrated online platform which is being developed by the National Payments Corporation of India for all kinds of bill payments. The platform intends to build an interoperable service through a network of agents, enabling multiple payment modes along with instant generation of receipts of payments. It would connect the utility service companies on one end and all payments service providers on the other.

What is the scope of BBPS? The Hindu Analysis

BBPS aims to make regular bill payments for all utility services easy. That includes water, DTH and telecom. However, the plan is to expand its service area to include school fee, university fee, municipality taxes, mutual funds, insurance premiums etc., but as per clearances from the RBI.

Benefits of using BBPS? The Hindu Analysis

Customer Benefits: The biggest advantage is that the bill can be paid anywhere and anytime. There would be retail points for bill payments across the country who would be able to accept all kinds of bills payments made through credit cards, debit cards, mobile wallets, net banking (IMPS, NEFT). The BBPS outlets would include banks, ATMs, business correspondents, kiosks etc. and payments would be made securely through the NPCI network with instant receipts getting generated.

Participants Benefits: Utility service providers would be able to get payments instantly, they would not need to maintain bill collection centres by themselves, value added services can be added by the operators, bills can be generated electronically and disbursal can also be electronic. Along with these, the BBPS platform would have fraud monitoring and risk mitigation systems in place in order to ensure smooth online transactions. The Hindu Analysis

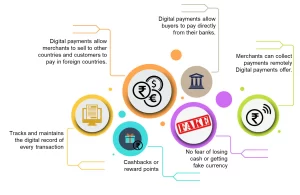

Instant Payment: Electronic payments are much faster than the traditional methods of payments such as cash or cheques. In the case of online payments, you do not have any constraint of time or location. You can easily make payments at any time from anywhere across the globe.

E-payment systems have eliminated the need for going to the banks to make payments. Now your customers do not have to waste their time standing in the long lines at banks. They can easily pay you by using an electronic payment app.

Higher payment security: Despite its robust features, electronic payments systems has not become so popular among the merchants. They are still using the same old methods for accepting payments. Due to which, they are missing out the opportunity for serving more customers. The Hindu Analysis

Electronic payment systems offer you multiple ways of securing your payments such as tokenization, encryption, SSL, etc. Now your customers do not have to enter their card details every time as they can save their card details or complete their transactions by using a One Time Password.

Better customer convenience: Electronic payments can help you to provide convenient payment experience to your customers. It allows your customer to purchase goods on credit by offering them with the pay later facility. Instead of sending constant reminders for payment to your customers, you can automatically collect money after a specific period. The Hindu Analysis

Saves processing costs: If you want to provide payment services to your customers then you first need to tie up with a card processor. The processor will provide you with a payment gateway for processing and in exchange, it will charge a fixed cost from you. This cost is very high.

On the other hand, if you are using an electronic payment system in your business then you do not have to incur such high charges. You just have to pay a fixed subscription to your service provider. The Hindu Analysis

Low risk of theft: The phrase ‘Cash is the king’ is popular in the business world, but this king has also had some limitations. If you are using cash for accepting payments from customers, chances are there it can be stolen. Also, you need to take high safety measures in depositing cash into your bank account.

But this risk can be decreased if you are using a secure electronic payment system in your business. By using it, you do not have to worry about your payment record. You can easily get an accurate record of all your transactions at the end of the day. The Hindu Analysis

Transparent: Transparency becomes an essential factor when it comes to payments. And when you are using the digital medium for accepting payments, then it becomes essential for you to maintain transparency in your transactions.

In the case of electronic payments, you do not have to worry about the record of your payment details. Also, you can provide the payment details to your customers beforehand. So that there will be fewer chances of confusion.

Contactless: In the times of the COVID-19 pandemic, people have started finding ways of avoiding human touch to save themselves from getting affected by the coronavirus. Due to this, the need for contactless payments has increased.

You can use contactless POS terminals in your business to avoid the human touch. In this system, the payee needs to hold his phone near the terminal and his payment will get automatically processed. Also, you can enable your customers to make payments by using QR codes or One Time Passwords (OTP).

Conclusion

The cash transactions have started decreasing after the integration of an electronic payment system in the markets. This means the small businesses need to start using the latest technology to prevent the risk of being overtaken by the competitors.

Here we mention all information about Bharat Bill payment: RBI lowers networth bar for non-bank units Today Current Affairs.

No Comments