31 Mar Disinvestment

Disinvestment

This article covers “Daily Current Affairs for UPSC” and the topic details Disinvestment. The topic “Disinvestment” has relevance in the Economy section for the UPSC CSE exam.

For Prelims:

- What is Disinvestment?

- What are the types of Disinvestment?

For Mains:

- GS 3: Economy

- Government policy on disinvestment

- Status of Disinvestment – Target set and achieved receipts of disinvestment of assets.

Why in the news?

The Finance Ministry has made a statement that it is finding it difficult to achieve the disinvestment target for 2023-24 ₹51,000 crores. It is finding challenges in privatizing Public sector enterprises as well as raising money through minority sales.

The reasons cited are:

- Reduced availability of government stake over 51% for large listed central PSEs.

- Muted perception of investors in these stocks as compared to private sector peers.

- Price overhang in the market due to high disinvestment targets.

- Frequent use of exchange-traded funds (ETF) route for stake sale till 2019-20.

What is Disinvestment?

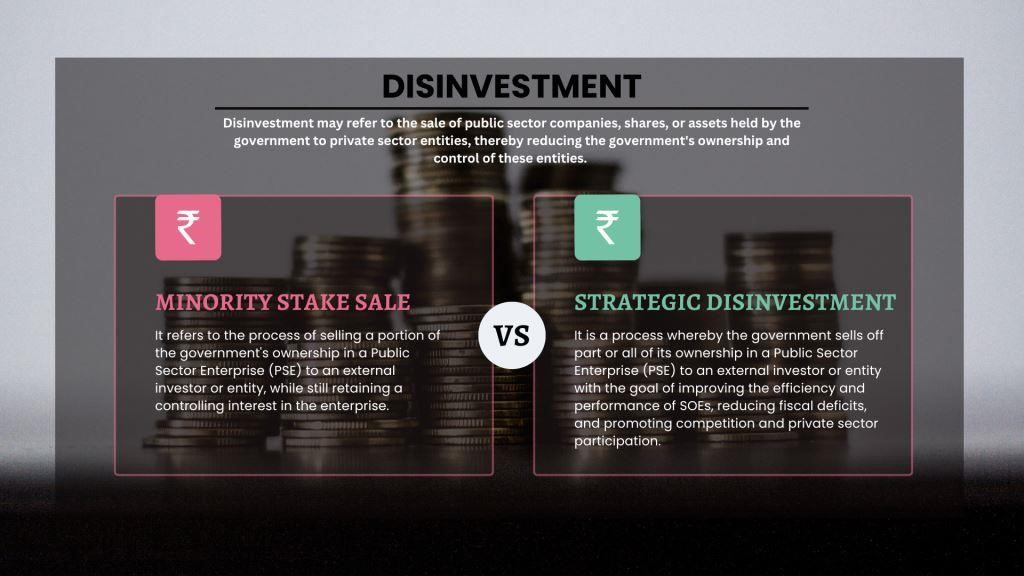

Disinvestment may refer to the sale of public sector companies, shares, or assets held by the government to private sector entities, thereby reducing the government’s ownership and control of these entities.

disinvestment

How has the government’s approach toward disinvestment evolved?

The disinvestment policy has evolved over some time as follows:

- Pre-independence era: During the pre-independence era, the economic policies of colonial governments were primarily aimed at benefiting their home country rather than India. As a result, the majority of industrial activity was focused on exporting raw materials and importing finished products from Britain.

- Post-Independence: After independence, India’s economic and industrial policies were modeled after the Soviet Union’s “socialist framework.” However, this socialist policy of industrialization imposed strict regulations on most private enterprises, resulting in an ineffective industrial system that was eventually replaced by Import-substitution industrialization.

- The economic crisis of 1992: However, due to the underperformance of the industrial sector and the Balance of Payment crisis of 1991, policymakers were forced to reassess the situation and initiate reforms toward a more open-market-oriented policy.

disinvestment meaning

What is the need for disinvestment?

