20 Dec Global Minimum Corporate Tax

Global Minimum Corporate Tax

The article talks about how the Global Minimum Corporate Tax impacts the Indian Economy which is related to the daily current affairs for the UPSC examination.

Relevance for Prelims: Treaty Shopping, Round Tripping

Relevance for Mains: OECD Regulations, Impact of Minimum Corporation Tax

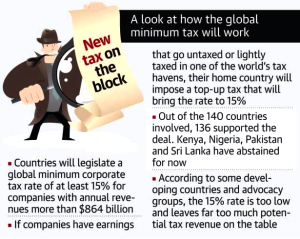

Context: Members of the European Union agreed in principle to implement a minimum tax of 15% on big businesses.

About Global Minimum Corporate Tax

Global Minimum Corporate Tax is tailored to address the low-effective rates of tax shelled out by some of the world’s biggest corporations, such as Apple, Microsoft, Meta, and Alphabet.

The majority of Global companies rely on web subsidiaries to move profits from major markets to know-tax countries (also known as Tax havens) such as the Bahamas, and the Panama Islands.

The OECD has proposed a two-pillared solution that would apply to overseas profits of multinational firms with $868 million in sales globally.

- Pillar 1 sets out the Minimum taxes and tax rules for companies that shift their tax jurisdictions. Governments could set local corporate taxes to eliminate the advantage of shifting profits.

Pillar 2 allows countries where revenues are earned to tax 25% of the largest multi-nationals-so called excess profit which is defined as a profit of more than 10% of revenue.

Pic: Global Minimum Corporation Tax

Need for the Corporate tax

- Mobilization of resources: Economies strained after the COVID-19 crisis has led many governments to want more than ever to discourage multinationals from shifting profits and tax revenues to low-tax jurisdictions regardless of the location of sales are made.

- Apply brake on diversion of funds to tax heaven: Income from software and royalties has migrated to tax heavens, allowing companies to avoid paying higher taxes in traditional home countries.

Associated Concerns with Global Minimum Corporate Tax

- Violation of sovereignty: Rights of countries are violated if a nation’s tax policies are subjected to global institutional norms.

- Effectiveness: Many organizations such as Oxfam said the deal would not end inequality and tax havens.

- Tax Competition: Critics of the OECD’s proposal, however, see the global minimum tax as a threat. They argue that without tax competition between governments, the world would be taxed a lot more than it is today, thus adversely affecting global economic growth.

Source:

Daily Current Affairs for UPSC

Get the latest daily current affairs for the UPSC examination free of cost. Also, read the best weekly, and monthly current affairs for the UPSC examination from Plutus IAS. It is the best coaching for Economic optional. Also, read weekly and monthly current affairs for the UPSC exam preparation.

No Comments