23 Feb Digital Lending

Digital Lending

This article covers “Daily current events “and the topic is about ‘Digital Lending’ which is in news, it covers “Economics” In GS-3, the following content has relevance for UPSC.

For Prelims: Digital Lending

For Mains: GS-3, Economics

Why in news: In the absence of clarification regarding the contractual agreement with the Reserve Bank of India, banks and non-banking financial firms (NBFCs) have almost halted partnerships with fintech players, or digital lending apps, under the first loan default guarantee (FLDG) structure for lending (RBI).

About Digital Lending

- With the help of technology, financial institutions may increase production, increase loan earnings, and provide quicker service at the point of sale (POS).

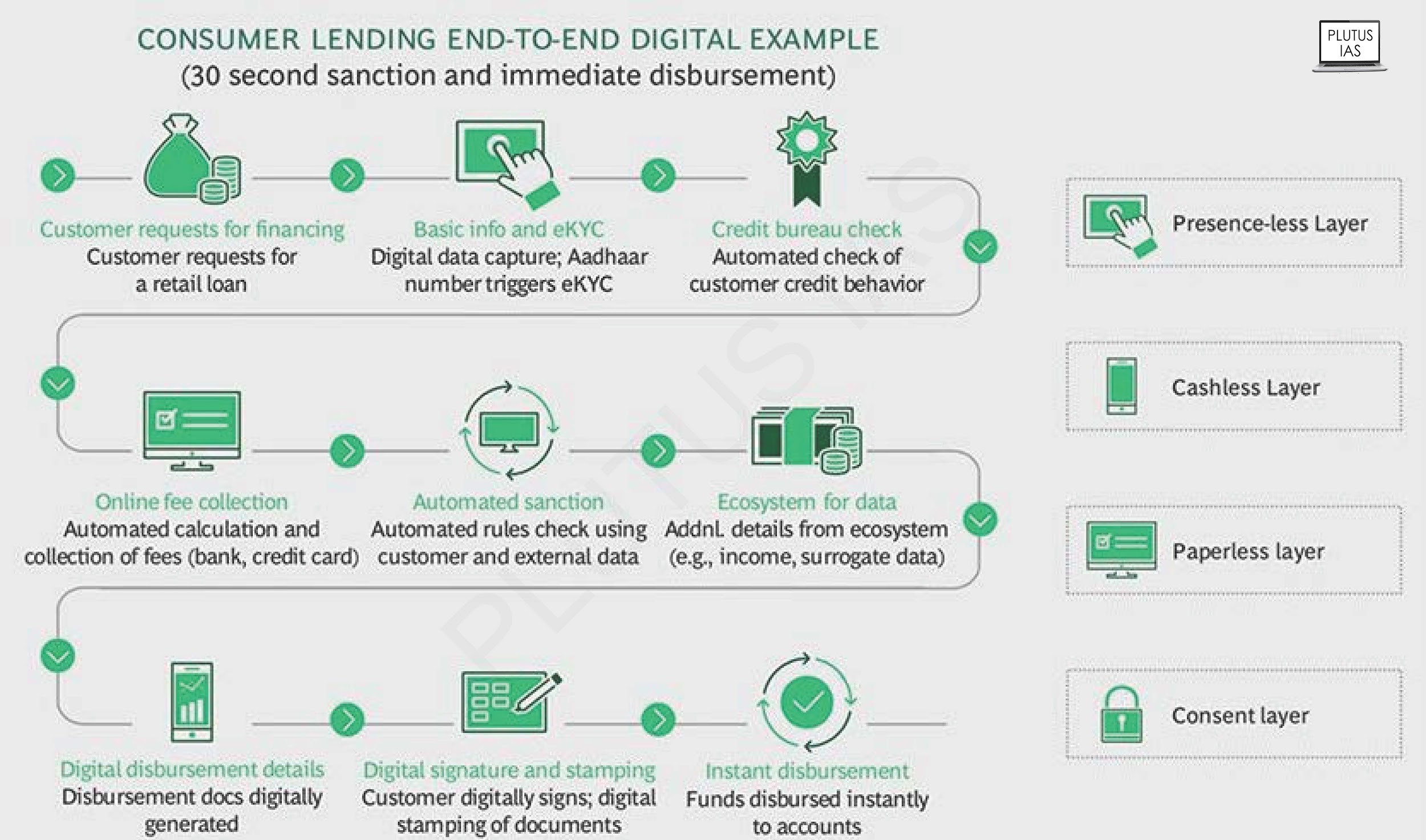

- Digital Lending incorporates credit evaluation and authentication using online lending platforms or mobile apps.