The government is accused of being less efficient and less competitive compared to the private sector. It is also alleged that there should not be any role for the government in areas that can be run by the private sector with better expertise and efficiency. Therefore, the proponents of disinvestment argue that the government must cede ownership and control of those areas in which the private sector can run better. The objectives are :

- Raising capital

- Reducing fiscal deficit

- Promoting competition

- Improving efficiency

- Strategic objectives

What are the types of Disinvestment?

The types of disinvestment conducted by the government are as under:

- Minority stake sale: It refers to the process of selling a portion of the government’s ownership in a Public Sector Enterprise (PSE) to an external investor or entity, while still retaining a controlling interest in the enterprise.

In a nutshell, through this process the government can have it both ways, it transfers the operations and management of the assets to a private company while retaining the ownership of the company.

The government retains 51 percent or 26 percent of the value of the assets with itself. - Strategic Disinvestment: It is a process whereby the government sells off part or all of its ownership in a Public Sector Enterprise (PSE) to an external investor or entity to improve the efficiency and performance of SOEs, reducing fiscal deficits, and promoting competition and private sector participation.

The share of the government in the value of the assets goes below 51 percent. It maintains ownership in the company but the private sector holds all the decision-making power.

What is the current policy of the government?

According to DIPAM, the current policy of the government is as follows:

- Public Sector Undertakings are a valuable asset of the Nation and preserving this asset in the hands of the people promotes public ownership of CPSEs.

- While pursuing disinvestment through a minority stake sale in listed CPSEs, the Government will maintain at least 51% shareholding and retain management control of the Public Sector Undertakings.

- Strategic disinvestment will involve the sale of a substantial portion of Government shareholding in identified CPSEs, up to 50% or more, along with the transfer of management control.

What are the targets set by the government in the latest budget?

The government has set a disinvestment target of ₹51,000 crores in the Union Budget for 2023-24. This figure is 21% lower than the budget estimate for the current year and only ₹1,000 crores more than the revised estimate, making it the lowest target in seven years.

Additionally, the Centre has not yet met the target for 2022-23, having raised ₹31,106 crore to date. Of this amount, close to a third of the budgeted estimate was achieved through the IPO of 3.5% of its shares in the Life Insurance Corporation (LIC), amounting to ₹20,516 crore.

How are the disinvestment proceeds used by the Government of India?

There is a debate on the use of disinvestment proceeds. The government uses the disinvestment proceeds in the following ways:

- To reduce the fiscal deficit: The government may utilize these funds to reduce the fiscal deficit, which is the difference between its total revenue and expenditure. This is not seen as a wise use of the disinvestment proceeds.

- To finance capital expenditure: The government can use the proceeds on infrastructure projects, such as building highways, airports, and power plants. This is seen as a wise way to spend the disinvestment proceeds as the push on capital expenditure will have a multiplier effect on the economy.

- To fund social welfare schemes: The use of the disinvestment proceeds on social welfare schemes like healthcare, education, and housing is seen as the least optimal use as its use for consumption adds no value.

Creation of the National Investment Fund (NIF)

It was established by the Government of India in November 2005, to channel the proceeds from the disinvestment of Central Public Sector Enterprises.

The corpus of NIF was to be permanent and managed professionally by selected Public Sector Mutual Funds. The NIF was designed to provide sustainable returns to the government while supporting selected social sector schemes promoting education, health, and employment, which would receive 75% of the annual income. The remaining 25% of the annual income would be used to meet the capital investment requirements of profitable and revivable PSUs.

Source:

Daily Current Affairs for UPSC

Current Affairs play a significant role in the completion for the UPSC examination. There are several benefits of reading current affairs. For Example:

- Reading Current Affairs regularly enhances the general knowledge of UPSC examinee

- Reading daily current affairs is very helpful for Passing the UPSC examination process like Prelims main and interview examinations.

Here, Plutus IAS provides the best daily current affairs for the UPSC examination. Also, read the weekly and monthly Current Affairs for the IAS Exam preparation.

No Comments