- Digital lending makes the best use of technology where sensitive information is kept private.

- Borrowers can apply for any consumer or corporate loan product using Digital Lending from any internet-capable device and from any place.

- Loan application processes will become more effective and less time-consuming with the use of services like video-KYC, Aadhaar-based KYC, and websites and applications with cutting-edge functionality.

- Lenders will progressively gather and assess data from many sources using cutting-edge technologies like AI, ML, and big data analytics.

- With the help of this information, an applicant’s creditworthiness can be evaluated more swiftly and effectively.

Benefits of Digital Lending

- Streamlining Application Process: Borrowers will have a better experience if consumer information is consolidated and digitalized.

- Customer frustration is mitigated via increased process openness and quicker decision-making.

- The possibility of incomplete files is decreased, which slows down the application screening process.

- Digital Lending promotes improved communication with the client regarding the upfront disclosure of information.

- Digitizing the Lending Information: The entire credit team benefits significantly from digitizing the information flow and access. Transparency is increased, and bottlenecks are decreased. With a single interface, many digital lending systems let loan processors get data from other sources, including credit agency reports and bank and financial information. Faster decision-making is made possible by this method, which reduces errors and gets rid of pointless manual activities.

- Using Lending Information for Analysis: Also, the analytics and intelligence portions of the loan process can be digitalized by financial organizations. Lenders and analysts frequently use a range of estimates and evaluations. These differences frequently lead to flawed computations, which then produce bad credit choices and false reporting.

- Providing Loan Options for Poor or No Credit Customers: With their conventional lending procedures, financial organizations heavily rely on credit scores. Credit scores give lenders a detailed look at a potential customer’s previous borrowing habits.

- Increases Efficiency: A digital lending platform improves efficiency by cutting overhead costs by 30 to 50%, which frees up time, boosts revenue, and creates high growth opportunities.

Digital Lending

Digital Lending Trend

- By 2030, digital lending is anticipated to have increased by more than four times from its present $270 billion value to $1.3 trillion.

- By 2030, it predicts that the market for financial technology in the nation would be 60% dominated by digital lending.

- The typical customer is in the age range of 22 to 45.

- The typical loan amount is $168, or roughly 18,000 rupees.

Challenges in Digital Lending

- By providing credit to borrowers in excess of their ability to repay it, LSPs frequently engage in risky lending practices.

- By distributing the risk to overall customers and charging higher interest rates, the risk is reduced.

- The assessment of a participant’s operational legitimacy was difficult due to the lack of standardized disclosure and regulatory standards.

- For Android users in India, there were over 1,100 loan apps accessible, of which 600 were illicit.

- They were either not under RBI regulation or had NBFC partners with assets worth less than $1 billion, raising concerns about their viability.

- The sector is predominantly controlled by NBFCs, which serve small borrowers that lack credit history and are therefore underserved by conventional financial institutions.

- Other: The main issues of the digital lending Process include the unrestrained use of third parties, mis-spelling, data privacy violations, unfair business practices, the imposition of exorbitant interest rates, and unethical recovery methods.

Way Forward

- This law would also address issues raised by TechFin, or businesses that primarily provide tech-based services, like e-commerce, but also provide financial services.

- Although the percentage of digital lending is now limited, given their scalability, they have the potential to quickly become key participants.

- Despite increasing inflation and interest rates, it is anticipated that this fiscal’s demand for loans across the credit ecosystem would increase due to the economy’s recovery from the pandemic and our projections of GDP growth of 7.3%.

- The rules are intended to stop the growing number of unethical actions in the ecosystem of online lending.

Source:

Download the PDF Now:

PLUTUS IAS CURRENT AFFAIRS 23th FEB 2023

Daily Current Affairs for UPSC

Through reading current affairs, UPSC aspirants can familiar with the recent incidents of the world. Current Affairs is also the source of the latest news of the national and international world. The topic described above reflects the digitalization of the Indian Economy. It talks about digital landing which is related to the latest current affairs for the UPSC examination. Get such kinds of the best daily current affairs for the UPSC examination free of cost from Plutus IAS. Also, read the weekly and monthly current affairs for the IAS exam preparation.

No Comments